Like any other insurance policy, life insurance has many variations to meet different users’ needs. Thus, before choosing one, you must determine what you need in a life insurance policy.

Like any other insurance policy, life insurance has many variations to meet different users’ needs. Thus, before choosing one, you must determine what you need in a life insurance policy.

Being named the executor of an estate is both an honour and a burden. Entrusted with this pivotal role, one carries out the last wishes of a loved one, but the path is often strewn with complexities and unforeseen challenges.

At first glance, the executor’s role might seem straightforward. However, in practice, it’s a demanding role that requires interaction with a myriad of entities, such as banks, real estate professionals, utility companies, the deceased’s superannuation fund, and the taxation office.

Furthermore, an executor’s duties are vast and varied. They encompass everything from overseeing funeral procedures, securing the death certificate, and notifying friends and family about the loss. They’re also tasked with locating the will, identifying beneficiaries, gathering a multitude of documents, settling estate debts, documenting estate assets, and initiating insurance and superannuation claims.

For those in the process of drafting a will and designating an executor, a few proactive steps can immensely assist in the estate’s efficient management:

Collaborate with a knowledgeable probate lawyer or solicitor specialising in wills and estate management. Their insights can be invaluable, especially regarding local family and inheritance laws.

Given life’s unpredictability, regular updates to your will, insurance policies, and superannuation death benefit details are paramount.

It’s crucial to note that superannuation doesn’t fall within your estate and isn’t addressed in your will. Still, you can specify your wishes and arrangements concerning your super death benefit nominations in your will.

Seek guidance from your financial adviser and super fund to establish death nominations, thereby streamlining benefit acquisitions for beneficiaries.

If feasible, contemplate liquidating your entire death benefit from the super fund while still alive. This proactive step allows for immediate distribution based on your directives or deposits into a bank account, providing easy access for the executor upon your passing.

If you’re ever nominated as an executor by a loved one, it’s prudent to discuss these considerations with the person who drafted the will (the Testator). Collaboration with their legal advisor (and financial consultant if available is also advisable to ensure a comprehensive understanding of the responsibilities and challenges ahead.

The role of an executor is multifaceted, rife with both honour and intricate challenges. However, with a well-charted roadmap and diligent preparation, the process can be streamlined, ensuring a smoother transition for all involved.

This can be a complex discussion and should be undertaken with a trusted advice professional. Reach out to the Sherlock Wealth team here to get started.

Source: Matrix Planning Solutions

This information does not take into account the objectives, financial situation or needs of any person. Before making a decision, you should consider whether it is appropriate in light of your particular objectives, financial situation or needs.

The complexity of farm succession planning extends beyond mere financial transactions. For farm owners, navigating the transition of a generational asset such as a farm is both an economic and emotional endeavour. The process often grapples with uneven asset distribution, potentially leading to family strife if not managed well.

A typical farm usually constitutes the lion’s share of a farming family’s assets. However, the farm’s income is often adequate to sustain just one family. Consequently, when the time comes to hand down the farm, usually, one child becomes the inheritor.

Life is unpredictable, and the untimely demise of a parent can throw succession plans into disarray. Here, life insurance can serve as a financial cushion, providing immediate liquidity to manage an unplanned succession.

What sustains the parents after they step back? Ideally, they would live on the off-farm assets accumulated over the years. However, the reality is often a mix of income streams, such as leasing arrangements and continued payments from the farm. This is not always convenient for the next generation, who may prefer to invest in the farm rather than pay their retired parents. Moreover, assuming ownership may require the new generation to shoulder existing debts and potentially accrue new ones to buy out their parents.

Farm succession planning is more than just a financial transaction; it is an emotional and familial journey that requires collective decision-making. Initiating the process early and involving all family members can alleviate potential pitfalls. A balanced approach can help navigate the complexities and ensure the farm remains a generational asset while still considering the needs and feelings of every family member.

Reach out to our experienced advice professionals to discuss your unique situation here.

Source: Matrix Planning Solutions

This information does not take into account the objectives, financial situation or needs of any person. Before making a decision, you should consider whether it is appropriate in light of your particular objectives, financial situation or needs.

