Month in Review as at January 2024

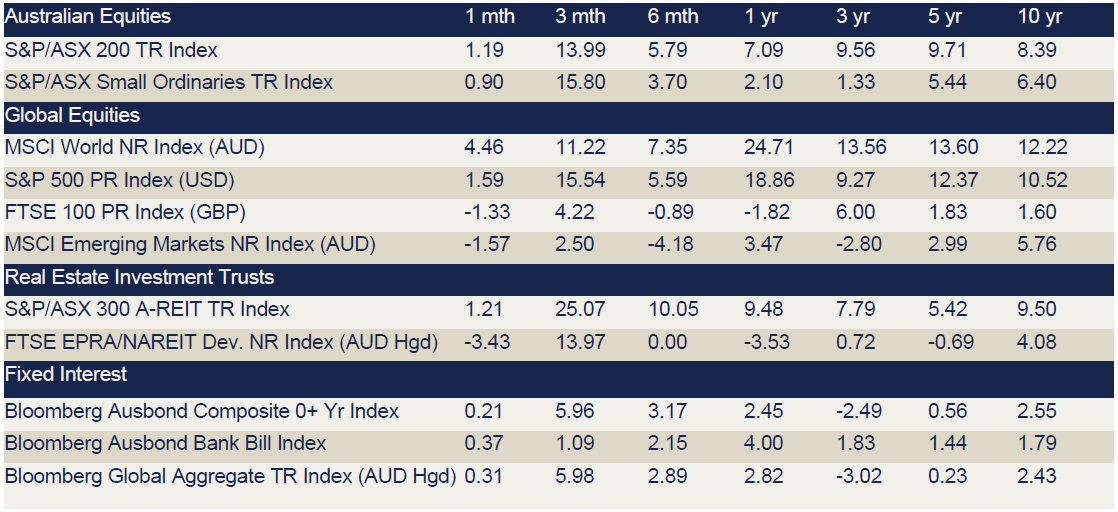

VIEW PDFIndex returns at January 2024 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Points

- The Australian market continued its march ahead in January, finishing 1.2% higher. Gains in the market were led by Energy, Financials ex Property and Healthcare.

- Overall, overseas markets finished higher, noting the experience in Asian markets was different with weaknesses in China and Hong Kong.

Australian equities

In January, the ASX 200 achieved a record high, ending the month 1.2% up. Most sectors (eight out of 11) closed the month positively. Lower-than-expected inflation for the December 2023 quarter buoyed investors. Energy (+5.2%), Financials (+5.0%), and Health Care (+4.3%) were the top performers, while Materials (-4.8%) and Utilities (-1.5%) lagged.

Energy stocks, especially Boss Energy (ASX: BOE) and Paladin Energy (ASX: PDN), benefited from positive uranium market news. BOE shares were also boosted by the positive drilling results at its Honeymoon mine in South Australia. The Financials sector was lifted by the “Big 4” banks, despite mixed outlooks for their upcoming earnings.

Conversely, Materials stocks suffered due to falling iron ore and lithium prices. Lithium miners had a tough January as supply outstripped demand, attributed to slower electric vehicle uptake. Sayona Mining (ASX: SYA) and Liontown Resources (ASX: LTR) shares were particularly impacted by the lithium outlook, and BHP (ASX: BHP) also took a hit in January.

As we approach February’s reporting season, the robust market of the past two months could face a downturn if earnings disappoint.

Global Equities

Global equity markets continued to gain despite US Federal Reserve Chairman Jerome Powell noting rate cuts were unlikely in March. The S&P500 rose 1.7% (in local currency terms) while similarly the Nasdaq 100 rose 1.9% (in local currency terms) despite a disappointing start to the Q4 earnings results season.

Similarly, European markets posted minor gains, with the DAX 30 Index finishing up 0.9% (in local currency terms). This was despite the European Central Bank holding off on rate cuts and keeping interest rates at a record high. Chinese markets crashed to a 5-year low as manufacturing activity shrank for the fourth straight month, with the CSI 300 and Hang Seng Index dropping 6.29% and 9.16% respectively (in local currency terms), spurred further by the liquidation of property giant Evergrande by a Hong Kong court.

Property

The S&P/ASX 200 A-REIT Accumulation index started the year positively in January, with the index finishing the month 1.3% higher. Conversely, global real estate equities (represented by the FTSE EPR/NAREIT Developed Ex Australia Index (AUD Hedged)) regressed, returning -3.6% for the month. Australian infrastructure started the year negatively, with the S&P/ASX Infrastructure Index TR returning -1.8%.

The Australian residential property market experienced an increase by +0.4% Month on Month (as represented by CoreLogic’s five capital city aggregate). Perth was the biggest riser (+1.6%), followed by Adelaide (+1.1%) and Brisbane (+0.9%). In contrast, Melbourne (-0.1%) was the only city to deliver negative returns in January.

Fixed Income

Amidst global economic uncertainty, Australian bond markets have moved cautiously in January, with investors awaiting the RBA’s February decision. The focus remains on monitoring the evolving economic conditions, particularly the interplay between a robust labor market and tempered household spending. Bond yields mirrored this cautious optimism, with the 2-Year decreasing marginally by 2bps and the 10-Year Australian Bond yields experiencing a slight increase by 6bps, as investors seek clarity on future monetary policy directions.

Globally, the fixed income landscape remained resilient. U.S. Treasury yields saw marginal movement, with the 2-Year decreasing by 5bps and the 10-Year yields increasing by 3bps, as markets adjust to the Federal Reserve’s latest guidance on interest rates amidst a stabilized inflation outlook. Meanwhile, UK Gilts rebounded with a modest increase in yields, with the 2- and 10-Year Gilt yields increasing by 25bps and 26bps respectively, reflecting a recalibration of market expectations following the Bank of England’s rate decisions.

