Month in Review as at December 2023

VIEW PDF

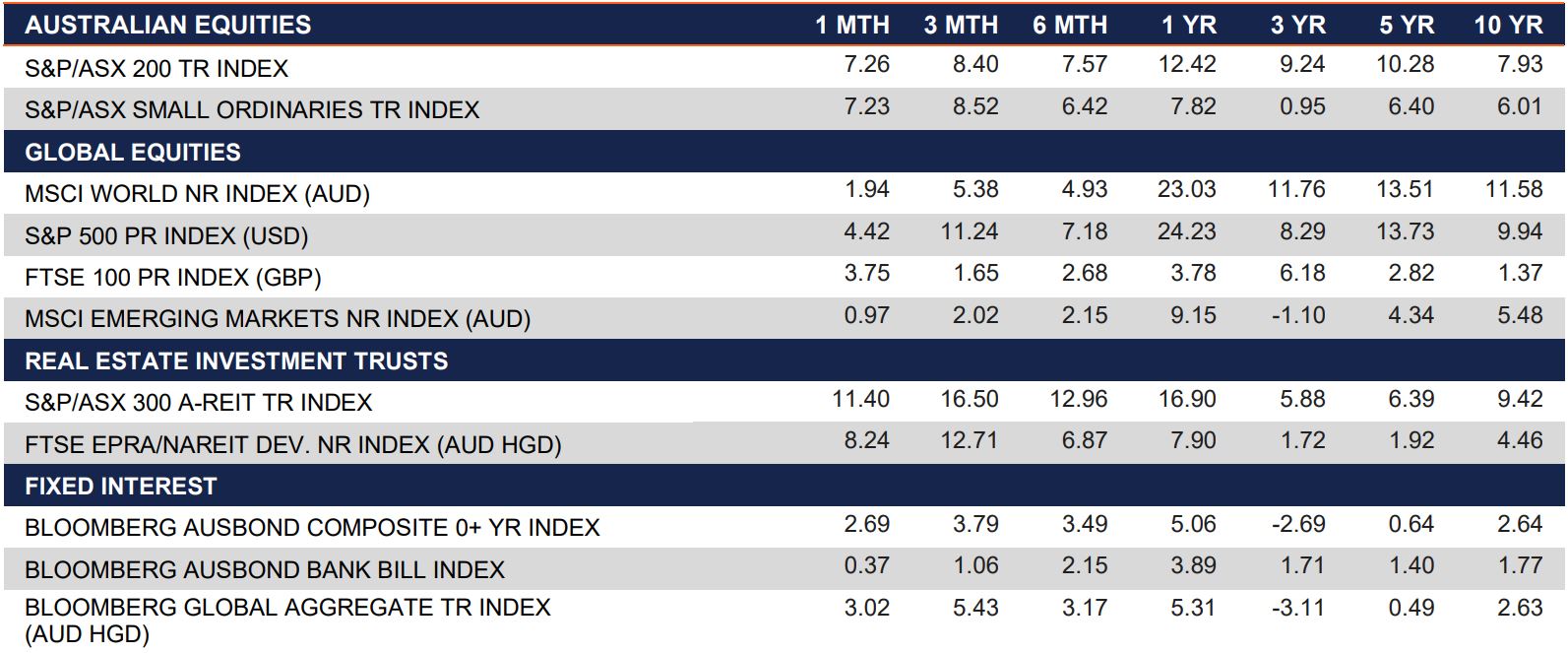

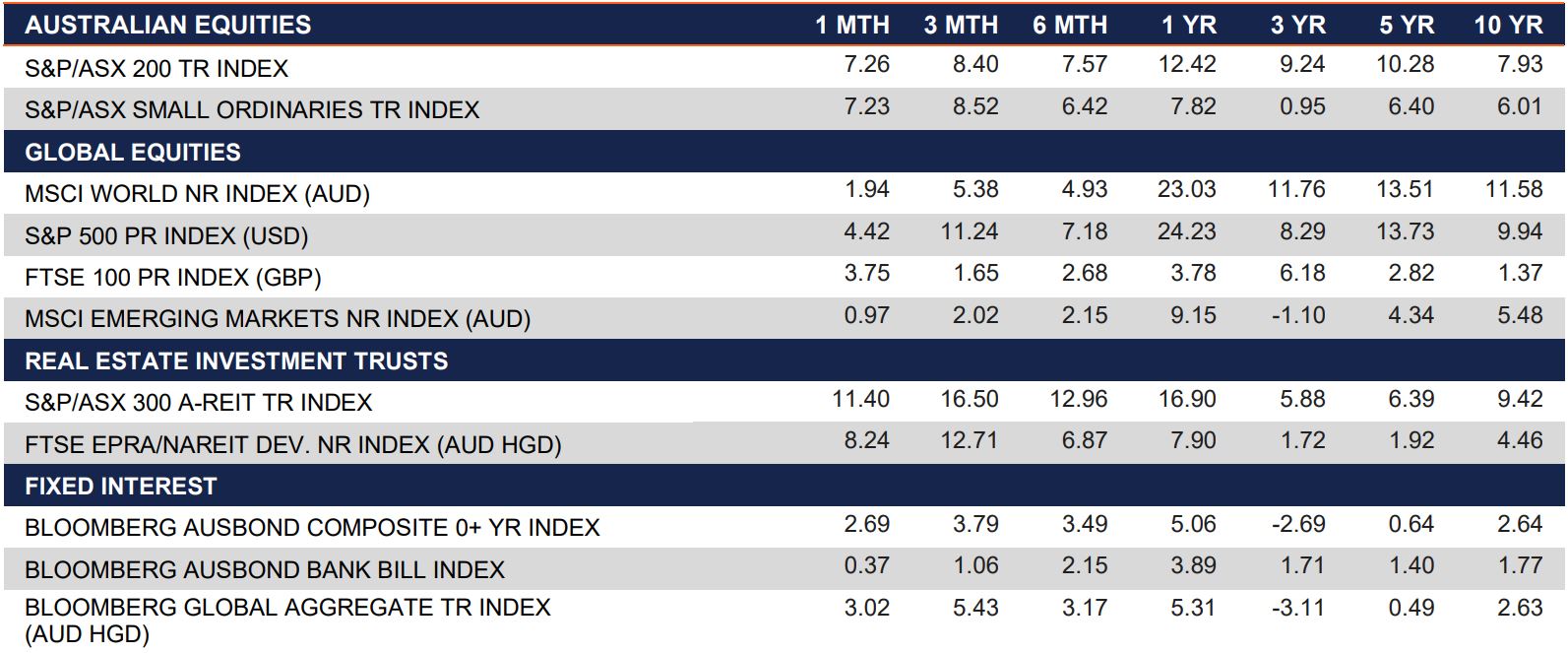

Index returns at December 2023 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Market Key Points

- The Australian market had a strong month in December, finishing 7.3% higher. Leading the market higher were Property (11.5%), Healthcare (9.8%) and Materials (8.8%), while Energy and, Utilities were laggards.

- Overseas markets also finished the month higher, particularly developed markets. Emerging markets were fixed, the CSI 300 Index (CNY) finishing the month lower.

Australian equities

The ASX 200 finished December up 7.3% with all 11 sectors posting positive returns. The December ‘Santa Rally’ rang true again, with market sentiment being supported by the indications from the US Federal Reserve that interest rates have peaked. Locally, the monthly returns transpired despite the release of weak data across several economic indicators. Investors also see potential for rate cuts from central banks in 2024, and these factors contributed to the monthly return.

Leading the pack were Property (+11.5%), Health Care (+9.1%), and Materials (+8.8%) while Utilities (+2.5%) and Energy (+3.4%) finished less favourably. Property had double digit returns for the second consecutive month, as investors gave the sector buoyancy following the Fed’s dovish tone. Robust gains in the price of iron ore and other commodities were beneficial for Materials shares.