The investment technique known as ethical investing prioritises the investor’s moral, religious and social ideals over financial gain. This is because a growing number of investors have begun to demand social responsibility from the companies they invest in, primarily because of the rise in dubious and unlawful investment arrangements.

In today’s society, the notion of wealth extends beyond financial resources. As individuals seek a more balanced and fulfilling life, the concept of wealth has evolved to encompass various factors such as education, healthcare, job satisfaction, and social connections. This article explores the changing perception of wealth in contemporary Australia and highlights the importance of holistic well-being in defining prosperity.

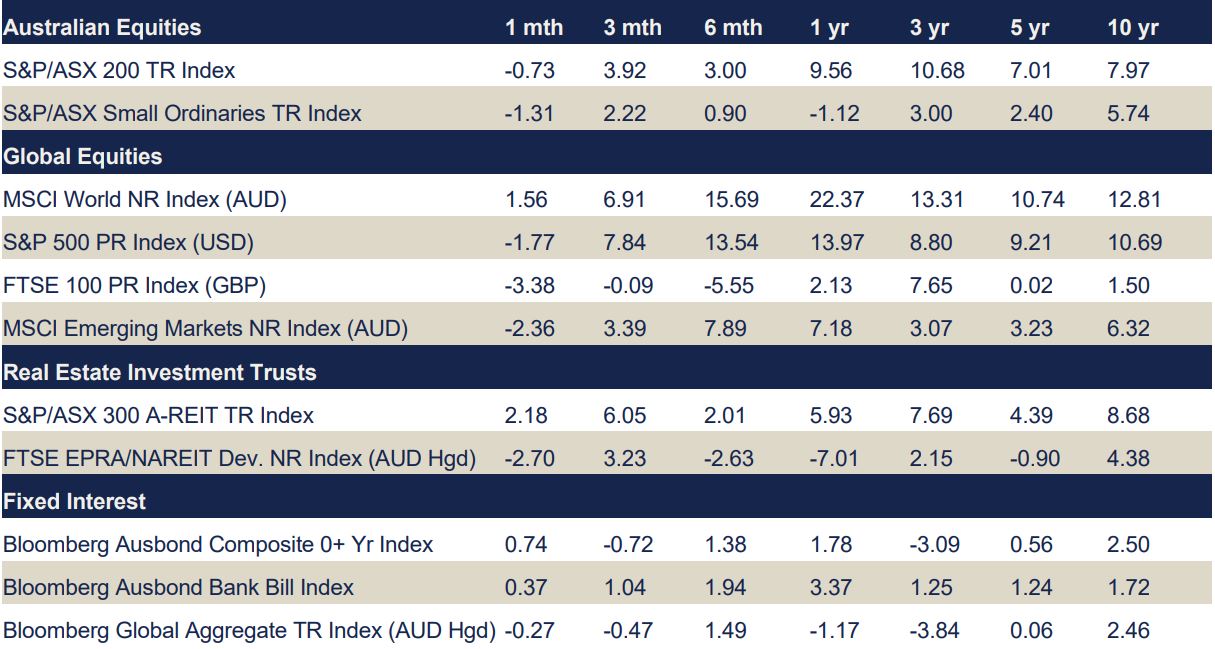

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

The S&P/ASX 200 Accumulation Index fell 0.7% in August, as earnings results dampened market returns. Of the 11 sectors, only Consumer Discretionary (+5.7%), Property (+2.3%) and Energy (+0.5%) had positive returns for the month, while Utilities (-3.9%) and Consumer Staples (-3.2%) were the biggest drags on the Index.

Share prices battled with a combination of mixed earnings results and a conservative outlook for companies, while soft economic data out of China continued to weigh on local investors.

Consumer Discretionary was the standout performer for the month, benefiting from resilient consumers. Given the continued strain on households through a higher cost-of-living, many companies in the sector had flagged headwinds in the months leading into reporting season, with a conservative outlook already baked into share prices. Another theme to emerge from earnings reports is the ability for companies to manage cost pressures, particularly those brought about through higher financing rates. Despite revenue growth, Consumer Staples reported disappointing profit results, leading to their waning share prices. More broadly, the sustained impact of a slowing Chinese economy was seen across the market, particularly Materials.

