In this video, our Head of Advice, Andrew Sherlock, discusses the importance of having income protection.

In this video, our Head of Advice, Andrew Sherlock, discusses the importance of having income protection.

Legislation has passed, taking effect from 1 July 2021, which increases the number of members allowed in an SMSF from 4 to 6. How could this impact you?

In this video, our Head of Advice, Andrew Sherlock, discusses some important changes that have been made to rules regarding SMSF’s that could impact you and your family.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

International share markets (unhedged) rose by 4.1% in July, helped by the weaker A$. Hedged international shares, which did not benefit from the falling A$, returned 1.8%. The US share market continued to edge higher. European shares also delivered positive returns. Chinese and Hong Kong share markets experienced a more difficult period, with concerns rising amongst property developers who are facing government restrictions on their capacity to borrow, as well as large Chinese technology companies who appear to have fallen out of favour with Chinese authorities.

Overall, share markets continued to be underpinned by a strong recovery due to the on-going rollout of COVID-19 vaccines and lower long-term interest rates. However, there are some areas of concern. Market breadth – which measures participation in the market – is becoming narrower, with fewer and fewer large capitalisation stocks responsible for driving the market higher.

The S&P/ASX All Ordinaries Index rose by 1.1% in July, supported by continued strength in the domestic economy. Sentiment remains positive, despite the growing number of COVID-19 related lockdowns in NSW and other states. In contrast to the first series of lockdowns in 2020, there are no aggressive stimulus packages currently in place. A key issue for both the Australian share market and the Australian economy is how quickly Australia will roll out its vaccination program. There are some grounds for optimism, with additional vaccine supplies becoming available.

Both Australian government bond yields and US Treasury yields moved lower in June, leading to capital gains in fixed interest markets. The RBA has indicated that Australian cash rates are likely to be held at current levels for at least the next few years. The rise in capital values for bonds and many fixed interest funds is welcome. However, investors who are depending on fixed interest investments to deliver income are likely to continue to experience low levels of interest rates over the coming periods.

The Australian dollar fell by approximately 2% against the US dollar in July and is now lower for the calendar year to date, amid broad US dollar strength. The US dollar rose against most other currencies.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.

Inheritance is an emotional subject on every level. The people leaving an inheritance generally do it with pride and love. The people receiving an inheritance often receive it with gratitude – and sorrow. But while emotional, it’s also a financial transfer that comes with a whole range of legal, financial planning and admin issues attached.

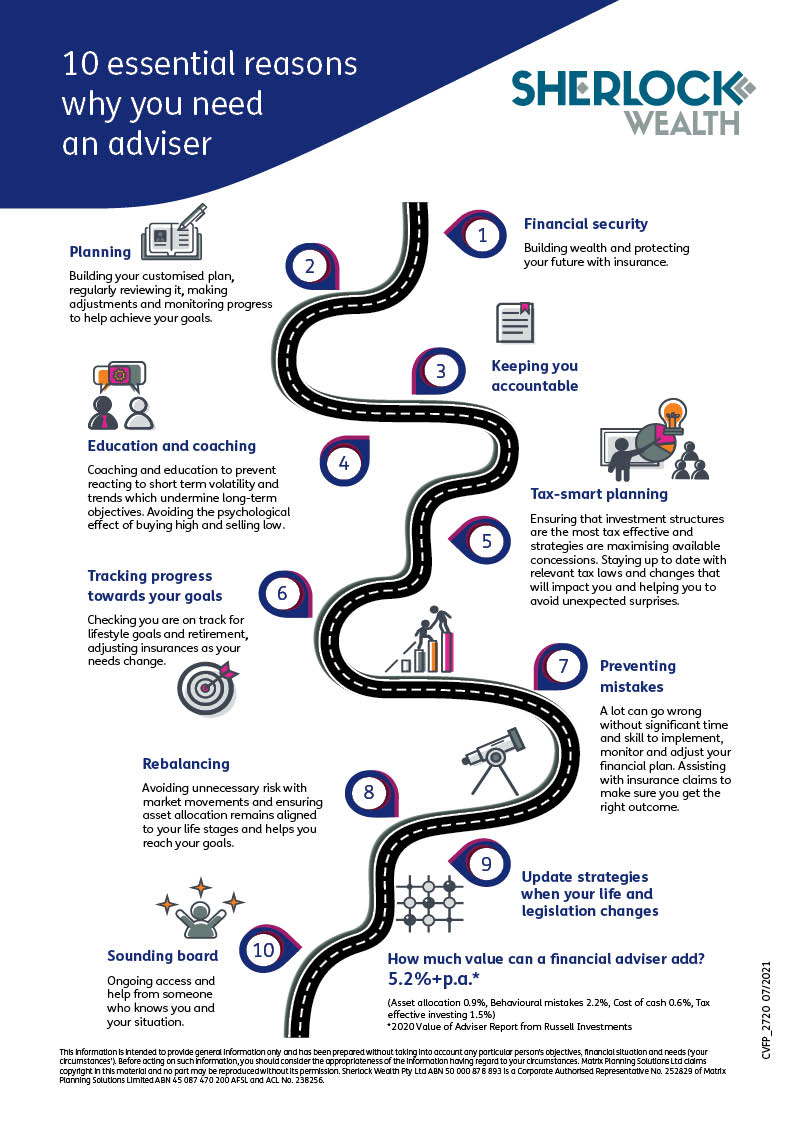

If you are not sure when to seek financial advice, here are 10 essential reasons why you need should get started.

If you were planning the trip of a lifetime, no doubt you’d make a list of all the things you wanted to see and do. We help people just like you with questions like these.

