Month in Review as at June 2023

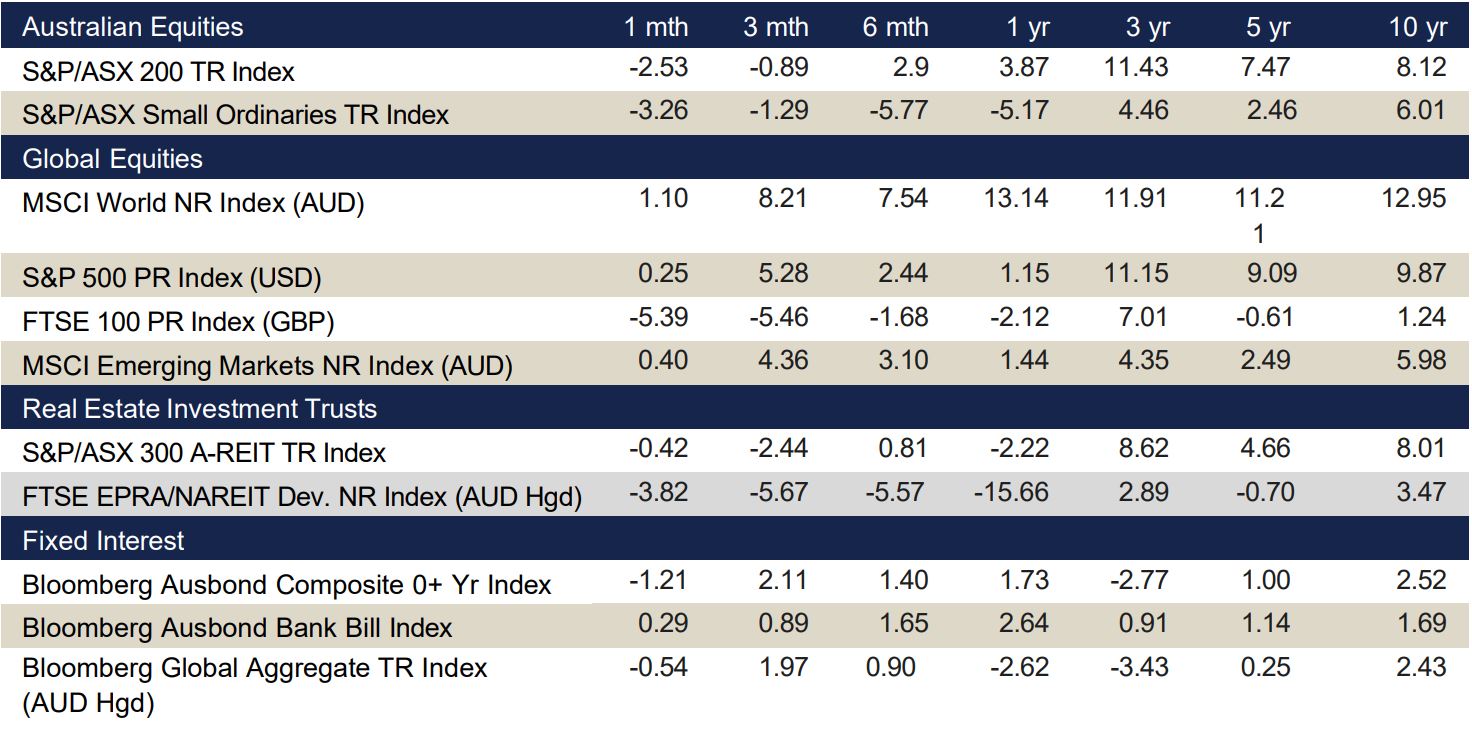

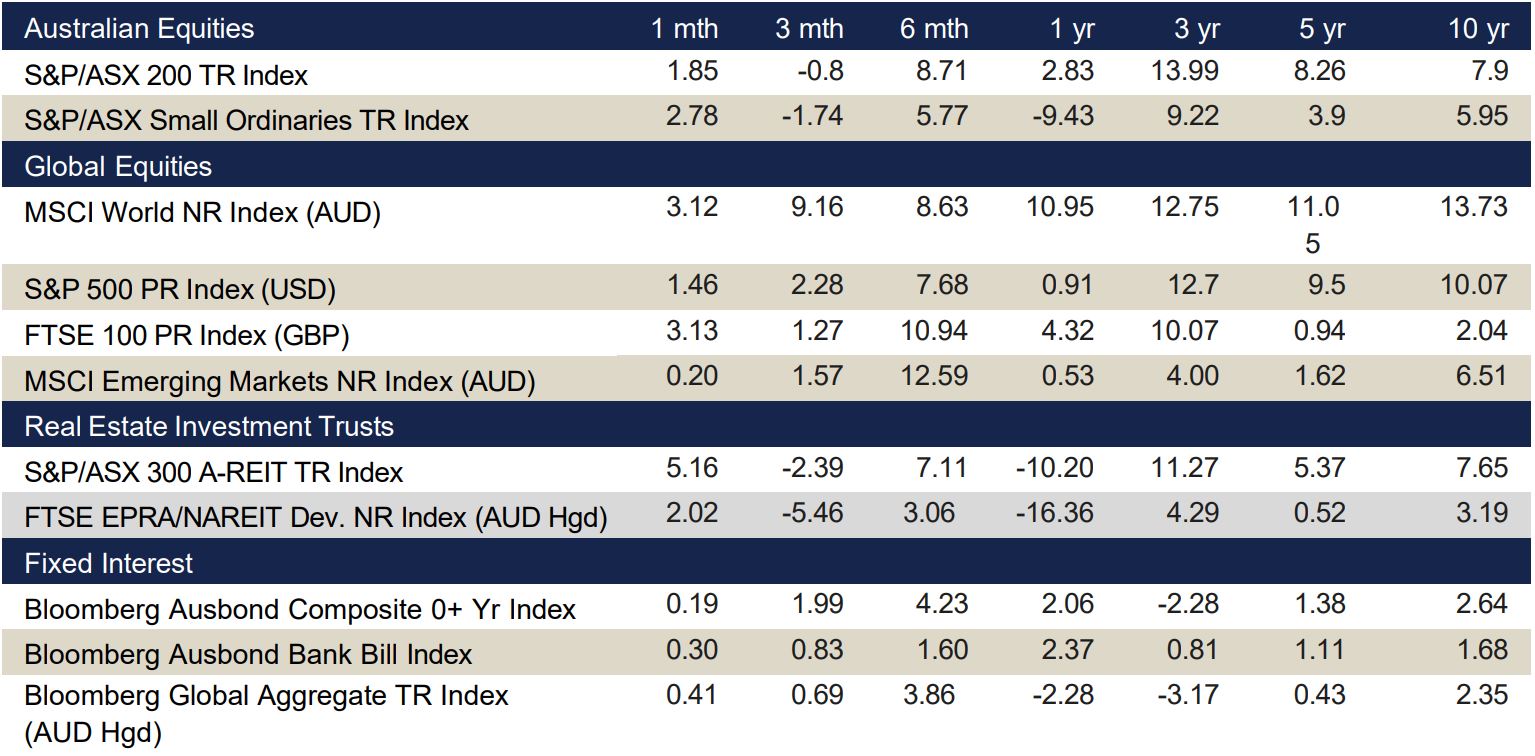

VIEW PDFIndex returns at end June 2023 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Market Key Points

- The Australian equity market returned 1.8% in June. Strong returns were evident in Materials (4.8%), Information Technology (3.5%) and Financials ex Property (3.1%). All sectors finished higher during the month except for Property (-0.1%), Communications (-1.0%), and Health Care (-6.6%).

- Global markets finished higher, with the S&P 500 (USD) returning a strong 6.6%, while the Nikkei 225 Index (JPY) returned 7.6%. The FTSE Eurotop 100 Index (EUR) returned 2.7%.

Australian equities

The S&P/ASX 200 Accumulation Index finished June up 1.8%. Materials led all sectors, finishing up 4.8%.

Information Technology (I.T.) rose again (+3.5%), with Financials (+3.1%), Utilities and Consumer Staples (both +2.9%) also posting healthy gains. Health Care (-6.6%) fell significantly, dragged down by an announcement from its largest constituent, CSL, that forthcoming foreign currency headwinds were expected to be higher than previously estimated. Despite an extensive list of economic headwinds, the Index finished the Financial Year up 14.8%.

I.T. shares continued to ride the artificial intelligence (AI) wave and followed the gains that were seen globally in the sector; through the Financial Year it led all sectors, gaining 38%.

Chinese data releases solidified the weakening activity there and led to action to further stimulate the economy, helping Materials to lead the month. Meanwhile, a tight labour market and sticky inflation have seemingly increased the likelihood of further RBA cash hikes, mitigating the gains in those sectors sensitive to interest rates.

Global equities

Global equities had another positive month, while emerging markets underperformed developed market counterparts returning 0.9% (MSCI Emerging Markets Index (AUD)) versus a 3.1% gain according to the MSCI World Ex Australia Index (AUD).

The U.S had one of its better performances of the year, driven in part by the Federal Reserve holding interest rates steady for the first time in over 12 months. This was supplemented with sustained strides in the technology sector. Large caps led a gain of 6.6% in the S&P500 Index (in local currency terms).

