Month in Review as at March 2024

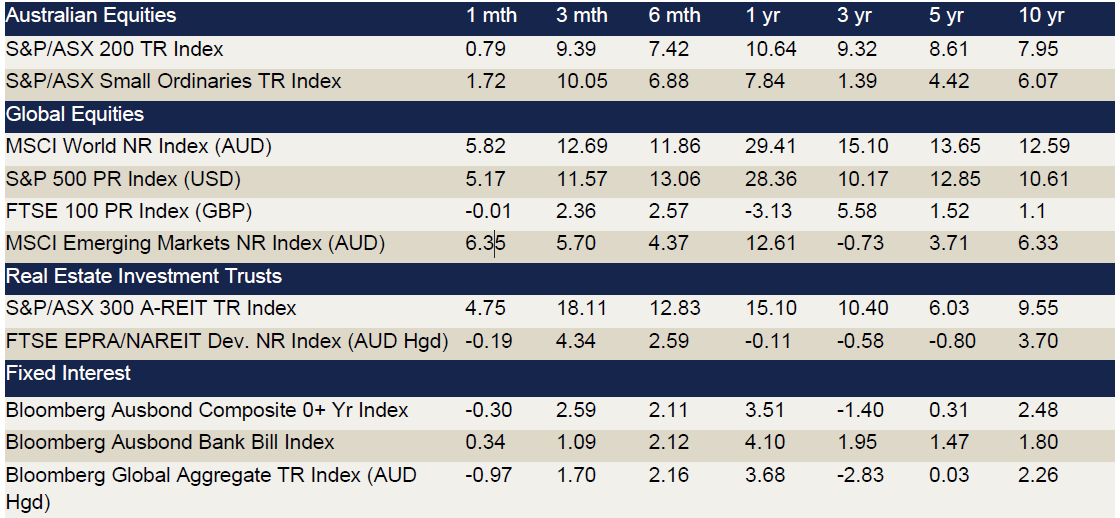

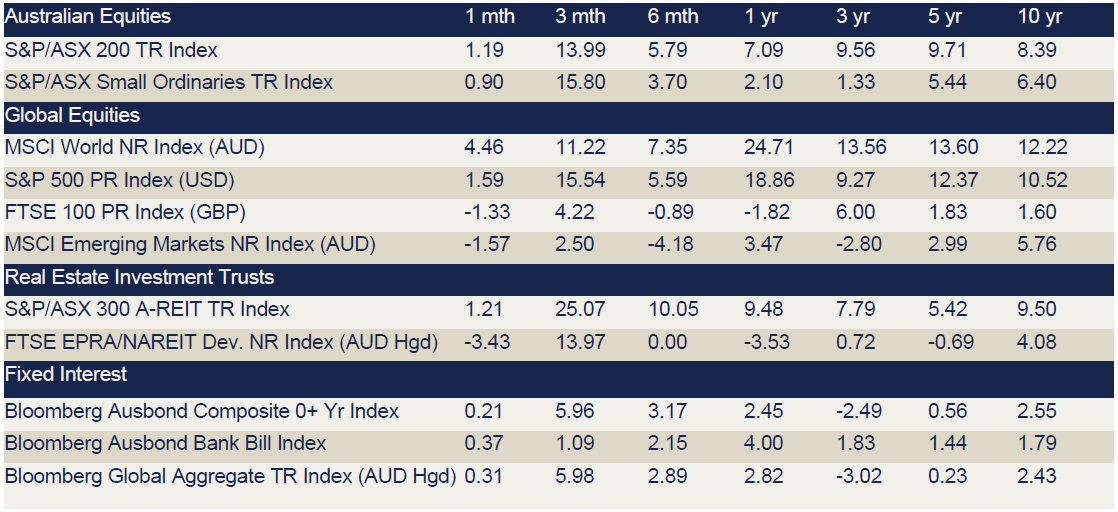

VIEW PDFIndex returns at March 2024 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Points

- The Australian market had a strong month in March, finishing 3.3% higher. Leading the market higher were Property, Energy and Utilities. The only sector finishing the month lower was Communications.

- Overseas markets also finished the month materially higher, with strong gains seen across the US, Europe and the UK.

Australian equities

The ASX 200 rose 3.3% in March, with the strong month punctuated by gains seen in ten of eleven sectors.

Property delivered the largest returns (+9.7%), while Energy (+5.3%) and Utilities (+4.8%) were other market-leaders. Despite only a minor retraction (-0.6%), Communications finished as the only sector in the red.

Despite mixed macro data releases, Property was the beneficiary of stabilising bond yields, slowing inflation, and a more dovish tone from the RBA. The market sentiment pointing towards a rate cut in late 2024 was a positive factor for the rate-sensitive sector. Of the individual constituents, McGrath Ltd (ASX: MEA) rose significantly after shareholders received a takeover bid.

