Monthly Market Review – May 2022

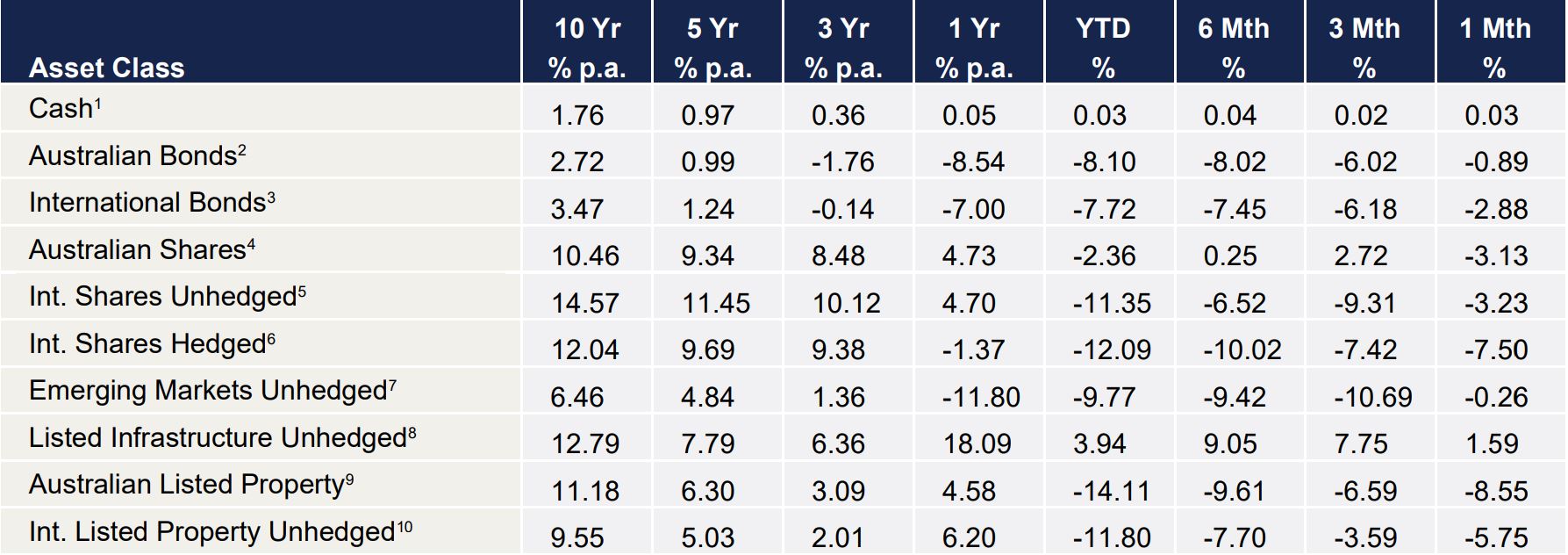

VIEW PDFHow the different asset classes have fared: (As at 31 May 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

Whilst volatility moderated somewhat during the month of May, International Shares, both unhedged and hedged fell 3.23% and 7.5% on the month. Markets continue to price in the impacts of increasing interest rates and inflation. Inflationary pressures remain present globally as the German inflation rate came in above forecasts at 7.9% during the month. Energy remains the biggest outperformer within the international equities market across the month followed by utilities. Real estate, consumer discretionary and consumer staples were among the worst performers. Listed real estate has started to show weakness as rising rates put pressures on property. Markets are paying close attention to every word coming out of Central Banks as their guidance remains the single most impactful driver of markets. The Federal Reserve Bank followed through with their promise and rose the target policy rate by a significant 0.5% in May. They have outlined that two more increases of 0.5% are still to come in the subsequent months.

Australian Equities

The domestic market also suffered a weak month (-3.13%) as technology and real estate dragged the index lower. Interest rates and inflation remain the key driver domestically just like in international shares. Weakness from China stemming from the lockdowns occurring across the region pulled down the price of iron ore, hurting the major materials miners within Australia. Australia remains one of the worlds best performing stock markets year-to-date (YTD) as resilience within financials, utilities and resources helped steady the market. An above forecast 0.8% growth in GDP for the first quarter of the year reassured Australians of economic weakness. This, however, is of course a backward-looking metric.

Domestic and International Fixed Income

Australian bonds (-0.89%) were finally not the worst performer relative to international bonds (-2.88%) on the month. They are however, still down 8.1% compared to 7.72% for international bonds YTD. Hotter than expected inflation numbers in Europe significantly increased bond yields in the region, feeding into the international bond index. Australia’s bond yields rose moderately on the month but have stabilised somewhat with a lot of the increases in interest rates already priced into the market.

Australian Dollar

The Australian Dollar (AUD) rose 0.94% in May due to a general weakening in the United States Dollar (USD) that saw most currencies valued in USD rise on the month. The USD weakened on the back of falling yields spurred by perceived dovish central bank rhetoric coming out of the Federal Reserve. This talk has been wound back by Fed Chair Jerome Powell since then.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.