Month in Review as at April 2024

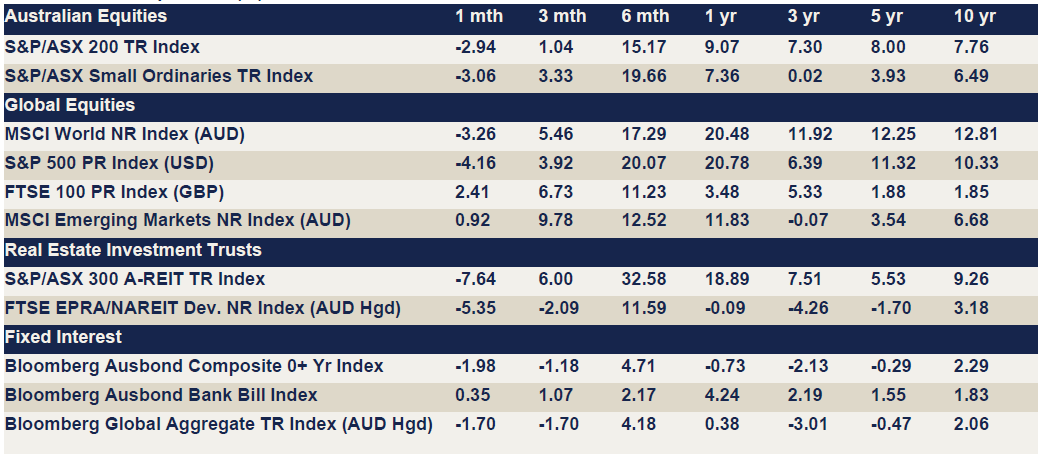

VIEW PDFIndex returns at April 2024 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Market Points

- The Australian market was weaker in April, finishing the month 2.9% lower. Leading the market lower were the Property, Consumer Discretionary and Communications sectors. The only sectors finishing the month stronger were Utilities and Materials.

- Most developed markets finished the month lower, with falls in the US and Europe. The UK and Asian markets finished the month higher.

Australian equities

Following a run of gains, the ASX 200 finished April down 2.9%, the Index’s first negative month since October 2023. Losses were felt broadly at the sector level, with Property (-7.8%), Consumer Discretionary (-5.1%), Communications (-4.9%) and Energy (-4.7%) seeing the biggest falls. Utilities (+4.8%) and Materials (+0.6%) were the only sectors which had a positive month.

The evolving interest rate environment was a significant contributor to the losses seen in the market, as data both locally and abroad pointed towards fewer rate cuts this year. This was most obvious in the rate-sensitive sectors, with Property being the most notable. Consumer Discretionary shares were hit by rate sentiment, while also being dragged down by The Star Entertainment Group (ASX: SGR), whose shares plunged by nearly 30% in the month. The Energy sector had a weak month despite accommodating oil prices.

As market volatility and geopolitical uncertainty was amplified in April, the market flocked to Utilities, as the defensive sector became a haven for investors. AGL Energy Limited (ASX: AGL) was a strong performer for the sector as it closed the month up 13.4%, after a class action proceeding was dismissed.

Global Equities

Developed equity markets finished lower, ending a five-month rally, while Emerging markets continue to gain. Developed markets in April returned -3.26% (MSCI World Ex-Australia Index (AUD)) versus a 0.92% return from Emerging Markets (MSCI Emerging Markets Index (AUD)).

US indices declined for the first time since October as the likelihood of a Federal Reserve rate cut lowered. Sentiment has shifted in the market to expectations of a 25-basis point rate cut by the end of the year as the Fed searches for clearer signs of further deflation.

The Nasdaq 100 dropped -4.4% for the month (in local currency terms), while the S&P 500 lost -4.08% for the month (in local currency terms). However, despite the macro-outlook, corporate earnings were generally positive with a higher-than-expected growth rate.

Japan similarly lost hard fought gains as the market mirrored wall street and the tech-sector lost favour. The Nikkei 225 Index dropped -4.86% for the month (in local currency terms).

The CSI 300 and Hang Seng gained 2.01% and 7.45% (in local currency terms), respectively. This reflects a continuing rebound from a tumultuous beginning of the year, boosted by strong GDP growth and PMI expansion.

