Month in Review as at February 2024

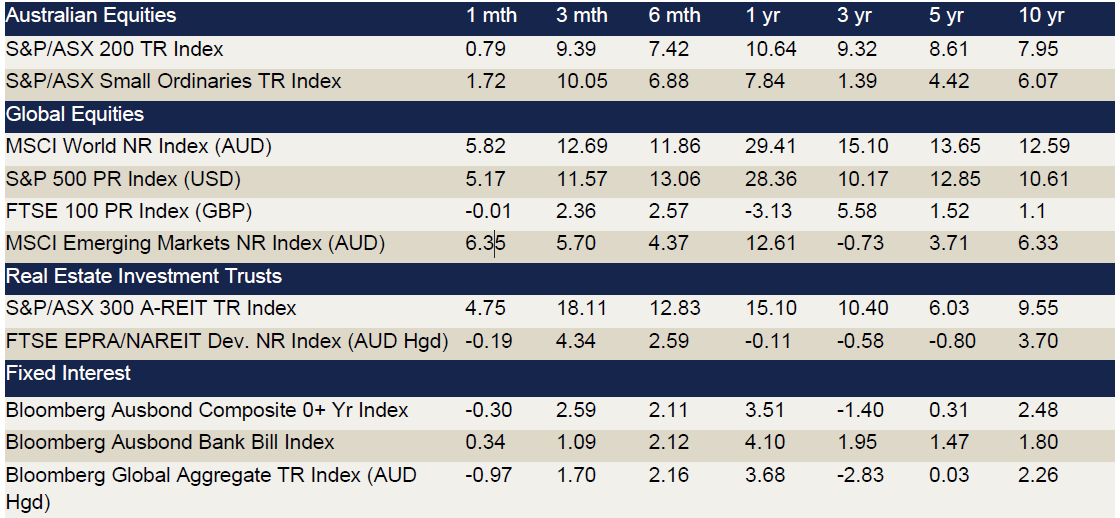

VIEW PDFIndex returns at February 2024 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Points

- The Australian market had another positive month in February, finishing 0.8% higher. Leading the market higher were Information Technology (I.T.) (+19.5%), Consumer Discretionary (9.2%) and Property (+5.1).

- Overseas markets also finished the month higher, with emerging markets outperforming developed markets. The CSI 300 and Heng Seng rebounded strongly after hitting five-year lows at the beginning of the month.

Australian equities

In February, the ASX 200 index continued its upward trend for the fourth consecutive month. The index saw a modest increase of 0.8%. Among the eleven sectors, five experienced gains. Notable sectors were Information Technology (I.T.) (+19.5%), Consumer Discretionary (9.2%) and Property (+5.1%), with their returns leading the market. Meanwhile, Energy (-6.0%), Materials (-5.0%) and Health Care (-2.7%) suffered declines, tempering the overall index performance during the month.

Local I.T. stocks had a stellar month, driven by the Artificial Intelligence-led rally in mega-cap U.S. tech names. Altium shares rose 31.5% after a takeover bid was recommended by its board of directors. Consumer Discretionary gained momentum due to surprisingly strong earnings reports from some of its constituents. Despite seemingly weak consumer sentiment, retailers reported stable margins despite price discounts, which buoyed share prices.

Among the laggards, Energy experienced the most significant decline after disappointing earnings reports were posted. Materials continued their slide as iron ore prices reached their lowest level since October 2023, primarily due to weak Chinese steel demand.

Global Equities

Global equity markets continued to rally in February with no sign of slowing down as strong earnings data pushed markets higher. Emerging markets outperformed developed markets, returning 6.4% (MSCI Emerging Markets Index (AUD) versus a 5.9% return (MSCI World Ex-Australia Index (AUD).

All major indices closed at a record high in the US. A strong reporting season supported growth with 73% of S&P 500 companies beating earnings projections. The Nasdaq Composite gained 6.2% (in local currency terms) in February, while the S&P 500 gained 5.3% (in local currency terms) extending its now four-month winning streak.

Similarly in Japan, the Nikkei 225 Index smashed its 1989 all-time high, gaining 8.0% for the month (in local currency terms), bolstered by strong earnings results, a weaker Japanese Yen and corporate governance reforms aiming to boost shareholder returns.

The CSI 300 and Heng Seng rebounded 9.4% and 6.6% (in local currency terms), respectively after sinking to five-year lows at the beginning of the month. The rebound came after the central bank cut the benchmark lending rate by the most on record and China’s securities regulator tightened controls on “market disruption”.

Property

The S&P/ASX 200 A-REIT Accumulation index continued its strong start to the year in February, finishing the month 5.1% higher. Conversely, global real estate equities (represented by the FTSE EPR/NAREIT Developed Ex Australia Index (AUD Hedged)) continued to regress, returning -0.1% for the month. Australian infrastructure started the year negatively, with the S&P/ASX Infrastructure Index TR returning -0.7% in February.

