Monthly Market Review – October 2020

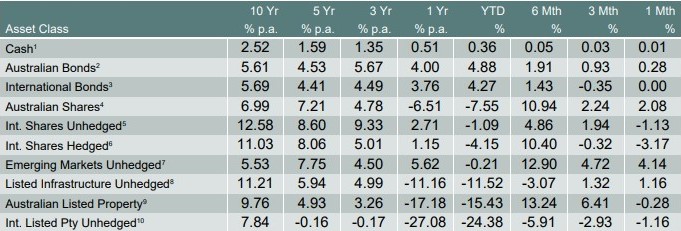

VIEW PDFHow the different asset classes have fared: (As at 31 October 2020)

The Australian share market performed strongly over October with the S&P/ASX All Ordinaries returning 2.08%, as COVID-19 cases remained low. The end of October saw Victoria’s relaxing of its lockdown restrictions. Data in Australian remained mix. Just over 50% of the jobs and hours cut in April/May have recovered, the remainder is expected to take significantly longer to recover. While new home sales strengthened in September due to HomeBuilder and other incentives.

Global markets were highly volatile in October. Two topics dominated markets over October: rising COVID-19 cases across Europe and the US and the absence of a pre-election fiscal stimulus. October started off strongly as most major indices were up but due to the increasing uncertainties, European and US indices sold off late in the month, giving up all gains and ending negative.

The S&P 500 ended October down -2.7%, as the markets dealt with the rising number of cases in COVID-19, particularly in the mid-west together with the ambiguity regarding a clear presidential winner. European stocks suffered considerably, with the Euro Stoxx 50 down -7.4% for the month, as all major economies reported new highs in inflection rates. Governments across Europe have imposed varying levels of containment measures, which is expected to prevent any near-term recovery. Fortunately, even with higher infection rates, death rates have remained low across Europe and the US due to better testing and treatments.

Asia was the standout region, in particular, China. The MSCI China A International USD returned 3.5% in October, as economic activity in China rebounded strongly. Chinese exports strengthened in September, imports rebounded, and credit growth accelerated.

The two topics that dominated October headlines will continue to substantially impact global markets. The results of the November election will remain in focus, as the outcome will affect the level of fiscal stimulus. While the ability of developing governments to curb infection rates will affect their ability to have a swifter recovery.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.