Month in Review as at April 2023

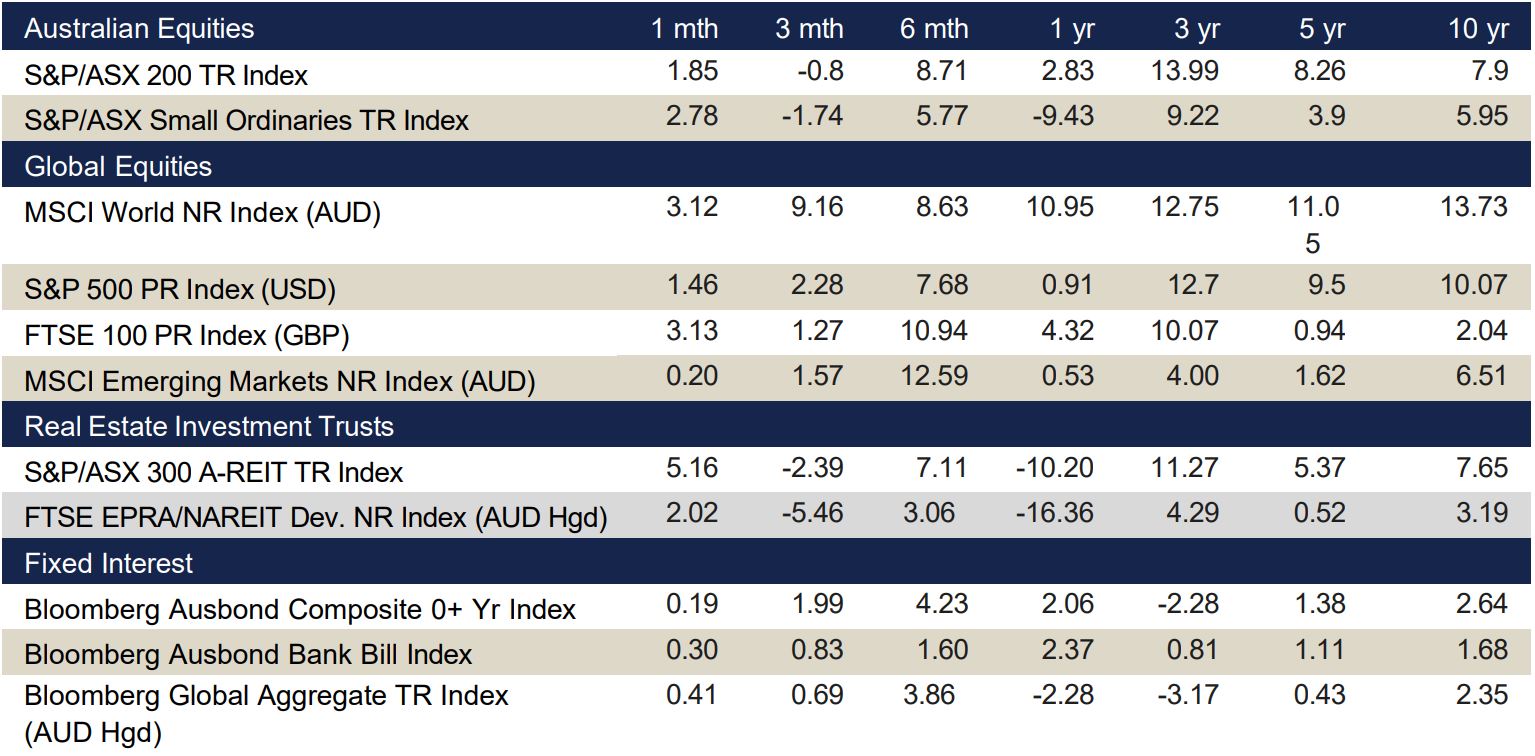

VIEW PDFIndex returns at end April 2023 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Points

- The Australian equity market returned 1.9% in April driven by strong returns in property (+5.3%), IT (+4.8%) and Industrials (+4.5%). Materials were a clear laggard (-2.6%).

- Globally, developed markets had reasonable gains, particularly the UK’s FTSE 100 Index returning 3.4% in local currency terms.

- Asian markets fared worse with the Hang Seng Index (HKD) finishing the month down -2.4% and the CSI 300 Index (CNY) down -0.5%.

Australian equities

The S&P/ASX 200 Accumulation Index finished April with a gain of 1.9% after two negative performing months. Softer inflation figures and a pause in the RBA’s rate hikes led to strong gains in the first half of the month, while a slump in commodity prices, particularly iron ore, moderated those gains in the back half of April. Property was a key contributor (+5.3%), with I.T. (+4.8%) and Industrials (+4.5%) also performing strongly. Materials (-2.6%) was the sole detractor.