In the month of February, M&A activity was relatively muted as companies reported their half-year results. Some notable half-year announcements included Dexus (ASX: DXS) reporting that net tangible assets had decreased by $903m driven by property devaluations of $687m. GPT Group (ASX: GPT) reported revenues and other income were down 65.2% for the year, resulting in a net loss of $240m. Charter Hall Group (ASX: CHC) guided that FY24 distribution per security is set for 6% growth over FY23 distribution.

The Australian residential property market experienced an increase of +0.6% Month on Month (as represented by CoreLogic’s five capital city aggregate). Perth was the biggest riser (+1.8%), followed by Adelaide (+1.1%) and Brisbane (+0.9%). In contrast, Melbourne (+0.1%) was the worst performer during February.

Fixed Income

The Reserve Bank of Australia has resolved to maintain the cash rate steady at 4.35% following their monthly monetary policy meeting. However, board members stated they would not rule out future interest rate hikes if inflation proves to be more persistent. Minutes from the 5 February meeting also revealed that while the Board acknowledged there had been progress towards inflation objectives, more progress was required, and the outlook remained uncertain.

Over the course of the month, Australian 2-Year and 10-Year Bond yields rose by 11bps and 12bps respectively, while the Bloomberg AusBond Composite 0+ Yr Index was down -0.3% over the course of February. The Statement of Monetary Policy report published by the RBA stated that economic growth in Australia is expected to remain subdued in the near term, and inflation continues to moderate and is expected to return to the target range of 2-3% in 2025.

In the U.S. the Federal Reserve announced that it would again maintain the overnight federal funds rate at 5.25-5.5% for the fourth meeting straight. Markets have priced in another hold in their March meeting. US Treasury notes yields rose, with 2-year and 10-Year Treasury yields rising 42 and 34 bps respectively.

UK GDP contracted 0.3% in the last quarter of 2023, confirming a recession, although by historical standards the recession is likely to be shallow and short-lived. The Bank of England has also decided to hold rates steady at 5.25% and in February the U.K 2-Year and 10-Year Gilt yields rose 36 and 42 bps respectively.

Economic key points

- Australian inflation fell to 3.4% in January.

- The USA saw higher than expected inflation at 3.1%, further discounting the possibility of interest rate cuts before June.

- The RBA left rates at 4.35% in the first meeting of the year but did not rule out further rate rises in 2024.

Australia

The RBA left rates at 4.35% in their first meeting of the year, with Governor Michele Bullock commenting that she was yet to be convinced that inflation was on a sustainable downward path, and therefore could not rule out further interest rate rises. The RBA’s base forecast is now for inflation to only return to the midpoint of its 2-3% target range in 2026. Inflation further retreated to 3.4% in January, below the expected 3.6%.

GDP for 2023Q4 came in at 1.5%, slightly ahead of the expected 1.4%. The unemployment rate rose to 4.1% in January suggesting that the economic slowdown is now feeding into the jobs market. Job vacancies fell 5.6% in Q42023 to a total of 387,900 and bringing the annual fall in job vacancies to 13.4%.

The Westpac-Melbourne Institute Index of Consumer Sentiment jumped to 86 amid easing inflation and optimism that the Reserve Bank of Australia has concluded its tightening campaign. Retail sales rose 1.1% in January, matching market estimates, with the annual rate also increasing 1.1%.

Composite PMI rose to 52.1 in February, signifying the first growth in private sector output since September 2023. The NAB business confidence index rose to 1 in January, with manufacturing and construction mainly supporting the improvement while wholesale and retail sentiment fell. The trade surplus increased to $11.03 billion in January, below the market forecast of $11.5 billion.

US

Higher than expected US inflation led investors to further discount the possibility of interest rate cuts before June. Headline inflation growth was +3.1% for the year to January 2024, compared to expectations of +2.9%, with rising rent costs accounting for most of the increase. While inflation has eased considerably from its +9.1% peak in 2022 it has not slowed since mid-2023, staying around 3%.

The economy added 275,000 jobs in February, well above the anticipated 195,000, however unemployment rose to 3.9%, against an expected 3.7%.

Retail sales dropped 0.8% in January, below the anticipated 0.1% fall, primarily driven by the aftermath of holiday shopping and colder weather. Annual retail sales grew 0.8% for the year to January, well below the +5.8% in December.

Composite PMI increased to 52.5 in February, up from 52 in January. It was the highest reading since June 2023, as manufacturing production saw a boost while service sector activity also rose. Consumer sentiment fell to 76.9 in February, reflecting weaker expectations for income and business conditions, and rising worries over the job market.

The trade deficit widened to US$67.4 billion in January, well above the anticipated US$63.5 billion.