The month saw all Factors perform negatively. Enhanced Value (-3.1%) and Low Volatility (-2.5%) were the worst performing factors, while Growth was able to limit its losses (-0.4%).

Primarily negative economic data in August resulted in a rise in bond yields and a decrease in equity markets. With renewed investor concerns, US equities stumbled with the S&P500 Index declining -1.6% (in local currency terms) during the month.

Most sectors across Europe fell, with the DAX 30 Index returning -3.0% (in local currency terms) for the month. Energy was one of the sole positive contributors, inflation has remained stable but is yet to decline below previous months’ levels. The European Central Bank’s next meeting will be a watchpoint for investors.

China experienced some of the sharpest declines for the month with a potentially challenged real estate sector. Investor concerns around stimulus deployment largely contributed to this decline, with the CSI 300 Index returning -6.0% for the month (in local currency terms). In Hong Kong, stocks fell sharply with weaker manufacturing and real estate market concerns in surrounding markets. This was reflected in the Hang Seng Index returning -8.2% for the month (in local currency terms).

The S&P/ASX 200 A-REIT Accumulation Index finished +2.3% higher in the month of August as the A-REIT sector continued its consolidation in recent months. In contrast, the Global Real Estate Equities market (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged) finished lower (-2.7%). The Australian Infrastructure sector (as represented by the S&P/ASX Infrastructure Index) finished -2.8% lower.

In the month of August, M&A activity was relatively muted as companies reported their full year results. Abacus Group (ASX: ABG) officially completed its de-stapling from Abacus Storage King (ASX: ASK). Ingenia Communities Group (ASX: INA) extended their development partnership with Sun Communities for an additional seven years. Meanwhile, Goodman Group (ASX: GMG) reported that Senko Co Ltd. signed a major lease agreement at their Goodman Joso location in Japan. The Australian residential property market experienced an increase by +0.1% Month on Month (as represented by CoreLogic’s five capital city aggregate). Brisbane was the biggest riser (+1.5%), followed by Adelaide (+1.1%). Over the one-year period, Perth was the largest gainer (+4.5%). In contrast, Hobart (-0.1%) was the only city to deliver negative returns in the month of August. Similarly, Hobart has the lowest percentage change year on year (-10.0%).

In their August meeting, the Reserve Bank of Australia have for the second time elected to pause rate hikes and leave the target cash rate at 4.10%, citing slowing economic growth and pressure on household budgets. The Australian bond market reacted mildly, with Australian 2- and 10- Year Bond yields falling 23bps and 3bps respectively over the course of the month.

The Australian yield curve continued to flatten throughout August, and the Bloomberg AusBond Bank Bill Index returned 0.37%. Markets are expecting a similar story in September, with the RBA expected to hold rates steady next month. RBA Governor Philip Lowe’s tenure will soon end, and the position will be headed by his deputy Michele Bullock.

In the US, the Federal Funds Rate remains at 5.25%- 5.50% following the most recent July rate hike, with the Fed’s first-rate cut being priced into futures contracts by March 2024. The Bloomberg Barclays Global Aggregate Index (AUD) returned 2.62% over the month, and US 2- and 10-Year Treasury yields rose 1bp and 15bps respectively. In the UK, the interest rate is at 5.25% after the BoE hiked by 25bps in their August 2 meeting, resulting in UK Gilt yields rising over the month.

Australian GDP came in slightly above expectations, increasing at an annual rate of +2.1% for the 12 months to June, despite very weak household consumption.

GDP growth has slowed from +2.4% to March, consistent with the RBA’s forecast for a continued softening of the domestic economy into the end of this calendar year before a gradual recovery through 2024 and 2025.

The RBA left the cash rate at 4.1% in August, reiterating that inflation was still too high and further tightening may be needed to bring inflation back to its target range of 2-3%. Inflation unexpectedly eased down to 4.9% in July, led by falling prices for fresh produce and fuel.