Equities across Asia were relatively strong, Japanese stocks continued to rally with sound economic data around production levels across industries. The Nikkei 225 Index reached new highs again with a gain of 7.6% for the month (in local currency terms) despite potential concerns around inflation and yield curve control.

China’s economic growth recovery efforts see optimistic levels of manufacturing and industrial production, with the Central Bank releasing cuts to lending rates. This was reflected by the Hang Seng Index and the CSI 300 Index, returning 4.5% and 2.1% respectively (in local currency terms) for the month.

Property

The S&P/ASX 200 A-REIT Accumulation index was relatively neutral in June finishing the month 5bps lower. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) performed strongly, returning 3.2%, driven by a surge in the office sector (+10.4%), following a positive reception of a New York transaction. Australian infrastructure continued its positive momentum during June, with the S&P/ASX Infrastructure Index TR advancing +0.6% for the month.

The Australian residential property market experienced an increase by +1.3% Month on Month (as represented by CoreLogic’s five capital city aggregate). Sydney was the biggest riser (+1.8%) alongside Brisbane (+1.4%) also performing strongly. All five capital cities performed positively for the second consecutive month.

Fixed Income

For the first time in over a decade the Australian yield curve has inverted, with growing market concern around the possibility of a recession. The RBA continues to tighten monetary policy and has lifted the cash

rate by 25bps in its June 6 meeting, bringing the target cash rate to 4.1%. The cash rate is now 375bps higher than what it was 12 months ago. The market responded with Australian 2-Year and 10-Year bond yields rising by 66bps and 68bps respectively, their highest levels in a decade. Higher yields led to losses in fixed income markets, with the Bloomberg AusBond Composite 0+ Yr Index returning -1.95% over the month.

In the US, the Federal Reserve voted to maintain the May federal funds rate of 5%-5.25%. Despite the reprieve of a rate hike, fixed income markets fell, and US 10-Year and 2-Year Treasury yields rose by 49bps and 41bps, respectively. Globally, fixed income markets performed largely the same with the Bloomberg Barclays Global Aggregate Index (AUD) returning – 2.79% over June. Yield curve inversion seems to be a major trend with looming threats of further rate hikes, weak consumer confidence, and recession.

Economic key points

- Financial conditions are likely to remain tight as central banks maintain quantitative tightening and continue their hawkish rhetoric, signaling the potential for further rate rises.

- RBA increased the cash rate to 4.1%.

- The Fed kept the cash rate at 5.25% while the ECB increased interest rates by 25 bps to 4.0%.

Australia

The RBA unexpectedly raised the cash rate by 25bps to 4.1% at its June meeting, while keeping the door open for further tightening as inflation remained persistently high and wage growth picked up. This decision brought a total of 4% increases since May 2022, pushing the cash rate to its highest level since April 2012. The Westpac-Melbourne Institute Index of Consumer Sentiment for May rose to 79.2, with the index at near recession lows for the past year.

May’s monthly headline inflation figure came in at 5.6%, well above the RBA’s targeted 2% to 3% range, but still the smallest increase since April last year. The unemployment rate eased down to 3.6% in May, against the expected 3.7%, as 76,000 jobs were added. Retail sales for May rose by 0.7%, above the market expectations of 0.1%, reflecting some resilience in spending with consumers taking advantage of larger- than-usual promotional activity and sales events. This is also reflected in the 4.2% rise in the annual rate.

Composite PMI fell to 50.1 in June, with domestic demand driving new orders driven. The NAB business confidence index dropped 4 points to -4 in May, with declines in all industries except mining, manufacturing, and transport and utilities.

The trade surplus increased to $11.79 billion in May, above the market forecasts of $10.5 billion as exports to China grew 9% month on month.

Global

The World Bank and OECD both released updated growth forecasts for the remainder of this year and 2024. The World Bank increased its global growth forecast for 2023 to 2.1%, up from the earlier 1.7%, with the OECD increasing its estimate marginally to 2.7%. For 2024, the OECD estimate is unchanged at 2.9%, however the World Bank cited central bank monetary tightening and increasingly restrictive credit conditions for its decision to cut its estimate from 2.7% to 2.4%.

US

The Federal Reserve maintained the cash rate at 5.25% in its June meeting with officials suggesting that it may raise rates further this year.

Inflation rose 0.1% in May, slightly below the 0.2% market expected, with the with the annual rate dropping to 4.0%.

Non-farm payrolls added only 209,000 jobs in June, below the forecast of 225,000 jobs. The unemployment rate rose to 3.7% in May, above the market expectation of 3.5%. Consumer Confidence increased markedly to 109.7 in June, reflecting belief that labour market conditions will remain favourable and that there will be further declines in inflation, Retail sales in May increased 0.3%, well above the expected -0.1% with the annual rate increasing 1.6%. The S&P Global Composite PMI fell to 53.2 in June.