Over the year, Information Technology (+31.3%) was the top performing sector, leveraging off the advances in A.I. technology. Other sectors that finished the calendar year with robust returns were Consumer Discretionary (+22.3%), Property (+17.6%), Communications (+16.6%) and Materials (16.2%). Given the late run, at the conclusion of 2023 the ASX 200 was up 12.4%, marking a strong rebound after the negative return in 2022.

Global Equities

Global equity markets rallied into the end of the year on easing inflation data. Developed markets continued to outperform emerging markets returning 1.8% (MSCI World Ex-Australia Index (AUD)) versus a 1.0% return according to the MSCI Emerging Markets Index (AUD). The CSI 300 Index lost 1.8% (in local currency terms) in December due to investor concern on lack of stimulus from the Chinese government.

US markets continued to gain as the FOMC meeting suggested three interest rate cuts in 2024, sending the S&P500 up 4.5% (in local currency terms), while the Nasdaq rose 5.6% in December, marking a 44.6% increase for 2023 (in local currency terms).

Property

The S&P/ASX 200 A-REIT Accumulation index finished the year strongly during December, with the index finishing 11.5% higher. Global real estate equities (represented by the FTSE EPR/NAREIT Developed Ex Australia Index (AUD Hedged)) also performed well, advancing 8.4% for the month. Australian infrastructure continued its positive trend through December, with the S&P/ASX Infrastructure Index TR advancing 4.4%% for the month and 11.3% for the calendar year.

December was relatively muted on the M&A front across the A-REIT sector. Some activity included Charter Hall Retail REIT (ASX: CQR) contracting to sell $225.5mn of shopping centre assets, with the focus on maintaining balance sheet strength. In broader news Cromwell Property Group (ASX: CMW) announced new CFO, Michelle Dance, who was promoted internally. Dexus (ASX: DXS) announced their new CEO Ross Du Vernet who has been a member of the executive team since he joined in 2012.

The Australian residential property market experienced an increase of +0.4% Month on Month (as represented by CoreLogic’s five capital city aggregate). Perth was the biggest riser (+1.5%), followed by Adelaide (+1.3%) and Brisbane (+1%). In contrast, Melbourne (-0.3%) was the only city to deliver negative returns in December. CoreLogic’s five capital city aggregate returned +9.7% for the calendar year in 2023.

Fixed Income

In a move reflecting its cautionary approach towards inflation, the RBA kept the cash rate on hold at 4.35%. This pause comes after a rate hike last month and a period of assessment on inflation’s trajectory, which has shown signs of moderation, particularly in the goods sector. Despite this, the RBA acknowledges the inflation risks associated with the tight labour market and rising housing prices, emphasising its commitment to reining in inflation to target levels.

Australian bond markets reacted with restraint to the RBA’s decision. The 2-Year Bond yield edged down by 40bps, while the 10-Year yield fell by 45bps, as investors digested the mixed signals of a steady cash rate against potential inflation concerns.

In global markets, US Treasury yields continued to decline amidst softer inflation data, with the 2- and 10-Year both falling by 45bps. The Bank of England (BoE) held interest rates steady for the third consecutive meeting, as CPI dropped to 3.9%, the lowest in over two years. UK 2- and 10-Year Gilt yields declined by 62ps and 64bps respectively, suggesting market confidence in central bank policies to manage inflation.

Key Economic Points

- RBA left the cash rate at 4.35% in its December meeting.

- Other major central banks followed suit, leaving cash rates at current levels.

- Inflation was mixed, with falls in Australia and USA and increases in the UK and Euro Zone.

Australia equities

As widely expected, the RBA kept interest rates on hold at its final meeting for the year. The accompanying statement carried a less hawkish tone than other recent commentary, noting that inflation was continuing to moderate and that the expected trajectory remained consistent with RBA targets.