Property

The S&P/ASX 200 A-REIT Accumulation index regressed for the first time this year in April, with the index finishing the month 7.8% lower. Global real estate equities (represented by the FTSE EPR/NAREIT Developed Ex Australia Index (AUD Hedged)) also performed poorly, falling 5.1% for the month.

Australian infrastructure continued its slight negative trend through April, with the S&P/ASX Infrastructure Index TR returning -0.1% for the month and -0.1% YTD.

Fixed Income

April was a tough month for bond markets, both locally and internationally, with yields back at levels last seen in December 2023. Over the month price pressures remained stubborn, CPI numbers came in higher than expected and the housing market continued to rise.

Against this backdrop, Australian 2- and 10- Year bond yields rose 33 and 41 basis points respectively over the course of the month and the Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, fell 1.98%.

Globally, bonds markets exhibited a similar story. US inflation remained sticky, and markets shifted their stance on any near-term rate cuts from the Fed. US 2- and 10- Year bond yields rose 42 and 77 basis points respectively over April, and the Bloomberg Global Aggregate Index was down 2.07%. The latest batch of US economic data exhibited strong evidence that inflation remains hot, with markets pricing in only one rate cut in 2024 from the Fed with expectations that that a much tougher stance on inflation will be taken.

Key Economic Points

- Australian annual inflation was 3.6% in the March quarter.

- Major central banks left rates on hold, continuing with the wait and see approach to inflation.

Australia

Annual inflation came in at 3.6% for the March quarter, down from 4.1% in the December quarter, but above market expectations of 3.4%, stoking the possibility of further interest rate increases. Most concerning for the RBA was the strength in the trimmed mean inflation rate, which was higher than both the market expectations and the December quarter figure, with inflation particularly sticky across the services and housing sectors.

Retail sales figures for March were weaker than expected, declining 0.4% from February’s levels, and gaining only 0.8% compared to March 2023, representing a decline in sales volume once adjusted for inflation over that period. This and other recent indications of a weakening domestic economy have complicated the deliberations of the RBA, with the financial markets now anticipating that the local cash rate could finish the year higher than the current 4.35%.

The unemployment rate rose to 3.8% in March, below the anticipated 3.9%. The Westpac-Melbourne Institute Index of Consumer Sentiment fell to 82.4 in April as persistent inflation and high interest rates continued to weigh on Australian households.

Composite PMI decreased to 53 in April, indicating a slightly slower pace of growth than previous months. The NAB business confidence index rose to 1 in March and while this is below the long-run average, sentiment has improved in retail, construction and transport.

The trade surplus fell to $5.0 billion in March, well below the market forecast of $7.3 billion.

US

The US Federal Reserve kept interest rates on hold, as widely expected, however Chairman Jerome Powell noted that it may take longer than previously expected for policymakers to become comfortable that inflation was on track towards the Fed’s 2% target.

Annual inflation growth was 3.6% in March, above the expected 3.4%, largely due to energy and transport costs.

Larger than expected increases in labour costs also added to concerns about persistent inflation. The US Labor Department’s employment cost index rose 1.2% in the first quarter of 2024, an acceleration from the +0.9% rate in the three months to December. Private sector wages also accelerated to +1.1% in the March quarter.

The economy added 175,000 jobs in April, well short of the anticipated 243,000, underscoring a significant slowdown in the jobs market. The unemployment rate rose to 3.9%, against an expected 3.8%.

Retail sales rose 0.7% in March, well above the anticipated 0.3% gain, suggesting consumer spending remains robust. Annual retail sales grew 4.0% for the year to March, ahead of the anticipated 2.5% increase. Consumer sentiment dropped to 77.2 in April from 79.4 in March, with concerns about the nation’s economic future pending the outcome of the presidential election.

Composite PMI eased to 51.3 in April just below the anticipated 52.2. Despite this fall it represents an uptick in factory activity.

The trade deficit was US$69.4billion in March, above the anticipated US$69.1 billion.

Euro area

Headline CPI inflation remained at +2.4% for the 12 months to April, while Core inflation decelerated only slightly to +2.7%, both rates were higher than anticipated. The region’s GDP growth for the March quarter was also better than expected at +0.3%, helped by Germany’s return to growth.

The European Central Bank (ECB) maintained its interest rates at 4.5% during its April meeting and despite the previously mentioned sticky inflation, recent comments from policymakers still suggest that a rate cut is likely in June.

The unemployment rate remained at a record low of 6.5% in March, in line with market forecasts.

