It seems like June 30 rolls around quicker every year, so why wait until the last minute to get your finances in order?

It seems like June 30 rolls around quicker every year, so why wait until the last minute to get your finances in order?

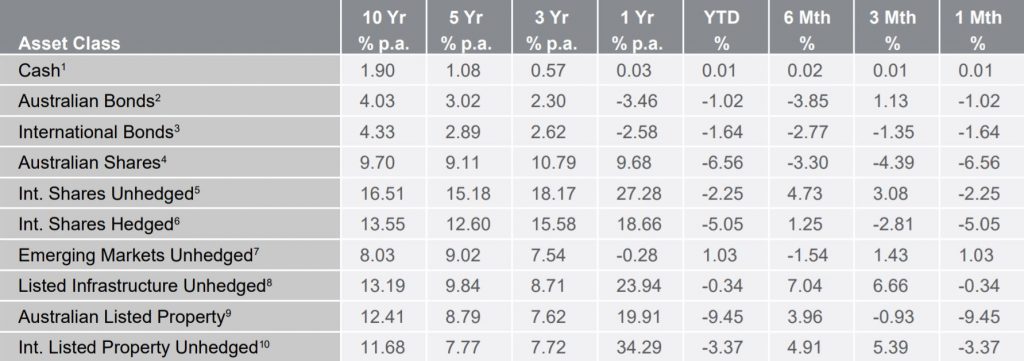

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

Unhedged and hedged international equities exposures finished negative on the month of January, falling 2.25% and 5.05% respectively. Over the month we saw a sell-off in technology stocks in the United States as markets priced in a sizable uptick in interest rates driven by strong inflation data in the US. Value stocks outperformed the broader market led by Energy and Financials, with strong oil demand underpinning the former as well as increasing geopolitical concerns in Europe over Ukraine. We also saw Emerging Markets outperform after being sold off in the latter half of 2021.

The S&P/ASX All Ordinaries Index fell by 6.56% in January, which was a stark contrast to last months rise. We saw cyclical stocks outperform defensive stocks over the month, with value stocks continuing their outperformance over growth stocks. We also saw a rally in the Iron Ore price as demand from China and expectations of increased stimulus there boosted the materials sector. Financials were also boosted by higher interest rate expectations as the Reserve Bank of Australia signalled that the strong economy may see rate hikes brought forward earlier than expected. Small Caps were caught out in the general market selloff (this often happens due to their poorer liquidity and lower quality relative to large caps) although small cap value fared stronger.

Australian bond prices fell over the month with the index falling 1.02% as the expectation of rising interest rates weakened investor sentiment. International bonds fell 1.64% as strong inflation data in the US was coupled with a more aggressive tone by Federal Reserve Chairman Powell increasing expectations of additional hikes in interest rates. As rates rise, cash (variable rate) becomes a more competitive alternative to bonds (fixed rate). When investors anticipate rising rates, they will typically reposition portfolios by selling down bonds leading to an overall weaker return for the market as happened in January. We also saw an expansion in credit spreads which hurt corporate bonds as investors reacted to the weakness in equity markets by selling off riskier bonds with high-yield or “junk” bonds the most impacted by this shift.

The Australian Dollar (AUD) sold-off in January as part of a risk off move in markets. The Australian dollar began its downtrend from the 13th January from a high of 0.7314 (AUD/USD) to a low of 0.6965 by the 30th January which was a slightly wider range than what we saw in December. The faster pace of US rate hikes relative to expectations for Australia made the US dollar more attractive reducing demand for AUD. Another source of weakness was poor performance for risk assets such as stocks or corporate bonds. The Australian dollar is usually a “risk on” rather than safe haven currency that investors will sell down when sentiment weakens. This was another factor in AUD weakness for the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD Source: Centrepoint Research Team, Morningstar Direct

Unhedged and hedged international equities exposures finished positive on the month of December, changing 3.98% and 1.73% respectively. Even with high inflation numbers and surging Omicron case numbers, international equities rose to finish the year. A gain in the AUD/USD caused by a rebound in the iron ore price, which is highly correlated to the AUD, meant slight divergence in the hedged and unhedged returns.

The S&P/ASX All Ordinaries Index rose by 2.67% in December to finish the year strong. Fears regarding the Omicron variant subsided from the previous month as markets didn’t believe the economic impacts from the outbreak would cause economic damage like the previous variants. This had a lot to do with the governments “learn to live with it” reaction to the virus.

Australian long and short-term bond yields remained mostly unchanged on the month as the index rose 0.09%. International bonds fell 0.44% on the month as the US 10-year bond rose slightly on the month, differing from the Australian market. The Federal Reserve is likely initiating rate hikes in March this year which slightly pushed up these yields.

The Australian Dollar rose 1.8% on the quarter as a bounce in the iron ore price provided support. The Aussie Dollar is still in a gradual downtrend over the one year as it fell ~6% across 2021. This was primarily driven by a significant fall in the iron ore price from the fall in demand in the commodity primarily from China. The correlation between this commodity and the AUD is significant as it is Australia’s most exported resource.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

It’s a chance to refresh and reflect on the year that was and hopefully set some goals for the year ahead. Yet this year more than most, many of us may feel that our personal and financial priorities have shifted depending on our experience of the pandemic.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD Source: Centrepoint Research Team, Morningstar Direct

Hedged and Unhedged International equities exposures varied strongly across the month of November changing 3.65% and -1.56% respectively. After moving sharply higher at the beginning of November, fears regarding higher and longer than expected inflation, news on the new COVID variant, combined with continued tapering talks coming the Federal Reserve was the catalyst in this index retracing the early gains. Higher interest rates in the US, making the USD more relatively attractive, forced the hedged index into negative territory.