Investors are navigating the early 2024 bond markets with an eye on central banks’ commitment to inflation targets and the potential impact of global economic shifts.

Economic key points

- Australian inflation fell to 4.1% for the December quarter.

- Inflation fell in the UK and Eurozone but rose in the US.

- The Fed, BoE and ECB left cash rates unchanged at their January meetings.

Australia

Inflation retreated to a two-year low of 4.1% in the December quarter, below the expected 4.3%. For the quarter alone, inflation rose 0.6%, half the pace of the September quarter and below the anticipated 0.8%.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell to 81 in January as a surge in the cost of living and high interest rates continue to dominate sentiment.

Retail sales fell 2.7% in December, missing market estimates of a 0.1% rise, with the annual rate increasing 0.8%.

Composite PMI jumped to 49 in January, still in contraction territory but services new business activity has notably stabilised. The NAB business confidence index rose to -1 in December, supported by a pick-up in the mining and retail sectors.

The trade surplus declined to $10.96 billion in December, just below the market forecast of $11 billion.

US

As widely expected, the Federal Reserve kept rates on hold at 5.25-5.50% in its January meeting. The Fed said it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward the 2% target. The comments were seen as more hawkish than expected as there was no mention of near-term rate cuts.

Annual inflation was 3.4% in December, higher than the expected 3.2%, as energy prices dropped at a slower rate. Meanwhile, PPI unexpectedly decreased 0.1% in December, mainly due to a 12.4% fall in diesel prices. The economy added 353,000 jobs in January, well above the anticipated 180,000, with the unemployment rate steady at 3.7%.

Services PMI came in at 52.5 in January indicating that the services sector is back in expansion territory. This result, combined with extremely strong employment figures suggests that economic growth momentum has continued into the new year. This has further diminished expectations for interest rate cuts by the Federal Reserve

Consumer sentiment rose to 79 in January, the highest reading since July 2021.

Euro area

The ECB maintained interest rates at 4.5% despite the steady improvement in inflation and ongoing weakness in economic activity. Governing Council member Mario Centeno took a dovish stance by commenting that rate cuts should start sooner rather than later, and in small steps rather than abruptly. Annual inflation dropped slightly to 2.8% in January, matching market expectations.

PPI fell 0.8% in December, with the annual rate dropping to 10.6% as energy prices continued to fall.

The unemployment rate was unchanged at 6.4% in December, matching market expectations.

Retail sales fell 1.1% in December, marginally below the expected -1.0%, as persistent high inflation and interest rates continued to dampen demand. This was also reflected in consumer confidence, which fell 1 point to 16.1.

The Composite PMI rose to 47.9 in January, in line with expectations, with services PMI falling to 48.4, representing the sixth consecutive contraction of activity.

UK

The Bank of England left rates unchanged at its January meeting and confirmed they are officially warming up to a rate cut. BoE Governor Bailey had three key messages for the market: that the upside bias for rates is gone, that “we are not there yet” with regards to inflation, and that the BoE will not speculate on the timing of rate cuts.

Consumer confidence rose to -19 in January, as lower inflation and a national insurance rate cut buoyed sentiment. Retail fell 3.2% in December, exceeding the expected 0.5% fall. Annual sales fell 2.4%, well below the expected 1.1% growth.

China

China’s consumer prices fell by 0.8% year on year in January, the biggest fall in more than 14 years and worse than market forecasts of a 0.5% fall.

PPI decreased 0.2% in January, bringing the annual rate to -2.5%, marginally above the expected -2.6%. While marking the softest drop in four months, the latest result was the 16th straight month of contraction in factory gate prices, reflecting persistent deflation forces in the economy.

Composite PMI was 52.5 in January, marking the 13th consecutive month of growth in private sector activity. Services activity inched down to 52.7 amid a softer rise in new orders.

Japan

The Bank of Japan kept interest rates steady at 0.1% and maintained a 0% target for its 10-year bond yields in its January meeting. In a quarterly outlook, the BoJ slashed CPI readings for FY 2024 to 2.4% from October’s projections of 2.8%, reflecting a recent decline in oil prices.

The annual inflation rate fell to 2.6% in December as food prices rose the least in 14 months. The unemployment rate fell to 2.4% in December, matching market expectations.

The consumer confidence index rose to 38 in January, above the forecast 37.6, with sentiment increasing in all components. Retail sales fell 2.9% in December, with the annual rate rising 2.1%, well below the anticipated 4.7%.

December saw Composite PMI rise to 51.5 in January, with continuing service sector growth offsetting a further easing in manufacturing production.

Currencies

The Australian dollar (AUD) depreciated over the month of January, closing 1.9% lower in trade weighted terms to 61.4, appreciating against the Japanese Yen (JPY) whilst depreciating against the US Dollar (USD), Pound Sterling (GBP) and Euro (EUR).

The AUD experienced its first monthly decline against the USD since October, driven by a rebound in the USD. Tensions escalating in the Middle East and ongoing concerns over the outlook for the Chinese economy pushed the AUD lower in the first half of January. Over the remainder of the month, the AUD remained stable before depreciating on the last day of January following a softer-than-expected Australian Q4 CPI, ruling out a further cash rate increase from the RBA.

Relative to the AUD, the USD led the pack in January, appreciating by 3.2%. Conversely, the JPY was the laggard of the month, depreciating in relative terms by 0.5% against the AUD. Year-on-year, the AUD remains behind the GBP, EUR, and USD by -9.3%, -6.3% and – 6.4% respectively, whilst ahead of the JPY by 5.2%.