Monthly Market Review – April 2022

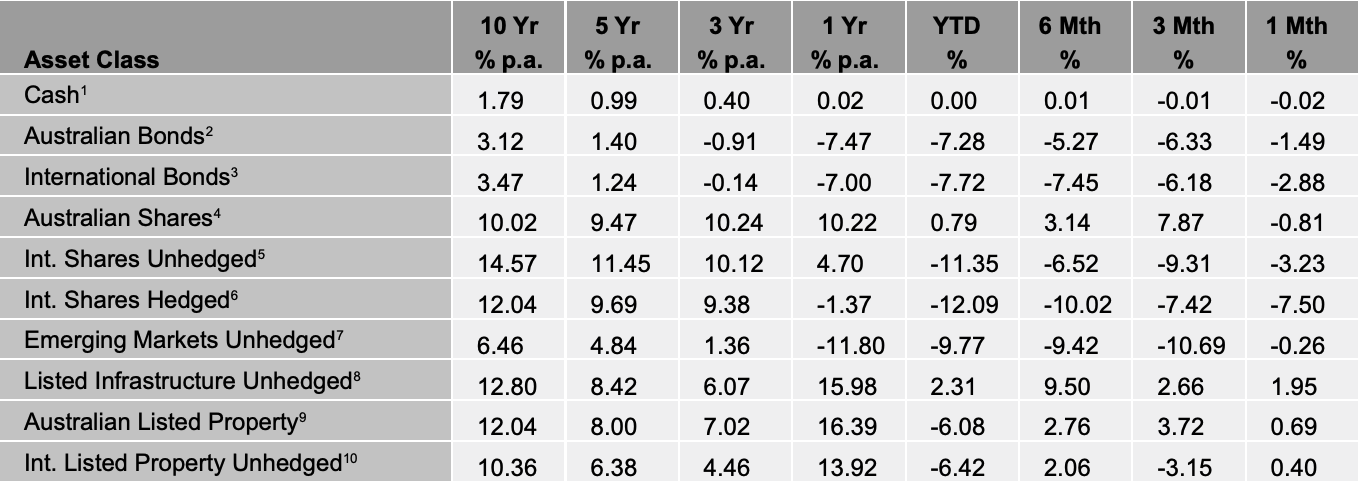

VIEW PDFHow the different asset classes have fared:

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

Volatility re-entered international equities over the month of April. This resulted in a 7.5% drop in the hedged index and a 3.23% fall in the unhedged index. A sharp US dollar rally caused divergence in these two indexes as the Dollar was once again seen as the safe haven currency. US based stocks remain the most impacted globally as the NASDAQ fell a whopping 13% with the S&P 500 following closely behind with a 9.6% fall. Consumer discretionary fell the most, followed by communication services and technology. Consumer discretionary has been severely impacted by inflation and the reshuffling of budget priorities by consumers as ‘needs’ are prioritised over ‘wants’. This is combined with the impacts of rising interest rates, especially on the technology sector. At the end of the month, GDP data came out of the US at a negative 1.4% QoQ (quarter on quarter) number, suggesting a significant slowing in the US economy may already be here.

Australian Equities

Australian shares took back some gains in the month of April as the index declined 0.81%. The Australian stock market remains resilient thus far in the face of steepening yield curves and inflation heating up. Australia finally got the CPI number that was expected to arrive sooner or later. Australian inflation hit a 21-year high of 5.1% in the first quarter of 2022 as Australia joined the globally synchronised rise in inflation. Australia remains well-positioned to deal with a rise in inflation from an equity market perspective relative to other countries due to the index comprising of high weightings to materials, energy and financials.

Domestic and International Fixed Income

Domestic and international bond indexes continued their decline, falling 1.49% and 2.88% respectively. This continues an already historic decline in the bond indexes. These indexes are down 5.27% and 7.45% calendar YTD (year to date) currently. This scenario is something that bond holders are not accustomed to as capital preservation and significant gains has been achieved for decades via holding bonds. Significant inflation has caused interest rates to adjust upwards quickly. The question is how high can these rates really go without causing too much pain in the economy and markets?

Australian Dollar

The Australian Dollar (AUD) fell 5.7% in April on the back of a strong United States Dollar (USD). Significant volatility in international foreign exchange markets resulted in a move into the safe-haven USD and caused devaluations in nearly all currencies priced in USD, suggesting the strength in the currency is the cause for the move as opposed to the weakness in the other currencies priced in USD.