Overview

The 2020-21 Budget was delivered on 6 October 2020, having been deferred from its original date of 12 May 2020 due to the COVID-19 pandemic. The budget is firmly focused on supporting Australia’s recovery from the first recession since 1991 and the worst economic performance since 1959.

The budget revealed that real GDP is projected to shrink by 1.5 percent in 2020-21, before rebounding in the following years. Similarly, the unemployment rate is set to peak this year at 7.25 percent and will take at least two years to fall below 6 percent.

Given the fall in tax revenue and an increase in spending, the 2020-21 Budget is projected to be in deficit by $213.7 billion, with the deficit falling to $66.9 billion by 2023-24. Net debt will increase to $703 billion this year and peak at $966 billion or 44 percent of GDP in 2024.

Central to the Government’s plans for economic recovery is the JobMaker package, which includes significant tax relief measures for households and businesses, a boost to infrastructure investment and a hiring credit for new employees.

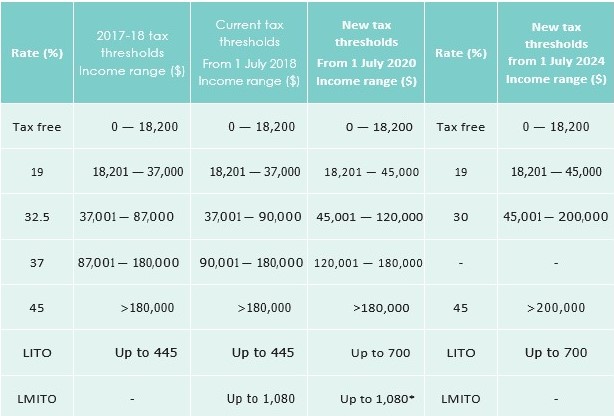

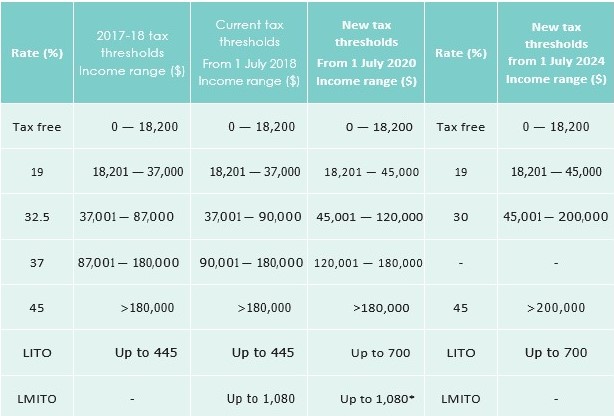

The Government has brought forward it’s stage-two income tax cuts by two years from their original start date of 1 July 2022 to 1 July 2020. The stage-two tax cuts lift the income threshold at which the 19 per cent tax rate applies – from $41,000 to $45,000 – and the rate at which the 32.5 per cent rate applies – from $90,000 to $120,000.

Major support for businesses with a turnover of less than $5 billion includes immediate expensing of capital investment for businesses; temporary carry-back of current and future losses to 2018-19; and insolvency reforms to assist stressed businesses to restructure.

The Government has also proposed a range of reforms to superannuation to reduce the cost of duplicate accounts, improve performance of MySuper funds and increase transparency in fund management.

Further details of these measures follow.

Personal Income Tax

Bringing forward the Personal Income Tax Plan and retaining the low and middle-income tax offset.

The Government will bring forward the second stage of its Personal Income Tax Plan by two years to 1 July 2020 while retaining the low and middle-income tax offset (LMITO) for 2020-21.

The changes are intended to provide immediate tax relief to individuals and support the economic recovery and jobs by boosting consumption by providing around $17.8 billion in tax relief to around 11.6 million Australians, including $12.5 billion over the next 12 months.

The top threshold of the 19 per cent personal income tax bracket will increase from $37,000 to $45,000. The top threshold of the 32.5 per cent personal income tax bracket will increase from $90,000 to $120,000.

* The LMITO will only be available until the end of the 2020-21 income year.

* The LMITO will only be available until the end of the 2020-21 income year.

Even with the quick passage of legislation, the tax measures will be backdated by around four months. As a result, reduction in PAYG tax for the remainder of the financial year will be around 1.5 times the ongoing rate.