Euro area

Annual inflation declined to 2.6% in February, slightly above the 2.5% market expectation. PPI fell 0.9%, with the annual rate dropping to 8.5% as energy prices continued to fall.

The unemployment rate came in at 6.4% in January, matching market forecasts. Retail sales rose 0.1% in January, as anticipated. Annual retail sales fell 1.0%, marking the 16th month of contraction. Consumer confidence rose to -15.5 in February thanks to reduced negative views on household finances.

The Composite PMI rose to 49.2 in February, the highest in eight months, with service sector activity showing growth for the first time since July of last year.

UK

A marginal decline in 4th quarter GDP of 0.3% confirmed that the UK economy slipped into technical recession at the end of 2023. This data is expected to allow the Bank of England to begin cutting interest rates in the second half of this year.

The UK’s inflation rate held steady at +4.0% for the year to January, compared to concerns that it would accelerate to +4.2%. However, it remains double the Bank of England’s target of 2.0%.

Producer input prices fell by 3.3% in the year to January, down from 2.1% in the year to December. Producer output (factory gate) prices fell by 0.6% in the year to January, down from a rise of 0.1% in the year to December.

PMI came in at 53.0 in February, indicating a robust expansion in private sector output, marking the swiftest growth since May 2023. Notably, service sector activity continued to exhibit strong growth, while the contraction in manufacturing output eased to its slowest pace in three months.

Consumer confidence unexpectedly fell to -21 in February, below forecasts for -18, retreating amid weaker readings on personal finances and the broader economic outlook. Retail sales rebounded 3.4% in January, double the market forecast of a 1.5% rise. Annual sales grew 0.7%, surprising the market which expected a 1.4% decline.

China

The Chinese economy grew by a seasonally adjusted 1.0% in 2023Q4, matching market expectations but moderating from an upwardly revised 1.5% increase in Q3. The government has set a modest 5% growth target for 2014, amid an economic slowdown and dwindling business sentiment. China’s economy grew by 5.2% last year, but this incorporated a substantial rebound from the COVID-zero policies of 2022, and many investors expect further policy support will be needed to maintain that growth rate, and for currently negative CPI inflation to recover towards the government’s +3% target.

The unemployment rate increased to 5.2% in January, higher than the 5.1% in December, but below the 5.5% government target.

China’s consumer prices rose by 0.7% year on year in February, the highest level in 11 months due to robust spending during the Lunar New Year holiday.

PPI was unchanged at -0.2% in February, bringing the annual rate to -2.7%, above the expected -2.5%. This is the 17th straight month of contraction in factory gate prices, underscoring that the economy continued to grapple with numerous headwinds as various support measures from Beijing to speed up recovery since last year apparently had little effect.

Composite PMI was unchanged at 50.9 in February, with services expansion offset by the continued contraction in manufacturing. It is worth noting that PMI readings in February are less reliable due to the distortion from the Lunar New Year break, making it difficult to get a clear picture of economic momentum, particularly for the manufacturing sector.

Annual retail sales grew 7.4% in December, below the expected 8% and under the previous month’s 10.1% growth, amid a slowing demand for communications equipment and cars.

A trade surplus of US$125.16 billion was recorded in January-February, well above the expected US$103.7 billion surplus.

Japan

GDP rose 0.1% in the December quarter, compared with flash data of a 0.1% fall and a 0.8% contraction in Q3, and narrowly escaping a recession. The annual inflation rate dropped to 2.2% in January as food price roses continue to moderate. The unemployment rate remained at 2.4% in January, matching the market forecast.

The consumer confidence index rose to 39.1 in February, the highest reading since December 2021 and above the forecast 38.3. Retail sales rose 0.8% in January, with the annual rate rising 2.3%, matching market forecasts. Composite PMI came in at 50.6 in February, down from 51.5 in January, but still in expansion territory amid a sustained increase in the service sector.

Currencies

The Australian dollar (AUD) depreciated over the month of February, closing 0.5% lower in trade weighted terms to 61.1, appreciating against the Japanese Yen (JPY) whilst depreciating against the US Dollar (USD), Pound Sterling (GBP) and Euro (EUR).

The AUD fell against the USD early in the month following a much stronger-than-expected US employment report, which saw traders unwind some of the pricing for US rate cuts this year. Furthermore, the higher than anticipated US CPI pushed the USD higher, sending the AUD/USD to a three-month low during the month. The AUD was also weaker against the majority of the remaining G10 currency basket.

Relative to the AUD, the USD led the pack in February, appreciating by 1.5%. Conversely, the JPY was the laggard of the month, depreciating in relative terms by 0.9% against the AUD. Year-on-year, the AUD remains behind the GBP, EUR, and USD by -7.8%, -5.6% and – 3.8% respectively, whilst ahead of the JPY by 6.2%.