Energy stocks clawed back some of the losses from February, with a few factors contributing to the uptick. Perhaps most importantly, OPEC+ members extended production cuts, a major contributor to rebounding oil prices. As a result, shares in stocks such as Santos (ASX: STO) and Beach Energy (ASX: BPT) saw significant rises.

In the first quarter of 2024, the ASX 200’s 5.3% gain was outpaced by major global indices, with the Japanese Nikkei up 18.1%, the S&P 500 up 10.6%, and major European stocks up 8.4%.

Global Equities

Global equity markets continued to rally, finishing Q1 on record highs. Emerging markets underperformed developed markets in March returning 2.28% (MSCI Emerging Markets Index (AUD)) versus a 3.02% return (MSCI World Ex-Australia Index (AUD)).

US indices continued to beat all-time highs, as market momentum boosted investor confidence and the Fed reiterated their commitment to three rate cuts in 2024. The Nasdaq Composite gained 1.8% for the month and 9.3% for the quarter (in local currency terms), while the S&P 500 gained 3.2% for the month and 10.6% for the quarter (in local currency terms), up 26.1% over five straight months of gains.

Japan similarly continued to extend its all-time high, the Nikkei 225 Index gaining 3.78% for the month (in local currency terms), as continued low interest rates and a weaker Yen drive growth.

The CSI 300 and Hang Seng gained 0.61% and 0.64% (in local currency terms), respectively. After a strong lunar new year, demand turned headline inflation positive and the annual National People’s Congress revealed a 5% growth target for 2024. This all comes despite the continued slowdown in the property sector and a 10- month low in the iron ore price.

Property

The S&P/ASX 200 A-REIT Accumulation index continued the strong start to the year in March, rallying 9.7%. Global real estate equities (represented by the FTSE EPR/NAREIT Developed Ex Australia Index (AUD Hedged)) finished 3.5% higher.

The AREIT index outperformed the broader markets buoyed by a fall in the Australian 10-year bond rate and continued M&A activity and transaction markets opening.

Fixed Income

Exhibiting a continued hawkish stance, the RBA has held the cash rate at 4.35% for the third straight meeting this year. Australian bond markets remained relatively unchanged with 10- and 2- Year Bond yields falling 5 and 4 basis points respectively over the course of the month. The Australian economy continues to show signs of progress, with the market anticipating rate cuts by the end of 2024. Against this backdrop, the Bloomberg AusBond Composite 0+ Yr Index returned 1.12% over the course of the month.

Globally, The US economy has remained resilient despite The Fed’s efforts to cool inflation by keeping interest rates at their 23-year high following their March meeting. US 2-Year Treasury Note yields were unchanged month-end to month-end, while 10-year Treasury yields rose 29 basis points. The sell-off comes as investors become less optimistic on expected rate cuts.

In the UK, the Bank of England board is determined to meet the 2% inflation target and has voted to maintain the Bank Rate at 5.25%. UK 2- and 10- Year Gilt yields fell 41 and 28 basis points respectively. This follows the announcement of a historic gilt issuance, with the UK to sell £265bn of gilts.

Economic key points

- Australian inflation was flat at 3.4% in February.

- Major central banks left rates on hold, continuing with the wait and see approach to inflation.

- The RBA left rates at 4.35% with markets anticipating a 0.25% rate cut in November.

Australia

The RBA left the cash rate at 4.35%, as widely expected. However, the accompanying commentary suggested that the bank’s previous bias towards further rate hikes had moderated to a more neutral stance. Governor Michele Bullock stated that “the Board is not ruling anything in or out”. Financial markets now anticipate a first 0.25% rate cut in November this year.

Annual inflation remained at 3.4% in February. This result was slightly below expectations of 3.5%, but there are mixed views amongst economists on the implications for RBA policy. Financial markets continue to price in a first interest rate cut in November this year for Australia, later than expectations for the other major Western economies.

The unemployment rate fell to 3.7% in February, below the anticipated 4.0%, with commentators suggesting the topsy turvy nature of the labour market reflects changes to the way and time we work throughout the year.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell to 84.4 in March, amid renewed concerns about the economy and family finances. Retail sales rose 0.3% in February, matching market estimates but slowing sharply from January’s +1.1%. The annual rate increased 1.6%.

Composite PMI rose to 53.3 in March, driven by strong growth in the services sector. The NAB business confidence index dropped back to 0 in February with the retail sector being the major drag amid high borrowing costs and elevated inflation.

The trade surplus fell to $7.3 billion in January, below the market forecast of $9.9 billion.

