Monthly Market Review – September 2020

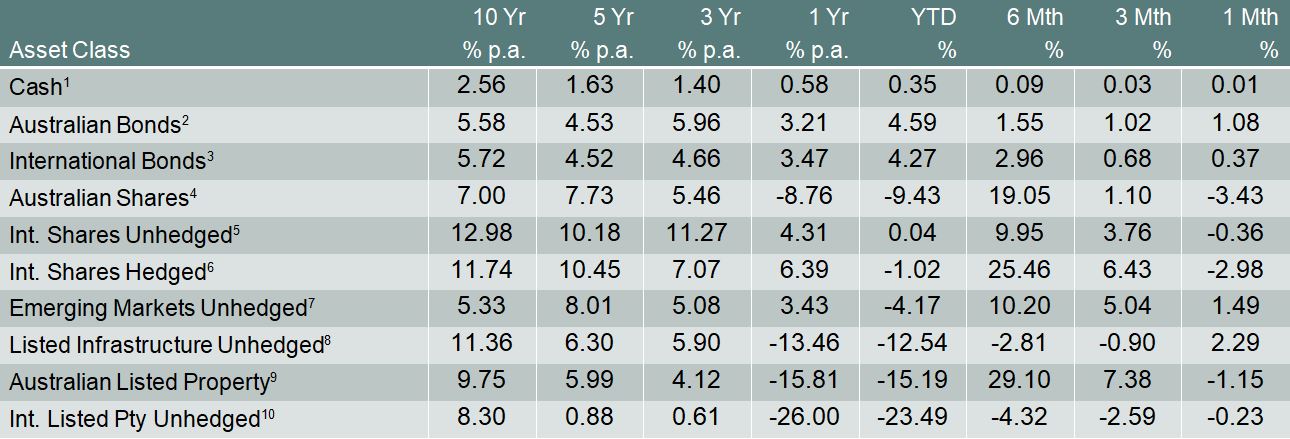

VIEW PDFHow the different asset classes have fared: (As at 30 September 2020)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Australian Dollar and Australian Shares

The Australian dollar fell during September as risk sentiment deteriorated and investors speculated that the Reserve Bank of Australia will further reduce interest rates from 0.25% to 0.1% at its next meeting in early October. The dollar rose slightly as a rally in local and international share markets at the end of the month signaled improving risk sentiment but still finished the quarter down by almost 3%. Australian shares also ended the month lower as a new bout of volatility raised questions about high valuations in IT and consumer discretionary stocks. The prolonged economic shutdown pulled down valuations in commercial real estate.

International Shares and infrastructure

International shares finished the month lower as investor sentiment turned negative with technology stocks dragging down the overall market. The month saw brief rallies following reports of progress on a COVID-19 vaccine. However, concerns about the November election in the US and an increase in European COVID-19 cases weighted heavily on investor sentiment.

Valuations in Europe continue to remain more attractive on a price-to-earnings basis than in the United States but repeated waves of COVID-19 and a poor outlook for the region’s banking system has meant that the regional index has struggled to rise. Japan continued to rally, albeit at a slower pace than in August as the country brought its second wave under control and attractive valuations drew in investment. US shares were more volatile than in July and August as high valuations, particularly in the technology sector, led to volatility.

Emerging Markets

Emerging markets rallied in September given attractive valuations relative to developed market equities. There are headwinds for EM with ongoing US efforts to prevent Chinese companies from accessing the US marketplace which will continue to weigh on sentiment. An end to the sell-off in the US dollar may cause more pain for EM companies and households making purchases of imported goods.

Fixed income

Australian fixed income rallied in September as speculation that the Reserve Bank of Australia will announce further easing at its October meeting placed downward pressure on yields. International fixed-income investors were also helped by central banks. In the US, yields fell as the Federal Reserve signaled it plans to maintain near-zero interest rates until 2023.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.