Monthly Market Review – April 2021

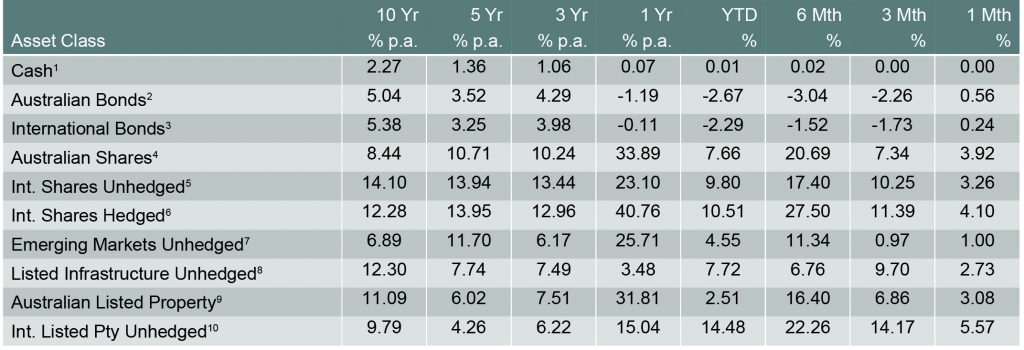

VIEW PDFHow the different asset classes have fared: (As at 30 April 2021)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Australian Equities

April was a great month for the Australian Share market with the S&P/ASX All Ord rising 3.92% over the period. Traditionally the month is a strong month for the share market as the end of financial year approaches. A great deal of the positive momentum can also be attributed to low interest rates, market stimulus and a rebound of economic activity. Materials was the best performing sector, driven largely by stronger metal prices and a slightly weaker US dollar. Technology also did well, due to by a decline in Australian bond yields. Energy was the worst performer with coal being a notable area of weakness within energy, as investor sentiment towards the carbon emitting sector sours.

International Equities

The global recovery is continuing to gather momentum with the IMF revising up its 2021 global growth forecast to 6.0%. The recovery has been positive for share markets which benefit from rising earnings and low interest rates. US stocks did well, buoyed by multiple signs of economic recovery including an impressive jobs report, a jump in retail sales, and a pick-up in housing. European markets also moved higher, lifted by solid corporate earnings and the progress made by EU countries in vaccine distribution. A recent surge in Covid cases plaguing India and Brazil has put pressure on these emerging economies and their markets. Overall, the performance of emerging market equities was flat. The slow vaccine rollout in the developing word is holding back emerging market stocks.

Domestic and International Fixed Income

Global and domestic bond yields eased back in April as central banks reiterated their desire to keep accommodative financial conditions. The recent stability in bond yields enabled share markets to resume their rising trend after a few wobbles earlier in the year.

Australian dollar

The Australian dollar continued to maintain its strength in April. Strong commodity export prices have helped keep the dollar strong.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.