Westpac-Melbourne Institute Index of Consumer Sentiment came in at 81.0 in August, ahead of expectations of 80.7 with the RBA’s decision to hold rates steady for a second month in a row, doing little to quell worries about higher borrowing costs. The unemployment rate rose to 3.7% in July, above the expected 3.6% and underscoring the RBAs prediction that the labour market is near a turning point. Retail sales increased by 0.5% in July, topping market estimates of 0.3%, while annual sales rose 2.1%.

The composite PMI edged down to 48 in August, with services activity falling at a faster pace than manufacturing output. The NAB business confidence index rose to 2 in July with wholesale, construction and recreation & personal services accounting for most of the upswing.The trade surplus narrowed to $8.04 billion in July, below market forecasts of $10 billion.

Record temperatures in August drove food prices higher with soybeans, olive oil and rice just three of the products affected by shortages and price hikes. While seasonal price fluctuations are usual, the exceptionally hot and dry summer experienced in the northern hemisphere has caused poor harvests and many crops to fail.

The war in Ukraine also continues to impact the global food supplies, as the UN brokered deal for safe passage of Ukrainian grains via the Black Sea collapsed, with Russia pulling out of the agreement. While some grain is still being exported via inland rivers, it takes longer and is more expensive than via sea.

The US economy grew at an annualized rate of 2.1% in 2Q23, ahead of the first quarter’s expansion of 2.0%. Annual inflation rose to 3.2% in July, just shy of the expected 3.3%.

The US economy added 187,000 jobs in August, more than market expectations of 170,000. This is the third month of sub 200,000 jobs growth and coupled with the increase in unemployment to 3.8%, suggests that the year of successive rate rises by the Fed is working to get inflation under control and avert a recession.

Consumers remain tentative about the outlook ahead with consumer sentiment falling from 71.6 in July to 69.5 in August. Retail sales in July increased 0.7%, beating the 0.4% forecast, with the annual rate increasing 3.2%. The S&P Global Composite PMI fell to 50.4 in August, with services activity weak and the contraction in manufacturing deepening.

The trade deficit widened less than expected to US$65 billion in July, from a downwardly revised US$63.7 billion in June, with China accounting for US$24 billion of this figure.

The Eurozone economy grew by 0.6% in 2Q23, easing from a 1.1% expansion in the previous period, due to the large drop in real incomes and surging interest rates.

Annual inflation remained steady at 5.3% in August, above the expectations of 5.1%. Unemployment stayed at the record low of 6.4% for July, matching the market forecast.

Consumer confidence dropped to -16 in August, as households were more pessimistic about both their own and the wider economic outlook.

Retail sales dropped 0.2% in July, below market expectations of – 0.1%, with the annual rate down 1.0%, ahead of the anticipated -1.2%.

The Composite PMI dropped to 46.7 in August, with the biggest contraction in services activity since November 2020. PPI dropped 0.5% in July, broadly in line with expectations, with the annual rate falling 7.6%. This can be attributed to the decrease in energy prices.

The Bank of England increased the cash rate by 25bps to 5.25% in August, the 14th consecutive rise. The Bank came under renewed pressure to raise interest rates again in September after wages jumped more than expected in June, boosted by a one-off payment to NHS workers.

Annual inflation slowed to 6.8% in July, matching market expectations, mainly due to a sharp fall in fuel prices. This was mirrored in the annual PPI which fell be 0.8% in July, below the market expectations.

The unemployment rate increased to 4.2% in June and above market expectations of 4.0%.

Consumer confidence rose to -25 in July as easing inflation reduced pressure on household spending sentiment. Retail sales fell 1.2% in July 2023, worse than market forecasts of a 0.5% fall, as sales declined for both food and non-food, reflecting the impact of wet weather and cost pressures. Annual sales fell 3.2%, compared to the expected -2.1%.

The composite PMI index fell to 48.6 in August with both services and manufacturing activity declining.

In China, the unemployment rate rose to 5.3% in July, up from June’s 16 month low of 5.2%.

Annual Retail sales grew 2.5% in July, down from 3.1% in June and falling short of expectations. Both consumer and business confidence are flagging as the post pandemic recovery has stalled and many believe that policymakers have fewer good options to fight the downturn than in the past.