Property led all sectors for the month off the back of the RBA’s rate decision, meanwhile, slowing construction activity in China contributed to the declines in Materials stocks. Overall, domestic markets were driven by relief from inflation data and the interest rate pause, while concerns around the U.S. banking system were somewhat tempered. These factors were all conducive to a positive month for the Index.

Global equities

Global equities started with another positive month despite mounting higher interest rates. Emerging markets underperformed developed market counterparts returning 0.2% (MSCI Emerging Markets Index (AUD)) versus a 3.2% gain according to the MSCI World Ex Australia Index (AUD).

A greater proportion of earnings surprises and decreased investor expectations have buoyed the U.S. markets, coupled with an outlook for disinflation to continue. Over half of companies have now reported, with the S&P 500 Index posting a 1.6% return (in local currency terms) for the month.

UK economic data followed a similar pattern with headline inflation also falling slightly. The FTSE 100 Index was one of the top performers globally, having a gain of 3.4% (in local currency terms). This was driven by a resurgence in value stocks leading the UK index charge.

Equities across China saw a decline off the back of concerns on the economic recovery slowing down. This was reflected by the Hang Seng Index and the CSI 300 Index, returning -2.4% and -0.5% respectively (in local currency terms) for the month. Expectations are that China’s central bank will ease policy to support weakening economic data.

Property

The S&P/ASX 200 A-REIT Accumulation Index finished +5.3% higher in the month of April as the A-REIT sector rebounded from its negative first quarter. In a global context, G-REITs (as represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) ended April +1.9% higher. The Australian Infrastructure sector (As represented by the S&P/ASX Infrastructure Index) finished +2.3% higher in line with the A-REIT sector.

The Australian residential property market experienced an increase by +0.7% Month on Month (as represented by CoreLogic’s five capital city aggregate). Sydney was the biggest riser alongside Perth (+0.6%) also performing strongly. In contrast, Darwin (-1.2%) was the only city to regress during April.

Fixed Income

In April, the bond market remained range-bound despite concerns over fallout from banking developments in March. US short-term Treasury Bills declined due to uncertainty regarding the debt ceiling with further volatility expected over the next few months.

The Australian 2-year and 10-year government bond yields were relatively unchanged, only moving up 9bps and 4bps respectively. The Bloomberg Ausbond Composite 0+ Yr Index reflected a return of 0.2% for the month. The US 2-year and 10-year Government bond yields fell by 2bps and 5bps, respectively. In the United Kingdom, GILT yields rose due to resilient activity data and inflation surprises. The 2 Year Gilt yields rose 34bps and 10 Year Gilt yields rose 22bps. During the month, higher quality fixed income delivered strong performance as spreads remained narrow despite apprehensions about the economic outlook. The Bloomberg Barclays Global Aggregate Index (AUD Hedged) returned 0.4% for the month.

Key points – Economic

- Inflation appears to have peaked but is proving sticky so central banks may have more work to do to drive it down.

- RBA maintained the cash rate at 3.6%.

- Both the FEB and ECB maintained interest rates.

Australia

The RBA maintained the cash rate at 3.6% at its April meeting. The headline consumer price index for the first three months of 2023 came in at an annual rate of 7%, in line with expectations and slower than the 7.8% of the December quarter. March’s unemployment rate was static at 3.5%, with the economy adding 72,200 jobs. Retail sales rose 0.4% in March, with food sales rising for the 13th month.

The Westpac-Melbourne Institute Index of Consumer Sentiment for April rose to 85.8, buoyed by the pause in rate hikes by the RBA. Composite PMI rose to 53 in April with the rise in services offsetting the fall in manufacturing output. The NAB business confidence index came in at -1 with confidence appearing to have stabilised albeit below long run averages with deeper negatives in retail and wholesale.

The trade surplus increased to $15.3 billion in March, above the market forecasts of $12.65 billion.

Global

Inflation appears to have peaked in April but is proving sticky. While goods inflation has come down as the covid-era shortages have largely eased, services inflation and rising wage costs are complicating issues. Central banks may have more work to do to really drive down those inflation numbers. A lengthy period of sub-par growth may be required to tame inflation, meaning a pause is more likely than an outright pivot, barring any further financial instability.

Growth has been surprisingly resilient thanks in part to a resilient consumer, tight labour markets, a mild European winter and China re-opening post Covid-19. However, growth is predicted to slow as the year progresses, with the lagged effect of rising interest rates and cost of living pressures making their way through the economy.

US

The Federal Reserve maintained the cash rate at 5.00% in its April meeting. Inflation rose 0.4% in April, matching market expectations, and bringing the annual rate to 4.9%.

The US economy grew by an annualised 1.1% in Q1 2023, slowing from a 2.6% expansion in the previous quarter and missing market expectations of 2% growth.