Financial protection for your loved ones when you die

Sudden death can place financial stress on those who depend on you. If this happens, life cover can help them pay the bills and other living expenses.

What is life cover?

Life cover is also called ‘term life insurance’ or ‘death cover’. It pays a lump sum amount of money when you die. The money goes to the people you nominate as beneficiaries on the policy. If you haven’t named a beneficiary, the super trustee or your estate decides where the money goes.

Life cover may also come with terminal illness cover. This pays a lump sum if you’re diagnosed with a terminal illness with a limited life expectancy.

Accidental death insurance is different from life cover. It will only payout if you die from an accident. It will not provide cover if you die from an illness, disease or suicide. This type of cover often has a lot of exclusions.

To understand what’s covered under a policy and the exclusions, read the Product Disclosure Statement (PDS).

Decide if you need life cover

If you have a partner or dependents, life insurance can help repay debt and cover living costs if you die.

If you don’t have a partner or people who depend on you financially, you may not need life cover. But consider getting trauma insurance, income protection insurance or total and permanent disability (TPD) insurance in case you get sick or injured.

How much life cover you might need?

To decide how much life cover to get, consider how much money you or your family would:

The difference between these is the amount of cover you should get.

Use our Life insurance calculator

Work out if you need life insurance and how much cover you might need.

If you need help deciding if you need life cover, reach out to the Sherlock Wealth team for assistance here.

How to buy life cover

Check if you already hold life insurance through super. Most super funds offer default life cover that’s cheaper than buying it directly. You can increase your level of cover through your super fund if you need to.

You can also buy life cover from:

Life cover can be bought on its own or packaged with trauma, TPD or income protection insurance. If it’s packaged, your life cover may be reduced by any amount paid on other claims in the package. Check the PDS or ask your insurer.

Before buying, renewing or switching insurance, check if the policy will cover you for claims associated with COVID-19.

Life cover premiums

You can generally choose to pay for life cover with either:

Your choice of stepped or level premiums has a large impact on how much your premiums will cost now and in the future.

Compare life cover.

Once you know how much life cover you need, shop around, and compare:

A cheaper policy may have more exclusions, or it may become more expensive in the future. You can find information about the policy on the insurer’s website or in the Product Disclosure Statement (PDS).

Use our Life insurance claims comparison tool

Compare how long it takes different insurers to pay a life cover claim and the percentage of claims they pay out.

What you need to tell your insurer

You need to tell your insurer anything that could affect their decision to insure you. You need to give them this information when you apply, renew or change your level of cover.

Insurers usually ask for information about your:

If an insurer doesn’t ask for your medical history, it may mean that the policy has more exclusions.

The information you provide will help the insurer to decide:

It is important that you answer the questions honestly. Providing misleading answers could lead an insurer to deny a claim you make.

Making a life cover claim

If someone close to you dies and you need to make a claim, or if you need to make a terminal illness claim, see how to make a life insurance claim.

If you would like help reviewing or selecting appropriate life insurance cover, please reach out to the Sherlock Wealth team here to help you look at what’s right for you.

Source: MoneySmart

(ASIC)

No one likes to think about the distress it will cause their loved ones or what kind of burden they’ll be left with. That’s why death is often considered a taboo topic of conversation, along with money and politics.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

International share markets (hedged) rose by 2.1% in June. Movements in share markets over the month were largely driven by comments from members of the US Federal Reserve (Fed) about the timing of future interest rate hikes. Share markets initially fell after the Fed brought forward the timeline of expected interest rate hikes at its June meeting due to the stronger-than-expected economic recovery (the median expectation of Fed officials showed two rate hikes in 2023 from zero after their March meeting). However, share markets rebounded after Fed Chair Powell calmed markets by reiterating that the recent spike in inflation is likely to be temporary, and it will prioritise a “broad and inclusive” recovery of the jobs market before raising interest rates.

Overall, share markets continued to be underpinned by a strong recovery in the global economy, the ongoing rollout of vaccines and the prospect of further significant fiscal stimulus in the US.

Global inflation readings continued to increase in June. However, economists largely expect the current spike in inflation to be transitory. The key drivers of the recent increase in global inflation are base effects (as last year’s deflation drops out of annual calculations), higher commodity prices, supply chain bottlenecks (due to production curbs during the pandemic) and consumers switching spending from services to goods.

The S&P/ASX All Ordinaries Index rose by 2.6% in June, supported by continued strength in the domestic economy. The release of GDP data for the March quarter showed that the economic recovery in Australia has been V-shaped, with the level of output in Australia now above its pre-pandemic level; not many other countries are in this same position. The employment data for May showed a strong increase in employment and a fall in the unemployment rate from 5.5% to 5.1%. The level of employment in Australia is now also above its pre-pandemic level. Australia and New Zealand are the only advanced economies where this is the case. The housing market in Australia also remains strong, with housing finance commitments continuing to boom in April, driven by existing owner occupiers and investors.

As was the case for international equity markets, the domestic share market was also impacted by comments from Fed members during the month regarding the timing of future interest rate increases in the US (see above).

Australian government bond yields and US Treasury yields both drifted modestly lower in June, despite early indications that some central banks may start tapering sooner than expected given the recent strength in economic data. In mid-June, the Fed brought forward its timeline of expected interest rate hikes, causing a sell-off in equities markets. However, bond yields were largely stable, having already increased sharply earlier in the year in response to higher inflation expectations.

The Australian dollar fell by around 3% against the US dollar in June, to its lowest level since December last year, amid broad US dollar strength. The US dollar rose against most currencies after the Fed brought forward its timeline of expected interest rate hikes at its monetary policy meeting in mid-June.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.