The Caixin/S&P Global Services PMI fell from 54.1 in July to 51.8 for August, the lowest reading since pandemic lockdowns in late 2022. The Composite PMI declined to 51.7, adding to the recent series of negative signals for the country’s future demand for Australian mining commodities.

China lifted anti-dumping tariffs on Australian barley in a move that points to improving bilateral relations and would alleviate supply concerns after Russia suspended a humanitarian corridor used to deliver key Ukrainian grains to global markets.

Japan’s 2Q23 GDP was slightly below expectations, coming in at 1.3% for the quarter, which may give further justification for the BOJ to relax its monetary stimulus.

The annual inflation rate was unchanged at 3.3% in July, notably higher than the market forecast of 2.5%.

The unemployment rate rose unexpectedly to 2.7% in July, defying market forecasts of no change from 2.5% in June.

The consumer confidence index dropped to 36.2 in August, below forecasts of 37.5. Retail sales rose 2.1% in July, with the annual rate rising 6.8%, exceeding forecasts.

The composite PMI came in at 52.6 in August with the fastest rise in services activity in three months offset by weakness in manufacturing production.

The Australian dollar (AUD) continued to descend over the month of August, closing -1.1% lower in trade weighted terms to 60.6, depreciating against all four referenced currencies in this update.

Volatility over the course of the month continued to be primarily influenced by weaker economic indicators from China, further eroding investor conviction in China’s growth trajectory. In addition, relative US dollar strength predominantly stemming from the appreciation of the USD/CNY mid-month added additional drag to the AUD.

Relative to the AUD, the US dollar (USD) led the pack in August, appreciating by 3.8%. Conversely, the Japanese Yen (JPY) was the laggard of the month, albeit appreciating in relative terms by 1.5% against the AUD. Year-on-year, the AUD remains behind the Pound Sterling (GBP), Euro (EUR) and USD by -13.4%, -12.5% and -5.6% respectively, and has now fallen behind the JPY by -1.0%.

Ensuring you’ve structured your finances tax-effectively is always a concern, but with new tax rules for super on the horizon, many people with large balances are considering alternative vehicles to save for retirement.

Unsurprisingly, this has sparked a renewed interest in an old favourite – trusts.

Trusts have always been popular in Australia, with the government’s Tax Avoidance Taskforce (Trusts) estimating more than one million were in place in 2022.

The popularity of trusts for business, investment and estate planning purposes is due to both their flexibility and inherent benefits, particularly when it comes to managing your tax affairs.

At their heart, trusts are simply a formal relationship where a legal entity holds property or assets on behalf of another legal entity.

This separation means the trustee legally owns the assets, but the beneficiaries of the trust (such as family members) receive the income flowing from the assets.

A common example of a trust structure is a self managed super fund (SMSF), where the fund trustee is the legal owner of the fund’s assets, and the members receive investment returns earned on assets held within the SMSF trust.

There are many different types of trusts, with the appropriate structure depending on the financial goals you’re trying to achieve.

For small businesses and families, the most common trust is a discretionary (or family) trust. These vehicles are very flexible and can be used with immediate and extended family members, family companies or even charities.

In a discretionary trust, the trustee has absolute discretion on how both the income and capital of the trust are distributed to various beneficiaries.

This gives the trustee a great deal of flexibility when it comes time to allocate income to family members paying different marginal tax rates.

Discretionary trusts offer tax, asset protection, estate planning and property holding benefits.

They can also assist with the accumulation of assets for younger generations within your family and provide opportunities for the discounting of capital gains.

For small businesses and farming operations, a discretionary trust can be used to provide valuable asset protection. If your business goes bankrupt or a beneficiary is divorced, creditors will be unable to access assets or property held within the trust as it is the legal owner of the assets.

With new tax rules for super fund balances over $3 million being introduced, trusts also provide a useful tool to consider for continued wealth accumulation.

Unlike super funds, trusts don’t have annual contribution limits, restrictions on where you can invest or borrowing limits. Money can be added and removed from the trust as necessary, providing significant financial flexibility.

Discretionary trusts can also be used with vulnerable beneficiaries who may make unwise spending decisions. The trustee can decide to provide a spendthrift child or a family member with a gambling addiction regular income, but not large capital sums.