The low-income tax offset (LITO) will increase from $445 to $700. The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000. The LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

The LMITO provides a reduction in tax of up to $1,080. It provides a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. Between taxable incomes of $37,000 and

$48,000, the value of the offset increases at a rate of 7.5 cents per dollar to the maximum offset of $1,080. Taxpayers with taxable incomes between $48,000 and $90,000 are eligible for the maximum offset of $1,080. For taxable incomes of $90,000 to $126,000, the offset phases out at a rate of 3 cents per dollar.

Stage three of the Personal Income Tax Plan is unchanged and scheduled to commence in 2024-25.

INCREASING THE MEDICARE LEVY LOW-INCOME THRESHOLDS

The Government has increased the Medicare levy low-income thresholds for singles, families, and seniors and pensioners from 2019-20. The increases take account of recent movements in the consumer price index so that low-income taxpayers generally continue to be exempted from paying the Medicare levy.

- The threshold for singles has increased from $22,398 to $22,801.

- The family threshold has increased from $37,794 to $38,474.

- For single seniors and pensioners, the threshold has increased from $35,418 to $36,056. The family threshold for seniors and pensioners has increased from $49,304 to $50,191.

- For each dependent child or student, the family income thresholds increase by a further $3,533, instead of the previous amount of $3,471.

Business Support

The Government has announced a significant suite of business supports intended to kick-start investment and help businesses manage the current economic downturn.

Notably, the measures that provide financial support are temporary, so as not to affect the long term fiscal outlook.

TEMPORARY FULL EXPENSING TO SUPPORT INVESTMENT AND JOBS

In a major initiative to promote business investment, the Government has announced it will allow eligible businesses to immediately deduct the full cost of eligible capital assets acquired between now and 30 June 2022. The initiative will be limited to businesses with a turnover of less than $5 billion.

Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets. For small and medium-sized businesses (with an aggregated annual turnover of less than $50 million), full expensing also applies to second-hand assets.

Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months, until 30 June 2021, to first use or install those assets.

This initiative is expected to provide $26.7 billion in tax relief for businesses over the next four years, with $1.5 billion in the current financial year.

TEMPORARY LOSS CARRY-BACK TO SUPPORT CASH FLOW

In another initiative intended to allow eligible businesses to better manage the current economic downturn, the Government has announced that eligible businesses will be able to carry back tax losses from 2019-20 to 2021-22 to offset previously taxed profits from 2018-19 or later years. The initiative will be limited to businesses with a turnover of less than $5 billion.

The carryback allowable must not be greater than the profit taxed in the earlier year and a carryback will not generate a franking account deficit.

This initiative is expected to provide around $4.9 billion in support over the forward estimates and, as it is a time-limited measure, will not have a significant long term impact on the budget.

JOBMAKER HIRING CREDIT

To support employment, the Government has announced a weekly payment for businesses who hire eligible new employees. The payment will last for twelve months and is available immediately. To be eligible, new employees must be between 16 and 35 years old. For employees between 16 and 30, the business will be eligible for $200 per week. For employees between 30 and 35 years old, the business will be eligible for $100 per week. Employees must be engaged for at least 20 hours per week and all businesses (except for the major banks) are eligible.

INSOLVENCY REFORMS TO SUPPORT SMALL BUSINESS

The Government had previously announced a new, quicker and lower-cost process to allow small businesses to address insolvency. This measure is intended to help small businesses to restructure, avoid liquidation and continue trading. This process will be available to businesses with liabilities under $1 million which represent around 76 percent of all insolvencies.

INCREASE THE SMALL BUSINESS ENTITY TURNOVER THRESHOLD

The Government will expand access to a range of small business tax concessions by increasing the small business entity turnover threshold for these concessions from $10 million to $50 million. Businesses with an aggregated annual turnover of $10 million or more but less than $50 million will have access to up to ten further small business tax concessions in three phases up to 1 July 2021.

DIGITAL BUSINESS PLAN

The Government is continuing its support for digital uptake in Australian businesses through its $796.5 million Digital Business Plan. Measures included in this plan will support the roll-out of the Consumer Data Right, assist in the commercialisation of regtech and fintech, and support Australian businesses using technology to reduce regulatory compliance costs.

Superannuation

Despite much speculation, the Government has not made any unexpected changes to the superannuation system for the 2020-21 financial year. Previously announced COVID-19 measures in relation to early access to super and pension drawdown relief will continue.

