Monthly Market Review – January 2022

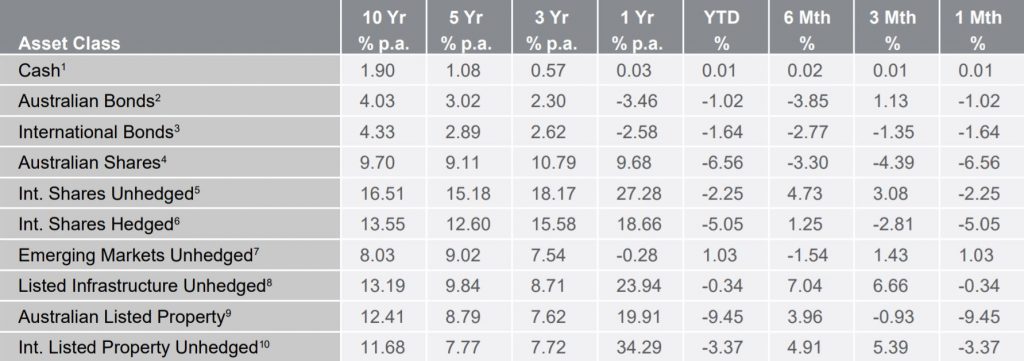

VIEW PDFHow the different asset classes have fared: (As at 31 January 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

Unhedged and hedged international equities exposures finished negative on the month of January, falling 2.25% and 5.05% respectively. Over the month we saw a sell-off in technology stocks in the United States as markets priced in a sizable uptick in interest rates driven by strong inflation data in the US. Value stocks outperformed the broader market led by Energy and Financials, with strong oil demand underpinning the former as well as increasing geopolitical concerns in Europe over Ukraine. We also saw Emerging Markets outperform after being sold off in the latter half of 2021.

Australian Equities

The S&P/ASX All Ordinaries Index fell by 6.56% in January, which was a stark contrast to last months rise. We saw cyclical stocks outperform defensive stocks over the month, with value stocks continuing their outperformance over growth stocks. We also saw a rally in the Iron Ore price as demand from China and expectations of increased stimulus there boosted the materials sector. Financials were also boosted by higher interest rate expectations as the Reserve Bank of Australia signalled that the strong economy may see rate hikes brought forward earlier than expected. Small Caps were caught out in the general market selloff (this often happens due to their poorer liquidity and lower quality relative to large caps) although small cap value fared stronger.

Domestic and International Fixed Income

Australian bond prices fell over the month with the index falling 1.02% as the expectation of rising interest rates weakened investor sentiment. International bonds fell 1.64% as strong inflation data in the US was coupled with a more aggressive tone by Federal Reserve Chairman Powell increasing expectations of additional hikes in interest rates. As rates rise, cash (variable rate) becomes a more competitive alternative to bonds (fixed rate). When investors anticipate rising rates, they will typically reposition portfolios by selling down bonds leading to an overall weaker return for the market as happened in January. We also saw an expansion in credit spreads which hurt corporate bonds as investors reacted to the weakness in equity markets by selling off riskier bonds with high-yield or “junk” bonds the most impacted by this shift.

Australian Dollar

The Australian Dollar (AUD) sold-off in January as part of a risk off move in markets. The Australian dollar began its downtrend from the 13th January from a high of 0.7314 (AUD/USD) to a low of 0.6965 by the 30th January which was a slightly wider range than what we saw in December. The faster pace of US rate hikes relative to expectations for Australia made the US dollar more attractive reducing demand for AUD. Another source of weakness was poor performance for risk assets such as stocks or corporate bonds. The Australian dollar is usually a “risk on” rather than safe haven currency that investors will sell down when sentiment weakens. This was another factor in AUD weakness for the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.