Holding ownership of assets within a trust is useful for estate management, as the assets will not be part of a deceased estate, avoiding the possibility of a Will being challenged.

Although trust structures provide many benefits, there are also tax issues that need to be considered. For example, any trust income not distributed to beneficiaries is taxed at the top marginal rate.

Distributions to minor children are taxed at higher rates and a trust is unable to allocate tax losses to beneficiaries, so they must remain within the trust and be carried forward.

Trusts can be expensive to set up, administer and dissolve when they are no longer needed and the trustee’s actions are restricted by the terms of the trust deed.

If a family dispute arises, running a trust can become difficult and making changes once it is established isn’t easy.

If you would like to find out more about trusts and whether one is appropriate for your business or family, reach out to our experienced advice team here.

Andrew Sherlock is the Owner & Head of Advice at Sherlock Wealth.

A Sydney-based financial planning firm, Sherlock Wealth has been helping successful families, business owners and individuals with their wealth creation and wealth protection needs for more than two generations.

A Chartered Accountant with a background in funds management, Andrew’s career spans more than 30 years. Andrew was one of the first people in Australia to obtain the Self-Managed Superannuation Specialist accreditation and is one of only a few advisers in Australia to be a Certified Investment Management Analyst. He is a lifetime member of the international MDRT Top of the Table and holds a BA Economics degree from Macquarie University with majors in accounting and finance.

Helping clients achieve their lifestyle goals through smart investing and asset management, wealth structures, and strategic planning are the cornerstones of what Andrew and the team at Sherlock Wealth provide.

Andrew can also be contacted at ask@sherlockwealth.com.

If you’re lucky enough to have received a windfall, perhaps an inheritance or a retrenchment payout, your first decision will be what to do with it.

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

The S&P/ASX 200 Accumulation Index finished July up 2.9%, the second-best monthly performance for the index this year. Commodity price rises aided the gains, while consumer sentiment has improved with positive inflation and employment data releases. Energy (+8.8%), Financials ex-Property (+4.9%), Information Technology (I.T.) (+4.5%) and Utilities (+4.0%) led Sectors. In all, 9 of the 11 Sectors in the Index finished positively, with Health Care (-1.5%) and Consumer Staples (-1.0%) the only laggards.

The driving factor in Energy names was rising commodity prices, particularly oil. This was evident in the gains Woodside (ASX: WDS), whose stock also benefitted from a quarterly update that was received positively by investors. Meanwhile, the other monthly leader, Financials ex-Property, saw investors pile into the “Big 4” banks, which all had strong months in July. While the RBA has left rates on hold, the banks have continued to increase their rates for home loan borrowers. Investors expect the rate rises from the lenders to ease competition and lead to higher net interest margins.

The month saw all Factors perform positively, led by Enhanced Value (+6.3%), Shareholder Yield (+5.5%) and Quality (+4.1%).

Global equities ended in a predominantly positive month with stabilising economic data. Emerging markets outperformed developed market counterparts returning 4.9% (MSCI Emerging Markets Index (AUD)) versus a 2.1% gain according to the MSCI World Ex Australia Index (AUD).

The U.S. markets had mixed results again, with inflation data falling in line with another expected rate hike. Most sectors were positive with standouts in Technology and Energy rising largely due to increased strength in suppliers. The S&P500 Index posted a gain of 3.2% (in local currency terms).

Emerging markets rallied strongest for the month, as China’s economic growth recovery plan continues, with new stimulus having positive effects across sectors; specifically manufacturing and real estate as indicated by development data. The CSI 300 Index returned 5.3% for the month (in local currency terms).

The S&P/ASX 200 A-REIT Accumulation index advanced during July, with the index finishing the month 3.8% higher. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also finished strongly, advancing 3.2% for the month. Australian infrastructure performed well during July, with the S&P/ASX Infrastructure Index TR advancing 4.1% for the month and up 13.2% YTD.