US

The Federal Reserve maintained interest rates at 5.25 – 5.5% but upgraded its expectations for US economic growth in 2024 from +1.4% to +2.1%. Financial markets were relieved that Fed policymakers maintained their expectation for three interest rate cuts in 2024.

Headline inflation growth was 3.5% for the year to March, above the expected 3.4%, largely due to shelter and gasoline costs.

The economy added 303,000 jobs in March, well above the anticipated 200,000. Unemployment fell to 3.8%, against an expected 3.9%.

Retail sales rose 0.6% in February, below the anticipated 0.8% gain. Such a modest increase suggests a potential slowdown in consumer spending. Annual retail sales grew 1.5% for the year to February, ahead of the anticipated 1% increase.

Composite PMI fell marginally to 52.1 in March just below the anticipated 52.2, and despite this fall it represents an uptick in factory activity. Consumer sentiment increased to 79.4 in February, reflecting a rosier outlook on inflation and business conditions.

The trade deficit widened to US$68.9 billion in February, above the anticipated US$67.3 billion.

Euro area

The European Central Bank (ECB) maintained its interest rates at 4.5% during its March meeting as policy makers try to balance concerns over a looming recession with elevated underlying inflationary pressures.

The inflation rate for March came in at 0.8%, below market expectations of 0.9%, keeping the annual rate steady at 2.4% (versus the expected 2.6%). The ECB has projected inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026.

The unemployment rate came in at 6.5% in January, just above the market forecast of 6.4%.

Retail sales fell 0.5% in February, just above the expected -0.4%. Annual retail sales fell 0.7%, better than the anticipated -1.3%. Consumer confidence rose to -14.9 in March as consumers are gradually brightening their views on both their personal and general economic situations.

The Composite PMI rose to 49.9 in March, the highest in nine months, and indicating a near-stabilization of business activity.

UK

The Bank of England maintained the bank rate at 5.25% in its March meeting as policymakers wait for clearer signals that the country’s persistent inflationary pressures have subsided.

Annual CPI fell to 3.4% in February with the Bank projecting inflation to fall below 2% in Q2 2024.

Composite PMI edged down to 52.9 in March, from 53 in February and just below the expected 53.1. Even so, this was the fifth month of expansion in the private sector thanks to a solid rate of increase in output. Service sector growth was quicker than that seen in the manufacturing sector, despite losing momentum in March.

Consumer confidence was unchanged at -21 in March, below the expected -19, as cost of living concerns continue to dampen sentiment.

China

China’s unemployment rate increased to 5.3% in February, higher than the previous month, but below the 5.5% government target.

Composite PMI was at 52.7 in March, the highest reading in ten months, and both manufacturing and services activity expanded. Business sentiment has improved for both manufacturers and services providers with the measures introduced earlier in the year to stabilise growth gradually having an effect.

Annual retail sales grew 5.5% in the January-February period, above the market expectation of 5.2%.

Profits from industrial firms rose 10.2% for the first two months of 2024 compared to last year. Coupled with better-than-expected growth in retail sales, exports and factory output for the same period suggests that, aside from the still-struggling property sector, the Chinese economy is gradually recovering.

Japan

The Bank of Japan (BOJ) raised its cash interest rate, which had been -0.10% since 2016, to between zero and +0.10%. The BOJ also opted to officially end its “Yield Curve Control” policy of buying government bonds to maintain yields below a cap of 1.0%.

These moves were generally anticipated by financial markets and the accompanying commentary was at the “dovish” end of expectations, particularly assurances that “accommodative financial conditions would be maintained for the time being.”

The Japanese equity market rose, and the yen fell on the news, suggesting that more substantial monetary tightening measures had previously been priced in.

Producer inflation came in at 0.8% over the year to March, meeting expectations and marking the strongest reading since October 2023.

Currencies

The Australian dollar (AUD) appreciated over the month of March, closing 0.7% higher in trade weighted terms to 61.5, appreciating against the Japanese Yen (JPY), US Dollar (USD), Pound Sterling (GBP) and Euro (EUR).

The AUD emerged as the top performer among G10 currencies in March, propelled by robust market sentiment that pushed global equities to record highs. The AUD surged to its highest point in two months, following the release of a strong Australian February employment report. Despite a discernible downtrend in the latter part of the month, the AUD managed to secure its first monthly gain against the USD for 2024.

Relative to the AUD, the GBP depreciated the least during the month, closing 0.3% lower. The laggard of the month was the JPY, depreciating in relative terms against the AUD by 1.2%. Year-on-year, the AUD remains behind the GBP, EUR, and USD by -4.8%, -2.1% and -2.5% respectively, whilst ahead of the JPY by 11.1%.