The S&P/ASX All Ordinaries Index fell by 0.33% in November. Fears regarding the Omicron variant spooked markets late in the month as fears of potential complications arising from the unknown variant got priced in. A weakish economic back drop (as highlighted in last month’s update) combined with the unknown impact of this new variant has put Australian markets into caution mode heading into the end of the year.

Australian 10-year bond yields fell on the quarter as investors bought government bonds to protect from the uncertainty present in the stock market. This meant the Australian bond index rose 2.08%, putting a slight pause in the 3-month trend of rising rates that started with the talks of central bank tapering emanating from the hawkish rhetoric within the United States.

The international bond index rose 0.78% on the month as the same economic factors drove investors to also buy longer-dated international bonds. The new variant will test the global rising rate trend that had begun as a response to higher-than-expected inflation numbers coming from both Europe and the US.

The Australian dollar may have finally found a direction as it fell from roughly 0.75 US cents to 0.71 US cents on the month as the United States dollar benefited significantly from interest rate differentials and a safe-haven trade stemming from the outlined uncertainties previously outlined in markets. This appears to be the trend that may follow through December to end the year.

This update is issued by Ventura Investment Management Limited (AFSL 253045), which is a related body corporate of Centrepoint Alliance Limited.

The information provided is general advice only and does not take into account your financial circumstances, needs or objectives. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure Statement for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

For more information, refer to the Financial Services Guide (FSG) for Ventura Investment Management Limited (available at).

Disclaimer

While Centrepoint Alliance Limited and its related bodies corporate try to ensure that the content of this update is accurate, adequate, and complete, it does not represent or warrant its accuracy, adequacy or completeness. Centrepoint Alliance Limited is not responsible for any loss suffered as a result of or in relation of the use of this update. To the extent permitted by law, Centrepoint Alliance Limited excludes any liability, including negligence, for any loss, including indirect or consequential damages arising from or in relation to the use of this update.

When thinking of insurance, the first thing that comes to mind is your home, car, boat, or health insurance. But there is a type of insurance that is key to protecting you and your loved ones through your different life stages.

Legislation has come into effect allowing a maximum of six members in an SMSF. What does this mean for your SMSF, and will this make it easier when it comes time to pass your super on to the next generation?

In this video, Andrew Sherlock discusses how you can ensure your wealth is passed on to the next generation in a tax-effective way through Family trusts.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International share markets (unhedged) rose 1.65% in October. Fully hedged international shares rose 5.41% on the month signaling a strengthening AUD across the month. Within the United States, the S&P 500 continues to make new all-time highs as markets in general have largely shrugged off the fears of inflation.

The S&P/ASX All Ordinaries Index rose by 0.15% in October, not nearly as much as other markets such as the US. Australian equities have traded largely sidewards since August. The primary driver has been the impact of the sharp fall in the iron ore spot price on major materials companies. These companies make up a significant percentage of the wider index. This is combined with various economic indicators such a rise in unemployment and a fall in consumer confidence which can be attributed to a slight rise in inflation expectations.

Domestic and International Fixed Income

Australian bonds had a significant fall in the final week of October (-3.55%). This was driven by an indication of policy change by the RBA as they stopped purchasing short-dated bonds which was part of their yield-curve control policy. Short-term yields rose sharply causing the Australian Bond Index to sell off. Sooner than expected rate rises could be what the RBA is attempting to set the stage for.

International bonds fell -0.26% as long dated government yields rose slightly. Inflation is now sitting at a 30 year high in the United States and looks to be moving upwards in many countries around the world. This is having an impact on bond yields and may cause central banks to start thinking about rising rates at a faster pace than previously anticipated.

The Australian dollar rose significantly in the month of October as it continues to move in a choppy trading pattern. Multiple factors such as rising inflation, central bank policy expectations, economic impacts of a slowing China and internal economic dynamics are all trying to be priced into the Australian Dollar causing a lack of clear trading direction at this point in time.

General Advice Warning

Sherlock Wealth Pty Ltd is a Corporate Authorised Representative of Matrix Planning Solutions Pty Ltd AFSL & ACL No. 238256, ABN 45 087 470 200. This information is of a general nature only and has been prepared without taking into account your particular financial needs, circumstances and objectives. No representation or warranty is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions or other information contained in this document. This document may contain certain forward-looking statements. Forward- looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control. You should not place reliance on forward-looking statements. To the maximum extent permitted by law, we and Matrix Planning Solutions Limited disclaims all liability and responsibility for any direct or indirect loss or damage which may be suffered as a result of relying on anything in this document including any forward-looking statements. Past performance is not an indication of future performance.

The attached material prepared by Ventura Investment Management Limited (AFSL 253045), Matrix Planning Solutions Limited and its related bodies corporate do not endorse or make any representations as to the accuracy or suitability of the information contained in the Materials including but not limited to any links to websites and does not accept any responsibility or liability for the content of the Material. This information is not advice. Before acting on any information, you should first seek financial advice from your financial adviser and where appropriate review and consider the relevant Product Disclosure Statement