July was relatively quiet across the A-REITs sector. Some activities include Abacus Property Group (ASX: ABP) successfully completing the retail offer of their Abacus Storage King (ASX: ASK) REIT. This offer raised gross proceeds of approximately $34m which follows the institutional component last month that raised $191m. Charter Hall Retail REIT (ASX: CQR) announced the sale of their Bricksworth Marketplace, SA property for $85m representing a 6.1% premium to book value.

The Australian residential property market experienced an increase of +0.9% Month on Month (as represented by CoreLogic’s five capital city aggregate). Brisbane and Adelaide were the biggest movers (both +1.4%) with Perth (+1%) also performing strongly. All five capital cities performed positively for the third consecutive month.

In its July meeting, the RBA decided to leave the cash rate on hold at 4.1%, pausing what has been an aggressive rate hiking cycle. The market responded with Australian 2-Year and 10-Year bond yields remaining elevated and rising by 4bps and 5bps respectively. Fixed income markets started to see some gains, with the Bloomberg AusBond Composite 0+ Yr Index returning 0.5% over the month.

In the US, bond markets continue to price the possibility of a recession and the US yield curve is inverted. The Federal Reserve raised rates in July by 25bps lifting the benchmark rate to 5.25-5.5%, which is the highest this range has been in 22 years. The market responded with US 10-Year and 2-Year Treasury yield rising by 15bps and 9bps respectively. US annual inflation for the year to June 2023 lowered to 3%. Globally, higher yields led to losses in fixed income markets, with the Bloomberg Barclays Global Aggregate Index (AUD) returning -0.5% over July.

The RBA left the cash rate at 4.1% in its July meeting with the Board saying that it needs more time to assess the impact of past hikes. Annual inflation dropped to 6% in Q2, below the forecast 6.2%, primarily driven by a slowdown in goods inflation (5.8%). Services inflation came in at 6.3%, the highest rate since 2001.

The Westpac-Melbourne Institute Index of Consumer Sentiment for June rose by 2.7% to 81.3. Although the reported fall in inflation appears to have boosted confidence, the index remains in deeply pessimistic territory.

The unemployment rate eased to 3.5% in June, against the expected 3.6%. Retail sales in June declined 0.8% as cost-of-living pressures continued to weigh on consumer spending. Conversely, annual sales rose 2.3%, down from +4.2% the previous month.

The Composite PMI fell to 48.2 in July amid a renewed contraction in the service sector as interest rate rises hit customer confidence and budgets. The NAB business confidence index rose to 0 in June but shows warning signs of growth. In trend terms, confidence is weakest in retail and is also negative in wholesale and recreation & personal services, reflecting concerns about the outlook for consumption.

The trade surplus widened to $11.32 billion in June from a downwardly revised $10.49 billion in May, beating market forecasts of $11 billion.

The International Monetary Fund (IMF) slightly raised its global GDP growth estimates for 2023 to 3%, however it continues to warn about persistent challenges over the medium term. The latest World Economic Outlook from the IMF points to reduced inflation as a factor in the improved outlook for 2023 but has kept its 2024 forecast unchanged – both standing at +3%.

India is expected to have the world’s highest growth rate this year at 6.1%.

The IMF also forecasts that global headline inflation will drop to 6.8% for 2023, down from 8.7% last year, with inflation predicted to fall to 5.2% next year. However, core inflation is likely to drop more slowly and not back in line with national targets until late 2024 or early 2025.

The Federal Reserve raised the cash rate by 25bps to 5.50% in its July meeting, bringing borrowing costs to the highest levels since January 2001.

Inflation rose 0.2% in June, slightly below the 0.3% the market expected, with the annual rate slowing to 3.0%.

Non-farm payrolls added only 187,000 jobs in July, below the forecast 200,000. The unemployment rate dropped to 3.5% in May, below the market expectation of 3.6%. This jobs data is largely supportive of the soft-landing narrative and is unlikely to influence Fed expectations. Consumer Confidence continued its bounce back, rising to 117.0 in July and likely reflecting lower inflation and a tight labour market.

Retail sales in June increased 0.2%, below the expected 0.5% with the annual rate increasing by 1.5%. The S&P Global Composite PMI declined to 52.0 in July, dragged down by slower service sector growth.

