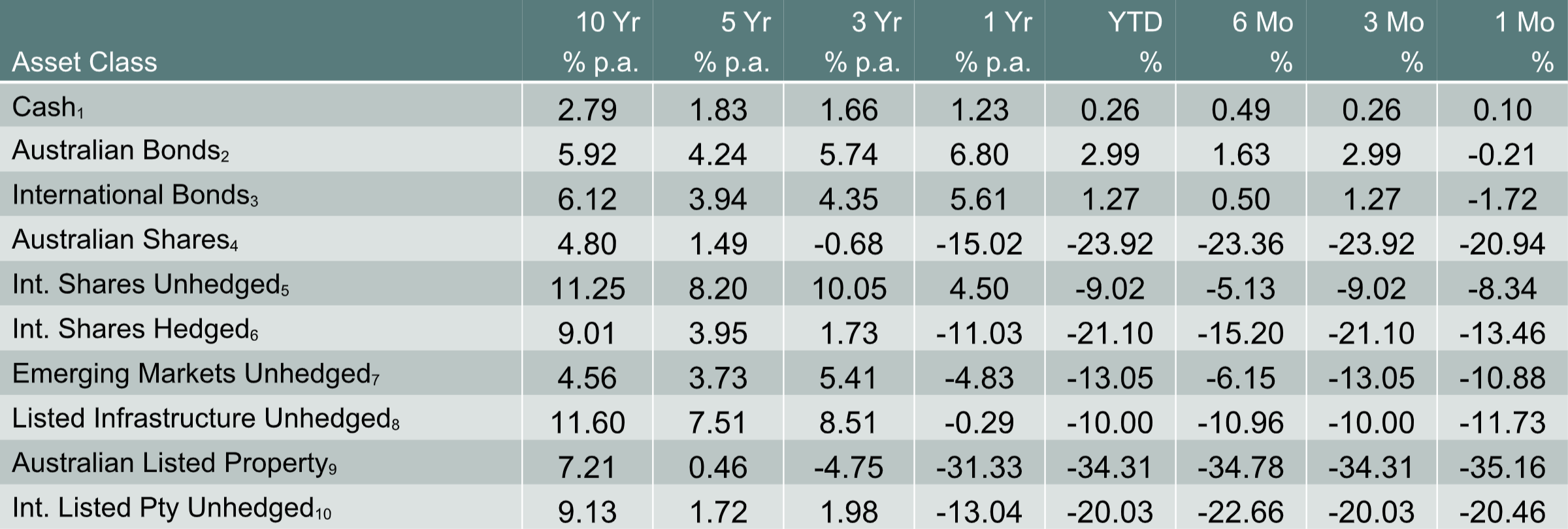

Monthly Market Review – April 2020

VIEW PDFHow the different asset classes have fared:

(As at 30 April 2020)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Financial markets partly recovered in April after very steep falls in March. Share markets, both in Australia and internationally, rose and the Australian dollar appreciated as risk sentiment improved. Government bond yields largely moved sideways over the month as liquidity conditions in bond markets improved and global central banks reaffirmed significant policy easing that had been announced in March.

Cash and Fixed Income

Global government bond yields largely moved sideways in April, at very low levels, after significant volatility in March. Central banks, including the Reserve Bank of Australia, reaffirmed the significant policy easing that they had announced in March.

Corporate credit spreads narrowed over the month after widening very sharply in March, but they remain at historically elevated levels as the perceived riskiness of buying corporate debt remains high due to the coronavirus crisis.

Australian Shares

After plunging by 21% in March, the Australian share market recovered by 9.5% in April alongside other global share markets. The recovery was fueled by the large monetary and fiscal easing measures that have been announced by both Australian and global authorities, combined with news of flattening coronavirus curves and moves towards relaxing lockdowns in a number of countries. However, further volatility in share markets is likely in the months ahead.

ANZ and NAB both reported their half-year profit results in April. ANZ deferred the decision on its 2020 interim dividend until there is greater clarity regarding the economic impact of the coronavirus and announced a 60% decline in its interim cash profit. ANZ will provide a dividend update in August. NAB announced that it will reduce its interim dividend to 30c per share (from 83c per share last year) and it will raise $3.5 billion in capital to improve its balance sheet ahead of an expected spike in credit losses due to the coronavirus crisis. The two banks underperformed the broader market in April, to finish the month little changed.

International Shares

International share markets partly recovered in April, supported by the substantial and coordinated fiscal and monetary response to the coronavirus globally and the prospect for social distancing measures to be eased in several countries. The recovery in shares was despite the release of economic data which showed a huge hit to global economic activity, including sharp falls in consumer confidence, surging unemployment claims and a record plunge in US retail sales.

The breadth of the recovery in the US S&P500 has been fairly narrow and has not been led by the traditional cyclical sectors. Rather, healthcare and technology sectors have outperformed based on their perceived defensive characteristics. The top five stocks in the S$P 500 now account for 20% of the overall index and these stocks have been leading the recovery, meaning that the breadth of the recovery has been very low. According to Morgan Stanley, the percentage of S&P500 stocks outperforming the index on a rolling two-month window is at the lowest level since 2008.

Oil prices remained under intense pressure in April, with the US oil benchmark (WTI) briefly plunging

into negative territory for the first time in history. Oil prices have fallen due to a sharp decline in demand because of global coronavirus shutdowns, travel bans and a disagreement between Saudi Arabia and Russia about cutting oil production. Since the start of the year, oil prices are down by between 60-70%. While this is bad news for producers, low fuel prices are good news for consumers as it frees up spending power which will eventually help consumer spending.

The Australian Dollar

The Australian dollar rebounded by around 6.5% in April due to positive risk sentiment as global share markets partly retraced their sharp March falls. The Australian dollar was also supported by resilient iron ore prices and a widening in the Australia/US interest rate differential (with the Australian 10-year government bond yield now higher than the US 10-year government bond yield); sharp falls in coal prices had little impact.

Money Matters – Winter 2020

Money Matters – Winter 2020

Money Matters – Autumn 2020

Money Matters – Autumn 2020

Money Matters – Summer 2019

Money Matters – Summer 2019