November’s inflation indicator came in at 4.3%, the lowest rate since January 2022 and below the anticipated. 4.4%. The most significant price rises were housing (+6.6%), food and non-alcoholic beverages (+4.6%) and insurance and financial services (+8.8).

The Westpac-Melbourne Institute Index of Consumer Sentiment rose to 82.1 in December but remains at pessimistic levels due cost of living and interest rate pressures. Retail sales rose 2% in November, well above the anticipated 1.2%, largely due to Black Friday sales.

The unemployment rate was steady at 3.9% in December, matching market forecasts. While the rate was steady, a softening of the labour market is underway with the economy shedding 106,600 full times roles, the largest drop since May 2020.

Composite PMI increased to 46.9 in December, but private sector activity remains subdued in both manufacturing output and services activity. The NAB business confidence index dropped to -9 in November, the lowest level outside the COVID period since 2012, with sentiment deteriorating in most industries.

The trade surplus increased to $11.44 billion in November, well above forecasts of $7.5 billion.

US

Following signs of easing inflation, the US Federal Reserve kept interest rates steady at its final meeting for the year, but indicated a clear willingness to reduce them in 2024. An updated “dot plot” trajectory of Fed policymaker estimates for future interest rates showed a median expectation for US cash rates to reach 4.50-4.75% by the end of next year, representing three cuts of 0.25% each, with a further four cuts anticipated in 2025.

Annual headline CPI inflation slowed to +3.1% in November, as falling fuel prices offset increases in rent. Core inflation, which excludes food and energy, also decelerated to an annualised +4.0%. Meanwhile, the PPI slowed to an annual rate of +2.5% through to November, down from +2.8% the previous month.

The economy added 216,000 jobs in December, above the market forecasts of 170,000, with the unemployment rate steady at 3.7%.

Consumer sentiment rose to 69.4 in December amid substantial improvements in outlook on inflation. Retail sales came in at 0.6% in December, the largest increase in three months and ahead of the anticipated 0.4% rise and the 0.3% increase in the prior month.

Composite PMI rose marginally to 50.9, primarily driven by the continued growth in the service sector.

The trade deficit narrowed to US$63.2 billion in November, below the forecast US$65 billion.

Euro area

The ECB maintained interest rates at 4.5% for the third month in a row in an effort to combat high inflation. The bank project inflation to average 5.4% in 2023, coming down to 2.7% in 2024. Annual inflation rose to 2.9% in December, just below the expected 3.0%.

PPI fell 0.3% in November, with the annual rate dropping to 8.8% as energy costs continued to fall, but at a slower rate than in previous months.

The unemployment rate fell to 6.4% on November, slightly below, market expectations of 6.5%. Consumer confidence rose to -15.0 in December, the highest level since February 2022 reflecting improved assessments of the general economic situation and easing inflation.

Retail sales fell 0.3% in November, matching market expectations. Annual retails sales fell by 1.1%, underscoring the impact of the ECB’s aggressive rate tightening.

The Composite PMI came in at 47.6 in December, with both services and manufacturing output declining.

UK

The Bank of England voted by a majority of 6-3 to uphold the cash rate at a 15-year high of 5.25% during its December meeting. This aligns with policymakers’ efforts to combat inflation, even in the face of a deteriorating economic landscape.

Annual inflation unexpectedly rose to 4% in December from a nearly two-year low of 3.9% in November, and above forecasts of 3.8%. It is the first increase in inflation rate in ten months, with the biggest upward contribution coming from prices of alcohol and tobacco (12.9% vs 10.2%), mainly due to a rise in tobacco duty.

PPI fell 0.6% in December, against market expectations of -0.2%, with the annual rate rising 0.1%.

Consumer confidence rose to -22 in December, as Britons became less pessimistic about their future financial situation amid easing inflationary pressures. Retail sales increased 1.3% in November, ahead of the expected 0.4%. Annual sales grew 0.1%, well ahead of the anticipated -1.3% and marks the first increase in retail activity in 19 months.