The trade deficit narrowed to US$65.5 billion in June, with China trade accounting for US$22.8 billion of this figure.

In July the European Central bank raised the key interest rate by 25 bps to 4.25%, citing persistently high inflation. At the same time, the annual inflation rate dropped to 5.3%, in line with market estimates.

Unemployment dropped slightly in June to 6.4, just under the market forecast.

Consumer confidence rose to -15.1 in July, the highest rate since February 2022. Retail sales dropped 0.3% in June, missing market expectations of + 0.2%. The annual rate was down 1.4%, ahead of the anticipated -1.7%.

The Composite PMI dropped to 48.9 in July, as new business inflows fell the most in eight months and backlogs of work dropped at the steepest rate in ten years. PPI dropped 0.4% in June, double the market expectations, with the annual rate falling 3.4%, against the forecast -3.1%. These drops were primarily driven by the decrease in energy costs.

Europe is counting the cost of fires across Greece, Spain and Portugal, as a ‘heat dome’ across the southern half of the continent led to the hottest temperatures on record.

There was no meeting of the Bank of England in July, so the cash rate remained at 5.0%. Annual inflation slowed to 7.9% in June, the lowest level in a year. Inflation remains well above the 2% target rate and therefore, the Bank of England is expected to raise rates at its next meeting in early August.

Annual PPI fell by 2.7% in June, more than the market forecast of -1.6%.

The unemployment rate rose to 4.0% in May, above market expectations of 3.8%.

Consumer confidence fell to -30 in July as persistent inflation and rising interest rates weigh on sentiment. Retail sales rose 0.7% in June, above the anticipated 0.2%, boosted by summer sales and good weather.

Annual sales fell 1%, above the expected -1.5%.

The composite PMI index fell to 50.8 in July, mainly due to a sharp fall in manufacturing orders.

The Chinese economy expanded by 6.3% year-on-year in Q2 2023, faster than the 4.5% of the previous quarter but falling short of market estimates of 7.3%. The latest figures are distorted by a low base of comparison from last year when Shanghai and other major cities were under strict lockdowns.

The unemployment rate was unchanged at 5.2% in June, in line with market forecasts and below the government target rate of 5.5%.

Annual retail sales increased by 3.1% in June, below the forecast 3.2%, as sales for clothing, footwear and textiles slowed considerably.

Composite PMI fell to 51.9 in July, with manufacturing contracting for the first time in three months and services activity expanded at a slower pace.

China was hit hard by extreme weather in July from record-breaking heatwaves to deadly rain, with at least 20 people killed and 31,000 evacuated in Beijing due to severe flooding.

As expected, the Bank of Japan kept its key short-term interest rate unchanged at -0.1% and that of 10-year bond yields at around 0% in its July meeting. The Bank also made a surprise move by making its yield curve control policy more flexible in an effort to improve the sustainability of stimulus policy.

The annual inflation rate increased slightly to 3.3% in June, below the forecast 3.5%.

The unemployment rate came in at 2.5% in line with expectations and improving from a prior reading of 2.6%.

The consumer confidence index rose above forecasts to 37.1 in July, as the economy further recovered from pandemic disruptions. Retail sales fell 0.4% in June, with the annual rate rising 5.9%, which matched forecasts.

The composite PMI came in at 52.2 in July mainly underpinned by a solid expansion in the services sector. Factory activity remains subdued with both output and new orders falling.

The Australian dollar (AUD) fell over the month of July, closing -0.7% lower in trade weighted terms to 61.3.

Key volatility drivers over the month of July included weaker than expected CPI and PPI data releases in the US, bolstering spirits that the Fed may be approaching its final rate hike for the cycle. In addition, softer Q2 CPI data released domestically caused the AUD to retreat on gains made earlier in the month.

Relative to the AUD, the Japanese Yen (JPY) led the pack in July, appreciating by 0.6%. Conversely, the US dollar (USD) was the laggard of the month, falling by – 0.9% relative to the AUD. Year-on-year, the AUD remains behind the Euro (EUR), Pound Sterling (GBP) and USD by -10.6%, -8.9% and -3.7% respectively, and remains ahead of the JPY by 2.6%.