Monthly Market Review – July 2022

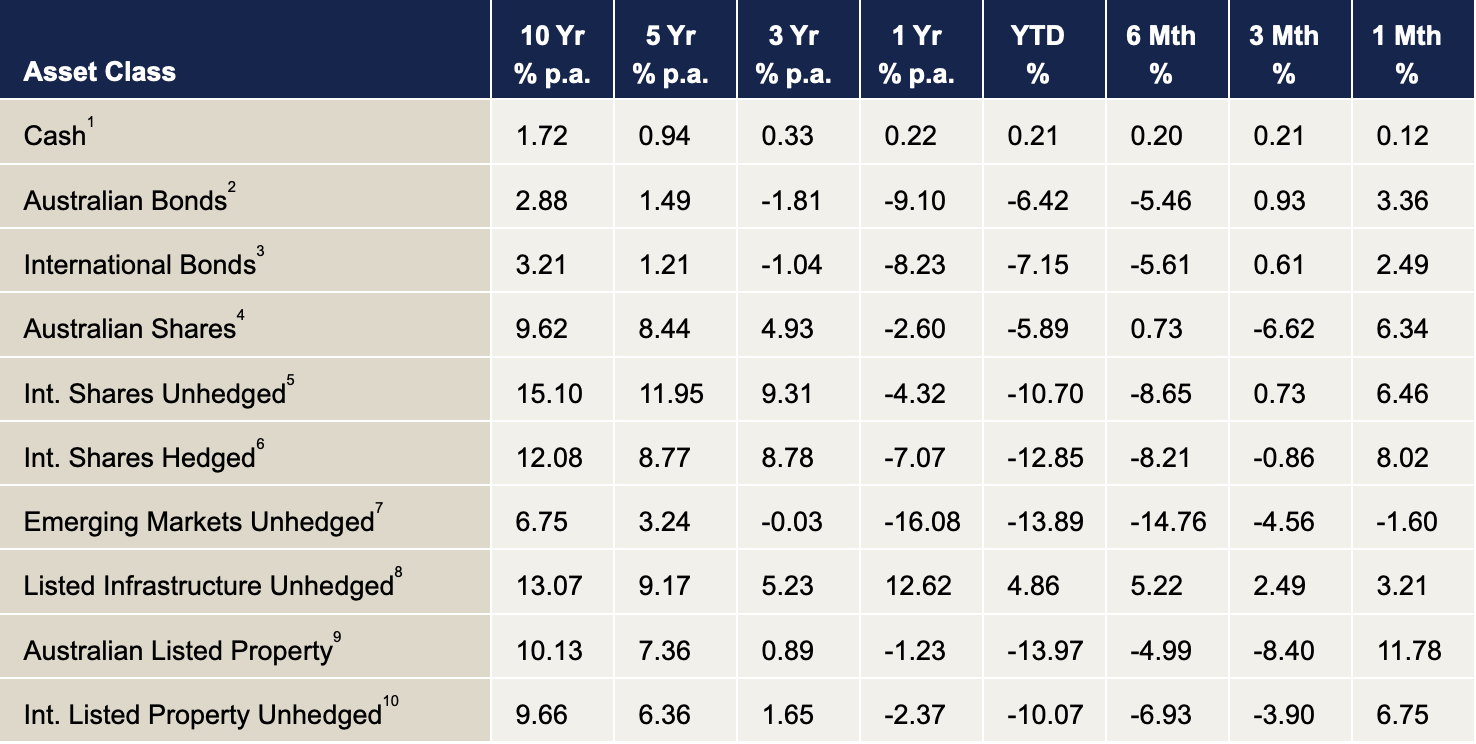

VIEW PDFHow the different asset classes have fared: (As at 31 July 2022)

(As at 31 July 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

In stark contrast to the previous months, international equities posted strong returns during July 2022. Unhedged returned 6.46%, whilst hedged returned 8.02% across the month. Whilst central banks around the world are continuing to raise rates to combat inflation, markets are beginning to price in an easing of this policy as many economists are predicting a ‘peak in inflation’ towards the end of 2022. Time will tell as to whether this actually plays out. A reacceleration in inflation towards the later end of the year would be a shock to markets.

Australian Equities

Australia joined in on the global equity rally and posted a 6.34% gain for the month. This was led by Technology, Real Estate and Healthcare, all sectors which are most sensitive to interest rates. As long-term interest rates fell over the month, a tailwind behind these sectors took place. As a gloomier economic environment evolved over the month, sectors such as industrials and materials were hurt as they rely on economic growth to perform well.

Domestic and International Fixed Income

Positive returns within both Australian and International bonds occurred across the quarter with 3.36% and 2.49% gains, respectively. This is a significant change in trend to what has been occurring over the year. Significant drops in long term interest rates took place as a recessionary environment began to get priced into markets. These falls in interest rates are very positive for bonds overall and caused a significant rally globally.

Australian Dollar

The Australian Dollar (AUD) rallied 3.05% across the quarter as pullback occurred in the United States Dollar (USD). The US Dollar pullback occurred as the United States posted a 9.1% increase in inflation from this time in the previous year. The US has also entered a recession by posting two quarters of negative GDP growth. A gradual weakening in the USD has been the main cause of the AUD rise as opposed to Australian economic strength.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.