The Government has otherwise continued its commitment to the Your Future, Your Super package which will see super funds follow members as they change jobs, new interactive comparison tools, active management of underperforming funds, and increased trustee transparency and accountability.

COVID-19 RESPONSE PACKAGE

Temporary early access to superannuation

The Government is allowing eligible Australian and New Zealand citizens and permanent residents affected by the financial impacts of COVID-19 to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21 to help support them during COVID-19. The 2020-21 application period for the measure will cease on 31 December 2020.

Temporarily reducing superannuation minimum drawdown rates

The Government has reduced the superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for the 2019-20 and 2020-21 income years. Minimum payment amounts are calculated on the basis of asset values on 1 July of each income year.

YOUR FUTURE, YOUR SUPER

The Government will provide $159.6 million over four years from 2020-21 to implement reforms to superannuation to improve outcomes for superannuation fund members. The reforms will reduce the number of duplicate accounts held by employees as a result of changes in employment and prevent new members joining underperforming funds.

Commencing 1 July 2021, the Your Future, Your Super package will improve the superannuation system by:

- Having your superannuation follow you: preventing the creation of unintended multiple superannuation accounts when employees change jobs by “stapling” super funds

- Making it easier to choose a better fund: members will have access to a new interactive online YourSuper comparison tool which will encourage funds to compete harder for members’ savings. This tool will be developed and maintained by the ATO, and enable new employees to select the right MySuper fund for themselves when they start

- Holding funds to account for underperformance: to protect members from poor outcomes and encourage funds to lower costs the Government will require MySuper products to meet an annual objective performance Those that fail will be required to inform members. Persistently underperforming products will be prevented from taking on new members.

- Increasing transparency and accountability: the Government will increase trustee accountability by strengthening their obligations to ensure trustees only act in the best financial interests of The Government will also require superannuation funds to provide better information regarding how they manage and spend members’ money in advance of Annual Members’ Meetings.

RETIREMENT INCOME REVIEW

The Retirement Income Review was speculated to be released with the budget, however, this has not occurred. The Government did announce however that the Retirement Income Covenants which would have required superannuation trustees to have a strategy in place to support the retirement income needs of members from 1 July 2020 has been delayed to 1 July 2022.

Social Security

As the country finds itself in a recession, much of the focus for the 2020-21 Budget has been on social security measures to support Australian’s who are out of work. The Government has confirmed announced extensions to the JobKeeper payments, provided clarification around COVID-19 payment supplements to those on JobSeeker, will make two $250 payments for eligible social security recipients, and a developed a new JobMaker Hiring Credit for employers who bring on younger Australian’s who have been on JobSeeker.

JOBKEEPER PAYMENT EXTENSION

28 March 2021, with the Payment, targeted to those businesses that continue to be most significantly affected by the economic downturn. The level of the JobKeeper Payment is being tapered to enable businesses to transition towards their longer-term plans and a two-tiered payment is also being introduced to better match the Payment with the incomes of employees. The ATO will also be given additional resources to manage the JobKeeper and JobMaker programs.

The JobKeeper Payment extension announced on 21 July 2020 provides continued support until

COVID-19 RESPONSE PACKAGE — FURTHER ECONOMIC SUPPORT PAYMENTS

The Government will provide two separate $250 economic support payments, to be made from November 2020 and early 2021 to eligible recipients of the following payments and health care cardholders:

- Age Pension

- Disability Support Pension

- Carer Payment

- Family Tax Benefit, including Double Orphan Pension (not in receipt of a primary income

- Carer Allowance (not in receipt of a primary income support payment)

- Pensioner Concession Card (PCC) holders (not in receipt of a primary income support payment)

- Commonwealth Seniors Health Cardholders

- Eligible Veterans’ Affairs payment recipients and concession cardholders.

- The payments are exempt from taxation and will not count as income support for the purposes of any income support payment.

COVID-19 RESPONSE PACKAGE — INCOME SUPPORT FOR INDIVIDUALS

Since 27 April 2020, the Government established a new time-limited Coronavirus Supplement to be paid at a non-income tested rate of $550 per fortnight. This is paid to both existing and new recipients of JobSeeker Payment, Youth Allowance, Parenting Payment, Austudy, ABSTUDY Living Allowance, Farm Household Allowance, Special Benefit, and recipients of the Department of Veterans’ Affairs Education Schemes, Military Rehabilitation and Compensation Act Education and Training Scheme and Veterans’ Children’s Education Scheme.

