Monthly Market Review – February 2021

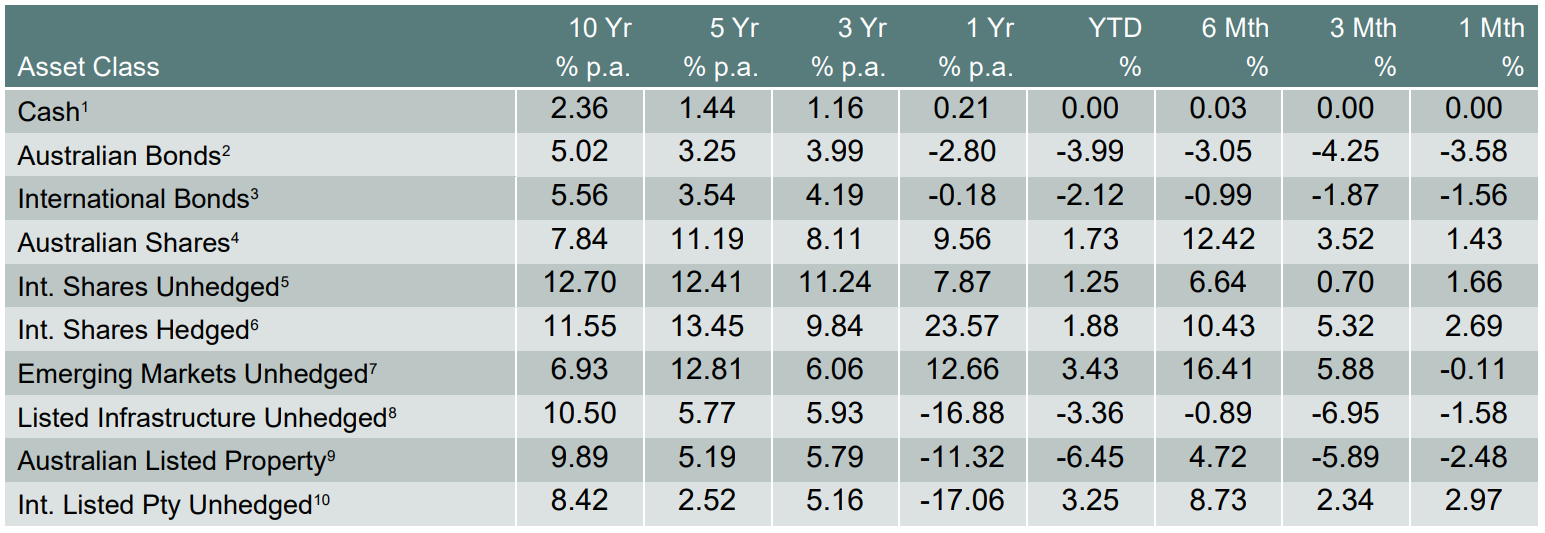

VIEW PDFHow the different asset classes have fared: (As at 28 February 2021)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Australian Equities

The S&P/ASX All Ordinaries recorded a gain of 1.43% in February. It was a volatile month for Australian shares due to fears of a return of inflation. The best performing sectors for the month were materials, financials, and energy, which were expected to benefit from an economic recovery as vaccines drive normalisation in the economy and rising bond yields pressure valuations.

Reporting season saw the release of earnings data, with many ASX companies beating expectations. Around 86% of ASX 200 companies reported a profit. The better-than-expected earnings were partly a function of the disruption in 2020 when many companies ditched forecasts entirely, leaving analysts forecasting earnings in the dark, because of the uncertainty stemming from the pandemic.

Australian Property

Whilst listed property fell in February, the residential housing market performed well, rising at its fastest rate in 17 years. The property market has been more resilient than expected, helping the economic recovery and the performance of banks and developers. Much of this growth has been attributed to record low interest rates, multiple government homebuyer and income support measures, pent up demand from lockdowns and a fear of buyers’ missing out.

Australian dollar

Higher than anticipated iron ore prices kept the Australian dollar high, despite the RBA extending its bond-buying program to place downward pressure on the local currency.

International Equities

US Stocks performed well in February with the S&P 500 up 2.61%. This can be attributed to growing optimism surrounding the economic recovery and decreasing number of COVID-19 infections. Nevertheless, attention turned to rising yields on the U.S. 10-year treasury notes. There is growing fear that increasing yields, which are a consequence of an improving economy and greater pricing pressures, will prove competition for stocks. The casualties have been overbought high multiple growth stocks, many of which are traded on the NASDAQ and are tech related. The inevitable stylistic shift back in markets to value-oriented stocks and stocks which are more favourably exposed to rising bond yields appears to be occurring.

Asian and European markets did reasonably well. However, they experienced a strong sell off in the last trading day of the month as investors bet an economic rebound could lead to tighter monetary policy. Technology stocks were hardest hit during the sell off.

Domestic and International Fixed Income

The RBA has an official policy to keep 3-year government bond yields at around 0.1%. To do this, it buys bonds when the yield gets too high. Earlier in the month, the RBA announced another $100 billion in bond purchases, which means the RBA will be buying about $5 billion worth of government bonds every week until at least April. This is intended to help the economy by keeping other interest rates very low. Nevertheless, despite the RBA efforts, long-term 10-year interest rates have doubled since November. That’s because investors are starting to look ahead of the pandemic to possible inflation.

Internationally, central banks from Asia to Europe escalated efforts to calm panicking markets, by pledging to buy more bonds and signaling more policy accommodation, after U.S Treasury yields surged to their highest level in a year.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.