Monthly Market Review – January 2021

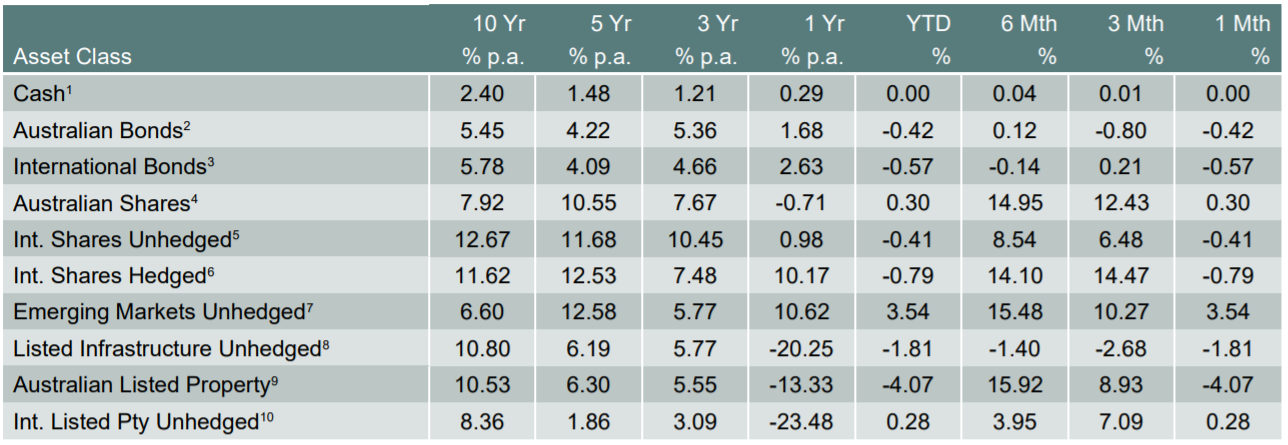

VIEW PDFHow the different asset classes have fared: (As at 31 January 2021)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

The year began dramatically. In the US Donald Trump called out to his supporters to help him contest the November US election results, which saw thousands of pro-Trump supporters descend onto the White House. The mob shattered windows, ransacked offices and pounded on barricaded doors. Throughout the chaos, the US stock market continued to rally due to the anticipation of more stimulus for the economy once President Biden enters office.

A disappointing final week of the month led to the S&P/ASX 200 climbing just 0.3% in January. The lackluster performance was linked to investors becoming spooked by extraordinary volatility in stocks with significant short selling exposure. Notwithstanding this most companies saw activity and profits rebound, and with few foreign travel options Australians are spending more at home.

A group of two million members of a Reddit subgroup called r/WallStreetBets (now 10 million members) turned the finance industry upside down late in the month. A short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial consequences for certain hedge funds and large losses for short sellers.

The Australian dollar reached a high of 78 US cents for the month. This has been attributed to rising iron ore prices brought about by news of record-high steel output in China. The strength of the Australian dollar has caused some concern for the RBA due to its impact on growth and inflation.

House prices hit record highs in January, surpassing pre-COVID levels. Every capital city saw an increase in values. This growth can be attributed to various government policies and stimulus measures that helped keep the economy afloat during the pandemic. This included $507 billion in stimulus policies and up to $200 billion by the RBA in near free (0.1 per cent interest) funding for the banks.

Bitcoin experienced a tremendous surge in value. Much of this rise seems to be the result of large flows of institutional money. The current bull run has seen it surpass its previous all-time high of December 2017.

News of several potentially highly effective vaccines against COVID-19 has significantly reduced uncertainty over the global outlook for 2021 and beyond, which is positive for all markets, including Australia. However, there remains the possibility that the existing vaccines may not be effective against all the new mutated COVID-19 variants.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.