From 25 September 2020, this supplement will change to $250 per fortnight and continue to 31 December 2020.

The income free area will also change to $300 per fortnight with a 60 cents taper for income earned above the income free area for JobSeeker Payment (except principal carer parents who have an income free area of $106 and a taper rate of 40 cents) and Youth Allowance (other) recipients.

Payment eligibility which was relaxed on a temporary basis, with the One Week Ordinary Waiting Period waived from 12 March 2020, and a range of further exemptions applied from 25 March 2020, including waiving the Newly Arrived Residents’ Waiting Period, Assets Test, Liquid Assets Waiting Period and Seasonal Work Preclusion Period, will all be reinstated from 25 September 2020 except the Assets test and Liquid Assets Waiting Period which will be reinstated from 31 December 2020.

Eligibility criteria for JobSeeker and Youth Allowance (Other) have also been extended to allow sole traders and the self-employed to access the payments provided they meet income test requirements.

Finally, mutual obligations will be changed to give job seekers greater flexibility to count education and training toward their activity requirements.

WOMEN’S ECONOMIC SECURITY

The Government is investing in women’s economic security and supporting increased female workforce participation through the 2020 Women’s Economic Security Statement. The Government will provide $240.4 million over five years from 2020-21.

The Government is supporting new parents whose employment was interrupted by COVID-19. As a result, 9,000 individuals will gain eligibility for Parental Leave Pay and 3,500 for Dad and Partner Pay. This change will extend the work test period from 13 months prior to the birth or adoption of the child to 20 months prior, enabling access to Paid Parental Leave (PPL) where eligibility has been impacted by COVID-19. The Government is supporting disadvantaged parents on Parenting Payment through a $24.7 million expansion of the Parents Next program.

Aged Care

With the Aged Care Royal Commission recently handing its interim report to Government, the expected adoption of recommendations and new support measures for the aged care sector have been implemented. The Government is introducing close to $3 billion of measures to address the recommendations as well as address the unfortunate COVID-19 related issues which have emerged in the aged care sector.

ADDITIONAL FUNDING TO SUPPORT THE AGED CARE SECTOR’S RESPONSE TO COVID-19

The Government will provide $2.0 billion over four years from 2020-21 to further support older Australians accessing aged care by providing additional home care packages as well as continuing to improve transparency and regulatory standards. Funding includes:

- $1.6 billion over four years from 2020-21 for the release of an additional 23,000 home care packages across all package levels

- $125.3 million over three years from 2020-21 to replace the Commonwealth Continuity of Support Programme with a new Disability Support for Older Australians program

- $91.6 million over two years from 2020-21 to continue the reform to residential aged care funding

- $4.6 million over two years from 2020-21 to review the support care needs of senior Australians who live in their own home and determine how best to deliver this care in the home.

SUPPORTING OLDER AUSTRALIANS THROUGH COVID-19

The Government will provide $812.8 million over four years from 2019-20 to support older Australians throughout the COVID-19 pandemic. Funding includes:

- $70.0 million over two years from 2019-20 to provide access to short-term home support services through the Commonwealth Home Support Program to senior Australians who are frail or have self-isolated due to a high risk of contracting COVID-19

- $59.3 million over two years from 2019-20 to guarantee the supply of food, including groceries and prepared meals, for senior Australians who are frail or have self-isolated due to a high risk of contracting COVID-19

- $71.4 million in 2020-21 to support residents of aged care facilities who temporarily leave care to live with their families.

SUPPORTING OLDER AUSTRALIANS — EXEMPTING GRANNY FLAT ARRANGEMENTS FROM CAPITAL GAINS TAX

The Government will provide a targeted capital gains tax (CGT) exemption for granny flat arrangements where there is a formal written agreement. The exemption will apply to arrangements with older Australians or those with a disability. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

CGT consequences are currently an impediment to the creation of formal and legally enforceable granny flat arrangements. When faced with a potentially significant CGT liability, families often opt for informal arrangements, which can lead to financial abuse and exploitation in the event that the family relationship breaks down. This measure will remove the CGT impediments, reducing the risk of abuse to vulnerable Australian

* The LMITO will only be available until the end of the 2020-21 income year.

* The LMITO will only be available until the end of the 2020-21 income year.