Monthly Market Review – December 2020

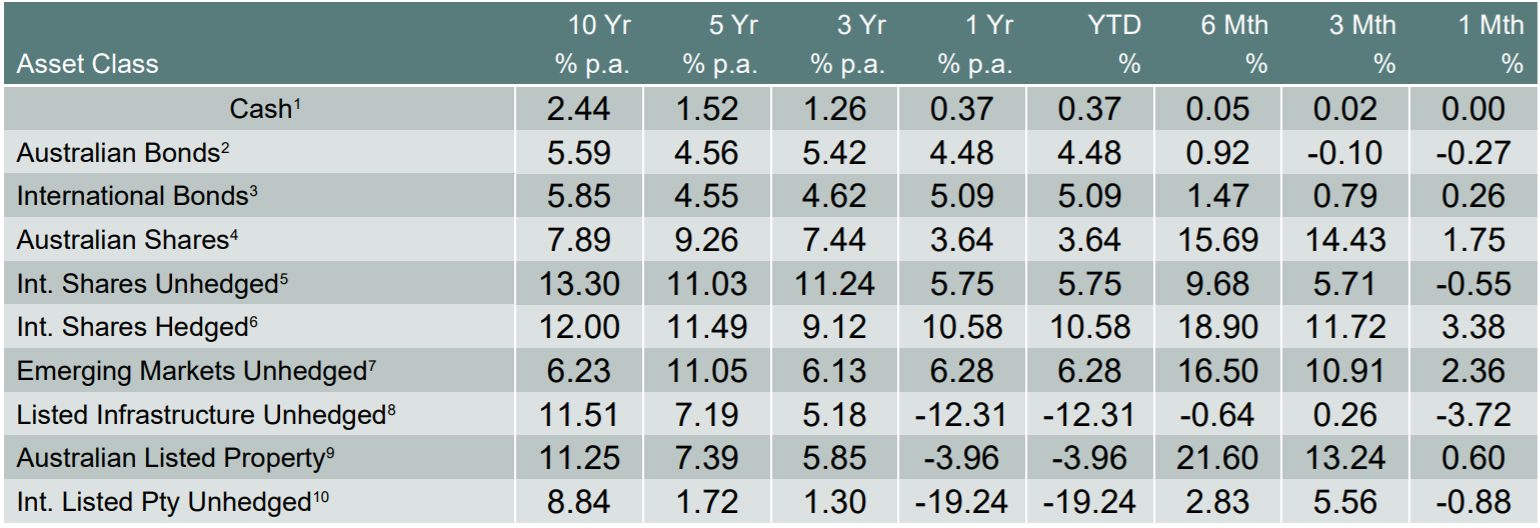

VIEW PDFHow the different asset classes have fared: (As at 31 December 2020)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

The ASX All Ords has had a strong start in December before the emergence of a new cluster of COVID-19 cases in Sydney’s northern beaches on 9 December 2020 saw markets tempering expectations of a swift recovery. Despite this, the ASX All Ords returned 1.75% in December 2020. Markets were buoyed by strong commodity prices with iron ore rising 20.0% over the month to be up an astounding 152.9% since its April lows. Strong demand from China and supply disruptions in Brazil were behind the price increases. The surge in commodity prices and overall weakness in the US dollar has seen the Australian dollar trade to $0.76, levels not seen since 2018.

Meanwhile, tensions between Australian and China continued to flare during December 2020, with China banning Australian coal exports and Australia taking up action with the World Trade Organisation. Given China’s high reliance on Australia’s iron ore exports, the impact is expected to be limited. In addition, the incoming Biden administration is expected to try and resolve the US/China tensions in a more diplomatic way, paving the way for Australia to resolve tensions with China too.

New global coronavirus cases continued to climb although at a slower pace. While the mortality rate in developed countries has dropped from 8.5% to around 2.0%, the number of deaths is approaching April highs and some hospitals are at or near capacity. Alarmingly, in the UK, a new strain of COVID-19 was discovered to be more infectious, though not necessarily more severe. This led to more than 40 countries suspending travel with the United Kingdom and a nationwide lockdown. Thankfully vaccines are still expected to be effective on the new strain. Across the globe vaccines were rolled out, however, supply and transport issues meant the rate of roll out was below expectations. The vaccine rollout is not expected to help with the current wave but should significantly help the recovery in the second half of 2021.

With the rise in global coronavirus cases, major governments around the world continued to reiterate their support for the economy with the ECB and the US committing to stimulus support. The ECB increased its pandemic emergency purchase program from €1.35tn to €1.85tn and extended the program to March 2022. The US also passed a nearly $900bn stimulus bill. While not as large as many had expected the stimulus is big enough to hold off a recession. Markets reacted positively to these announcements. Finally, after years of negotiation, the Brexit agreement was completed and signed between the UK and the European Union.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.