Monthly Market Review – September 2022

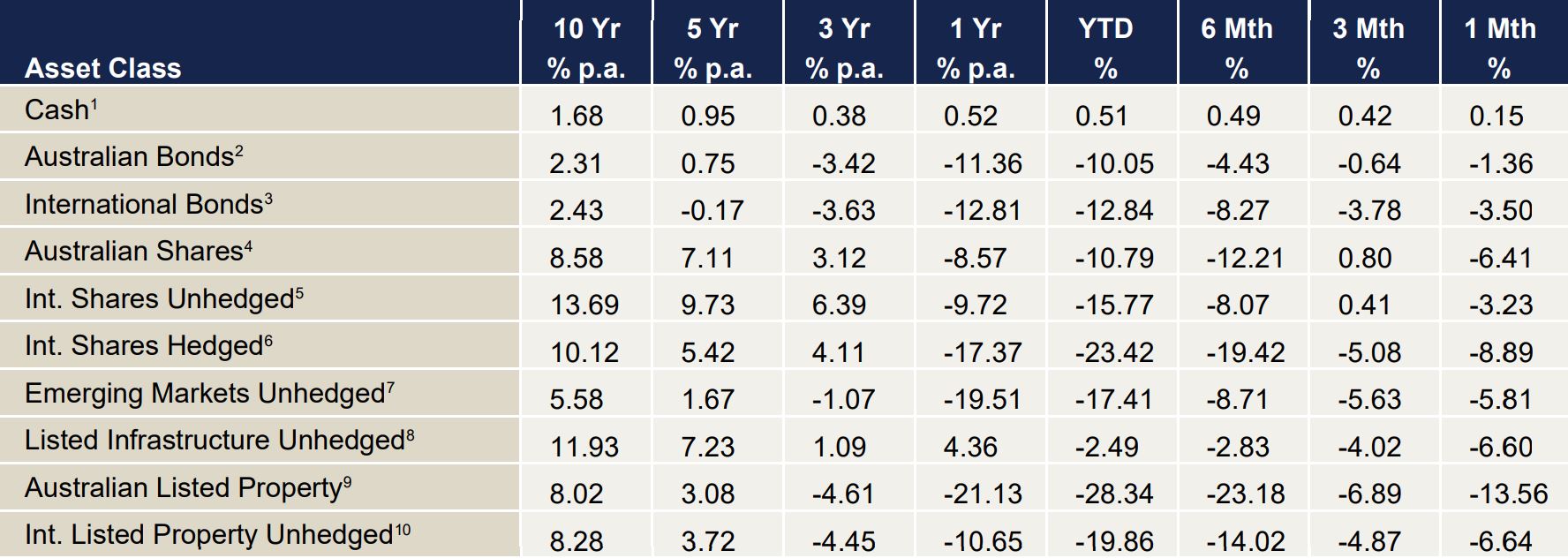

VIEW PDFHow the different asset classes have fared: (As at 31 September 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

Global markets sharply returned to the downward trend that started in early 2022. Fresh concerns regarding global economic growth and stability hit the markets as central banks have not shied away from sticking to their policy of quashing inflation through increasing rates. Unhedged international shares fell 3.23% whilst hedged fell 8.89%. Significant volatility has been present in all asset classes, not excluding currency, which saw the US Dollar (USD) rise significantly on the month. This caused the wide divergence between hedged and unhedged returns. Cracks are starting to emerge in the global economy as the Great British Pound (GBP) had flash crash moment against the USD, highlighting the fragility of the global economic picture.

Australian Equities

Australian shares were not sheltered from this volatility as they fell 6.41% on the month. After being sheltered from significant market losses to begin the year, concerns over the weakening domestic picture and reliance on elevated house prices, sparked concerns as the Reserve bank continues its policy of increasing interest rates to stem inflationary pressures. Real Estate and Utilities lead the market lower with drops over 10% each on the month. Energy and materials were the better performers yet were still negative.

Domestic and International Fixed Income

Interest rates continued their march higher as domestic and international fixed income fell 1.36% and 3.5%, respectively. With inflation rates hitting near double digits across most developed economies, central banks have not yet found an opportunity to talk down future rate increases. This has been led by the US who have raised their target policy rate to 3.25%, a 15-year high. Australia has it’s highest policy rate since 2013, but keep in mind has not increased interest rates since 2009 before this recent change in policy.

Australian Dollar

The Australian Dollar (AUD) ended the month down a staggering 5.2% to the USD. This move had little to do with the economic strength of Australia versus the US but was primarily an incredible strengthening of the USD compared to all currencies. The USD as measured by the Dollar Index (DXY) is the strongest it has been since the early 2000s. The reason for this a combination of factors hurting the currencies it is compared to. The Euro, the Pound and Yen are the three main currencies measured against the USD and have all shown domestic weakness instigated by the European energy crisis, interest rate differentials compared to the US and poor policy decisions made by governments. This has amounted to a historic rise in the USD.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.