The trade deficit narrowed to US$69 billion in May on the back of a fall in imports.

Euro zone

In June the European Central bank raised the key interest rate by 25 bps to 4.0%, citing persistently high inflation. Christine Lagarde, ECB President, noted that with wage growth pressuring inflation, the bank needs to bring interest rates into sufficiently restrictive territory and therefore is likely to increase rates again in July. The annual inflation rate dropped to 5.5% in June, slightly below market expectation of 5.7%. Core inflation increased to 5.4%, supporting the view that policymakers are likely to continue raising rates in the upcoming months. Unemployment was flat at 6.5% in May, meeting market expectations and indicating a tighter labour market.

Consumer confidence rose to -16.1 in June, the highest rate since February 2022. Retail sales for May came in flat, against expectations of 0.2% The annual rate was down 2.9%, below the anticipated -2.7%.

The Composite PMI dropped to 49.9 in June, signaling a slowing of economic activity due to a deepening downturn in factory output and softer expansion in services. PPI dropped 1.9% in May compared to the expected -1.8%, with the annual rate falling 1.5%, against the forecast -1.3%. This drop in process was primarily driven by the decrease in energy costs, which fell 5% in the month.

UK

The Bank of England increased interest rates by a surprise 50bps to 5.0% in June in response to stubbornly high inflation. Policymakers have also flagged further hikes if the ongoing inflationary pressures persist.

Annual inflation was steady at 8.7% in May, above the expected 8.4% and remains the highest level of the G7.

The unemployment rate came in at 3.8% in April, below market expectations of 4.0% and a prior reading of 3.9%. Consumer confidence rose to -24 in June, better than the expected -26 as households grew more optimistic about their finances and the economy. Retail sales rose 0.3% in May, with the annual rate falling 2.1%, below the expected -2.6%.

The composite PMI index fell to 52.8 in June, missing market expectations and aligning with Europe wide trend of steady services growth offsetting the accelerated slump in manufacturing.

Annual PPI fell sharply to 2.9%, below the expected 3.6%, due mainly to the continued fall in petroleum prices.

China

Annual inflation was unexpectedly flat in June, compared to an expected 0.2% increase.

The unemployment rate was unchanged at 5.2% in May, in line with market forecasts and below the government target rate of 5.5%.

Annual retail sales increased by 12.7% in May, below the forecast 13.6% and well down on the record increase of 18.4% in April.

Composite PMI fell to 52.5 in June, with the services sector continuing its post COVID rebound but at a slower pace than previous months. Manufacturing activity decline for a third straight month as demand falters both in China and abroad.

China’s economy grew faster than expected in the first quarter largely due to a strong post-COVID rebound in consumption, but policymakers have been unable to sustain the momentum in the second quarter. The government is expected to announce more stimulus measures, but these are likely to be smaller and more targeted as concerns over debt and capital flight remain.

Japan

As expected, the Bank of Japan kept its key short-term interest rate unchanged at -0.1% and that of 10-year bond yields at around 0% in its June meeting by unanimous vote. This approach is in sharp contrast to other major central banks who have raised borrowing costs to decade highs.

Referencing the economy as a whole, the board expects output to recover toward the middle of FY 2023, supported by pent-up demand.

The annual inflation rate unexpectedly declined to 3.2% in May, below the forecast 4.1%.

The unemployment rate was flat at 2.6% in May, in line with market forecasts.

The consumer confidence index rose to 36 in June, matching forecasts, and is the highest reading in 18 months. Retail sales increased 1.30% in May, with the annual rate rising 5.7exceeding the market forecast of 5.4%.

The composite PMI fell to 52.1 in June, with softer expansion in services and the eleventh fall the past year for manufacturing.

Currencies

The Australian dollar (AUD) gained ground over the month of June, closing 3.2% higher in trade weighted terms to 61.7, appreciating against all four referenced currencies in this update.

June found itself filled with mixed signals for the market, volatility primarily being influenced of the course of the month by an assortment of both positive and negative economic data releases from China and the US, amongst disparate signals from the RBA on monetary policy and the status of the rate hike cycle.

Relative to the AUD, the Euro (EUR) led the pack in June, depreciating by -0.5%. Conversely, the Japanese Yen (JPY) was the laggard of the month, falling by -6.4% relative to the AUD. Year-on-year, the AUD remains behind the Pound Sterling (GBP), EUR and US dollar (USD) by -7.5%, -7.4%, and – 3.6% respectively, however is now ahead of the JPY by 2.5%.

Small Business

Small Business