As anyone who has joined the weekend crowd at Bunnings knows, Australians love to DIY. And that same can-do spirit helps explain why 1.1 million Aussies choose to take control of their retirement savings with a self-managed superannuation fund (SMSF).

As well as control, investment choice is a key reason for having an SMSF. As an example, these are the only type of super fund that allow you to invest in direct property, including your small business premises.

Other reasons people give are dissatisfaction with their existing fund, more flexibility to manage tax and greater flexibility in estate planning.

What type of person has an SMSF?

If you think SMSFs are only for wealthy older folk, think again.

The average age of people establishing an SMSF is currently between 35 and 44. They’re also dedicated. The majority of SMSF trustees say they spend 1 to 5 hours a month monitoring their fund.i,ii

But an SMSF is not for everyone. There has been ongoing debate about how much you need in your fund to make it cost-effective and whether the returns are competitive with mainstream super funds.

So is an SMSF right for you? Here are some things to consider.

The cost of control

Running an SMSF comes with the responsibility to comply with superannuation regulations, which costs time and money.

There are set-up costs and ongoing administration and investment costs. These vary enormously depending on whether you do a lot of the administration and investment yourself or outsource to professionals.

A recent survey by Rice Warner of more than 100,000 SMSFs found that annual compliance costs ranged from $1,189 to $2,738. These are underlying costs that can’t be avoided, such as the annual ASIC fee, ATO supervisory levy, audit fee, financial statement and tax return.iii

If trustees decide they don’t want any involvement in the administration of their fund, the cost of full administration ranges from $1,514 to $3,359.

There is an even wider range of ongoing investment fees, depending on the type of investments you hold. Fees tend to be highest for funds with investment property because of the higher management, accounting and auditing costs.

By comparison, the same report estimated annual fees for industry funds range from $445 to $6,861 for one member and $505 to $7,055 for two members. Fees for retail funds were similar. Fees for SMSFs are the same whether the fund has one or two members.

Size matters

As a general principle, the higher your SMSF account balance, the more cost-effective it is to run.

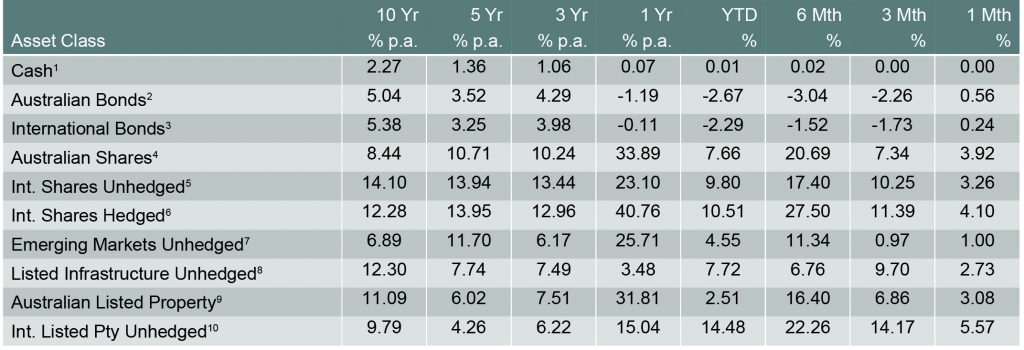

According to the Rice Warner survey:

- Funds with $200,000 or more in assets are cost-competitive with both industry and retail super funds, even if they fully outsource their administration.

- Funds with a balance of $100,000 to $200,000 may be competitive if they use one of the cheaper service providers or do some of the administration themselves.

- Funds with $500,000 or more are generally the cheapest alternative.

Returns also tend to be better for funds with more than $500,000 in assets.

Even though SMSFs with a balance of under $100,000 are more expensive than industry or retail funds, they may be appropriate if you expect your balance to grow to a competitive size fairly soon.

Increased responsibility

While SMSFs offer more control, that doesn’t mean you can do as you like. Every member of your fund has legal responsibility for ensuring it complies with all the relevant rules and regulations, even if you outsource some functions.

SMSFs are regulated by the ATO which monitors the sector with an eagle eye and hands out penalties for rule breakers. And there are lots of rules.

The most important rule is the sole purpose test, which dictates that you must run your fund with the sole purpose of providing retirement benefits for members. Fund assets must be kept separate from your personal assets and you can’t just dip into your retirement savings early when you’re short of cash.

Don’t overlook insurance

If you considering rolling the balance of an existing super fund into an SMSF, it could mean losing your life insurance cover. To ensure you are not left with inadequate insurance you may need to arrange new policies.

If you would like to discuss your superannuation options and whether an SMSF may be suitable for you, please reach out to the Sherlock Wealth team to discuss your unique situation here

i https://www.smsfassociation.com/media-release/survey-sheds-new-insights-on-why-individuals-set-up-smsfs?at_context=50383

ii https://www.smsfassociation.com/media-release/survey-sheds-new-insights-on-why-individuals-set-up-smsfs?at_context=50383

iii https://www.ricewarner.com/wp-content/uploads/2020/11/Cost-of-Operating-SMSFs-2020_23.11.20.pdf