China

China’s GDP grew at an annualised rate of 5.2% for the December quarter, slightly below market expectations. Of particular concern for the local mining sector was the sharp fall in Chinese steel production to 67.4mt in December 2023, the lowest rate in 6 years and a 13% drop from the prior December. The latest data caused spot iron ore pricing to fall around 3% as investors downgraded their expectations for Chinese demand in 2024. The Australian dollar also weakened, falling back toward US$0.65 after beginning this year at US$0.68.

Other data released at the same time showed that the population declined for a second year in a row as birth rates declined at an accelerating pace. Coupled with persistently high youth unemployment (at around 14.9%), the shrinking population will have a long term effect on growth.

The unemployment rate rose to 5.1% in December. Consumer prices fell by 0.3% in December, continuing a deflation streak started in October. PPI was down 2.7% in December, above estimates of a 2.6% drop, and having declined for 15 consecutive months.

Composite PMI rose to 52.6 in December, as both services and manufacturing activity increased. This is the 12th straight month of growth in private sector activity.

Retail sales increase 0.3% in December with annual sales increasing 7.4%, missing the market consensus of 8.0%.

Japan

The Bank of Japan kept interest rates steady at 0.1% and maintained a 0% target for its 10-year bond yield set under its yield curve control policy, as expected. Policy makers continue to wait for more indications that wages are improving enough to stoke inflation.

Economic growth has fallen by 2.9% per cent since this time last year, driven by sluggish consumer demand because of 18 months of real wage decreases.

The unemployment rate was unchanged at 2.5% in November, matching market expectations.

The consumer confidence index rose to 37.2 in December with sentiment increasing in all components. Retail sales grew 1% in November, with the annual rate rising 5.3%, above the anticipated 5.0%.

December saw Composite PMI rise to 50.0, with faster service sector growth offsetting a further reduction in manufacturing production.

Currencies

The Australian dollar (AUD) appreciated over the month of December, closing 1.8% higher in trade weighted terms to 62.6, appreciating against the US Dollar (USD), Pound Sterling (GBP) and Euro (EUR) whilst depreciating against the Japanese Yen (JPY).

The AUD strengthened against the USD in December for the second consecutive month, supported by improved market sentiment in Australia and weakness in the USD. The major difference in outlook is driven by the evolution of interest rate expectations. Against other currencies, the AUD performed moderately, experiencing its first monthly decline against the Japanese yen since August amid speculation regarding a potential shift in the Bank of Japan’s monetary policy.

Relative to the AUD, the JPY led the pack in December, appreciating by 1.9%. Conversely, the USD was the laggard of the month, depreciating in relative terms by 3.1% against the AUD. Year-on-year, the AUD remains behind the GBP, EUR, and USD by -5%, -3.1% and -0.1% respectively, whilst ahead of the JPY by 7.5%.

Important notice: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No.421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure at the date of publication: Lonsec receives a fee from the fund manager or product issuer(s) for researching the financial product(s) set out in this document, using comprehensive and objective criteria. Lonsec may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec services. Lonsec’s fee is not linked to the rating(s) outcome.

Lonsec does not hold the product(s) referred to in this document. Lonsec’s representatives and/or their associates may hold the product(s) referred to in this document, but details of these holdings are not known to the Analyst(s).

Disclosure of Investment Consulting services: Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other financial advice and may receive fees from this fund manager or product issuer for providing investment consulting services. The investment consulting services are carried out under separate arrangements and processes to the research process adopted for the review of this financial product.

For an explanation of the process by which Lonsec manages conflicts of interest please refer to the Conflicts of Interest Policy which is found at: http://www.lonsec.com.au/aspx/IndexedDocs/general/LonsecR esearchConflictsofInterestPolicy.pdf

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Lonsec’s research process relies upon the participation of the fund manager or product issuer(s). Should the fund manager or product issuer(s) no longer be an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).