Non-farm payrolls added 253,000 new jobs in April, beating forecasts of 180,000. The unemployment rate edged down to 3.4% in April, better than market expectations of 3.6%.

Consumer confidence fell to a nine-month low of 101.3 in April. Retail sales fell 0.6% month-on-month in March, with the annual rate increasing 2.3%.

The S&P Global Composite PMI rose to 53.4 in April, showing a solid upturn in both services and manufacturing activity. PPI increased 0.2% in April against market expectations of a 0.3% increase, with the annual rate easing to 2.3% and below the market forecast of 2.4%.

The balance of trade deficit narrowed to US$64.2billion in March, above the expected US$63.3 billion.

Euro zone

The Eurozone economy grew slightly by 0.1% in Q1 2023 after a flat fourth quarter but missed market consensus of a 0.2% expansion. The surge in consumer prices was due to the higher cost of energy and food, alongside the fastest pace of policy tightening by the European Central Bank in over 20 years and weakening confidence have taken a toll on the bloc’s economy.

The annual inflation rate came in at 7.0% in April, above the expected 6.9%, signaling that inflationary pressure remains high in Europe. Unemployment dipped slightly to 6.5% in March against expectations of 6.6%.

Consumer confidence increased 1.6 points to -17.5 in April. Retail sales dropped 1.2% in March, well below the forecast -0.1%. The annual rate came in at -3.8%, the biggest decline since January 2021.

The Composite PMI rose 54.1 in April, solely supported by an increase in services activity. PPI dropped 1.6% in March, slightly less than the expected 1.7% decrease, with the annual rate easing to 5.9% as expected.

UK

An unexpected 0.3% contraction in GDP in March sees the UK at the bottom of the G7 growth league behind Germany, France and the US. Strong growth in January meant the economy grew by 0.1% over the first quarter but was unable to prevent the UK economy being 0.5% smaller than it was in 2019 before the Covid-19 pandemic.

The UK will face a difficult situation going into the summer, with millions of households finding that lower gas prices will be offset by higher income taxes and a rise in mortgage costs.

Inflation unexpectedly rose 0.8% in March, bringing the annual rate to 10.1% and above the expected 9.8%. The rate remains above the 10% mark for a seventh consecutive period and the Bank of England’s 2% target for almost two years, suggesting policymakers might continue to raise borrowing costs further to rein in inflation.

Consumer confidence rose to -30 in April, exceeding expectations of -35. Annual retail sales fell 3.1%, matching market expectations.

The composite PMI index rose to 54.9 in April driven by services growth. Manufacturing contracted for the ninth month in a row.

PPI increased 0.1% in March, compared to the market expectations of a 0.1% decrease, with the annual rate easing to 8.7%, slightly below the anticipated 8.8%.

China

The Chinese economy grew by 2.2% on a seasonally adjusted basis in the three months to March, picking up from an upwardly revised 0.6% growth in the fourth quarter and matching market forecasts. The annual inflation rate fell to 0.1% in April, lower than the market estimate of 0.4%.

The unemployment rate declined to a seven-month low of 5.3% in March. Retail sales for March increased 10.6%, exceeding market forecasts of 7.4%.

Composite PMI declined to a three-month low of 53.6 in April, with both services and manufacturing noting softer rises in output than the previous month.

Asia region

The Bank of Japan maintained its key short terms interest rate at -0.1% at its April meeting. The bank also slashed its FY 2023 GDP outlook to 1.4% from 1.7%.

Inflation increased 0.3% month on month with the annual rate dropping slightly to 3.2% in March.

The unemployment rate rose to 2.8% in March, above the expected 2.5%.

The consumer confidence index rose to 35.4 in April, well above the market forecast of 32, as household sentiment strengthened across all indices. Retail sales in Japan increased 0.6% in March, with the annual rate rising 7.2%, exceeding the market forecast of 5.8%.

The Composite PMI was unchanged at 52.9 in April, with strong services growth offset by a sharp fall in manufacturing output.

Currencies

The Australian dollar (AUD) fell for the third consecutive month in April, closing -0.8% lower in trade weighted terms to 59.8 and depreciated relative to three of the four major currencies referenced in this update.

April’s trading range of the AUD/USD pair remained narrow at just 2.3 cents over the month, similar to the 2.2 cent range observed in March. Volatility throughout the month was primarily influenced by the RBA rate hike pause in April, in addition to strong domestic labour market reporting and weaker than expected CPI data released for the quarter.

Relative to the AUD, the Pound Sterling (GBP) led the pack in March, appreciating by 2.8%. Conversely, the Japanese Yen (JPY) was the laggard of the month, falling by 1.6% relative to the AUD. Year-on-year, the AUD remains behind the Euro (EUR), US dollar (USD), GBP and JPY by -10.3%, -6.3%, -6.2% and -1.6% respectively and is down -5.2% in trade weighted terms.