Retail sales jumped 0.8% in March, reversing the 0.3% fall in February and ahead of the anticipated 0.6%. Annual retail sales grew 0.7%, well above the anticipated -0.3%. Consumer confidence rose to -14.7 in April suggesting a gradual brightening of views on both personal and general economic situations. Whilst encouraging, this figure is still well below the long-term average.

The Composite PMI rose to 51.7 in April, driven by an uptick in services activity.

UK

Inflation rose by 0.6% in April, with the annual rate falling to 3.2%, both driven by a slowdown in increases in food prices.

Consumer confidence rose to -19 in April, improving for the first time in three months and coming in above market expectations of -20. The index has been ranging between -24 and -19 for the last six months, indicating slow progress as economic uncertainties continue to weigh heavily on households.

Retail sales were flat in March, compared to the expected 0.3% increase, while annual sales increased 0.8%, just above the anticipated 0.7%. Conditions remain delicate as price rises have been blamed for many retailers having a difficult start to the year. The expected uptick in spending from lower inflation and January’s cut to National Insurance is yet to materialise.

Composite PMI rose to 54.1 in April, driven by the robust and accelerated upturn in services activity.

China

Inflation in China dropped 1% month on month in March, compared to the market estimate of -0.5%. Annual inflation rose 0.1% for the year to March, below the expected 0.4% rise, as the effects of Lunar New Year spending waned.

China’s unemployment rate dropped marginally to 5.2% in March, in line with market expectations.

Composite PMI edged up to 52.8 in April, with the growth of the manufacturing sector being the highest in 14 months and services activity supporting this long run of expansion.

Business sentiment remained unchanged from March.

Annual retail sales grew 3.1% in March, well short of the expected 4.5%. Consumer confidence remains subdued at 89.1 in February, well below the long-term average of 109.85.

Japan

The Bank of Japan (BOJ) maintained the cash rate at the 0% to 0.1% range at its April meeting, having raised it for the first time in 16 years in March. The Yen fell to near record lows following the March decision and remains weak, putting additional cost pressures on both businesses and households.

Retail sales declined 1.2% in March, missing market expectations for 0.6% growth. Annual sales grew 1.2%, slowing from 4.7% in February and well below the anticipated 2.5%.

Composite PMI rose to 52.3 in April with services activity expanding and factory activity stabilizing following declines in the last ten months.

Currencies

The Australian dollar (AUD) appreciated over the month of April, closing 1.1% higher in trade weighted terms to 62.2, appreciating against the Japanese Yen (JPY), Pound Sterling (GBP) and Euro (EUR).

The AUD weakened against the US dollar (USD), marking its third monthly decline in four months. Initially, the AUD saw gains due to soft US economic data and dovish remarks from Fed Chair Jerome Powell. However, it slid as US CPI inflation and geopolitical tensions rose. A rebound followed with improved Australian inflation data, but strengthened US labour costs pushed the USD higher again. Overall, the AUD strengthened against the G10 currency basket.

Relative to the AUD, the USD led the pack during the month, appreciating by 0.5%. The laggard of the month was the JPY, depreciating in relative terms against the AUD by 3.6%. Year-on-year, the AUD remains behind the GBP and USD by -1.5% and -1.9% respectively, whilst ahead of the JPY and EUR by 13.3% and 1.2% respectively.

Important notice

This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No.421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure at the date of publication: Lonsec receives a fee from the fund manager or product issuer(s) for researching the financial product(s) set out in this document, using comprehensive and objective criteria. Lonsec may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec services. Lonsec’s fee is not linked to the rating(s) outcome.

Lonsec does not hold the product(s) referred to in this document. Lonsec’s representatives and/or their associates may hold the product(s) referred to in this document, but details of these holdings are not known to the Analyst(s).

Disclosure of Investment Consulting services: Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other financial advice and may receive fees from this fund manager or product issuer for providing investment consulting services. The investment consulting services are carried out under separate arrangements and processes to the research process adopted for the review of this financial product.

For an explanation of the process by which Lonsec manages conflicts of interest please refer to the Conflicts of Interest Policy which is found at: http://www.lonsec.com.au/aspx/IndexedDocs/general/LonsecR esearchConflictsofInterestPolicy.pdf

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Lonsec’s research process relies upon the participation of the fund manager or product issuer(s). Should the fund manager or product issuer(s) no longer be an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).