If you’re close to retirement, chances are you’ve already spent time thinking about how to tap into your superannuation when you retire.

If you’re close to retirement, chances are you’ve already spent time thinking about how to tap into your superannuation when you retire.

Getting more money into superannuation is a proven way of building wealth to spend in retirement.

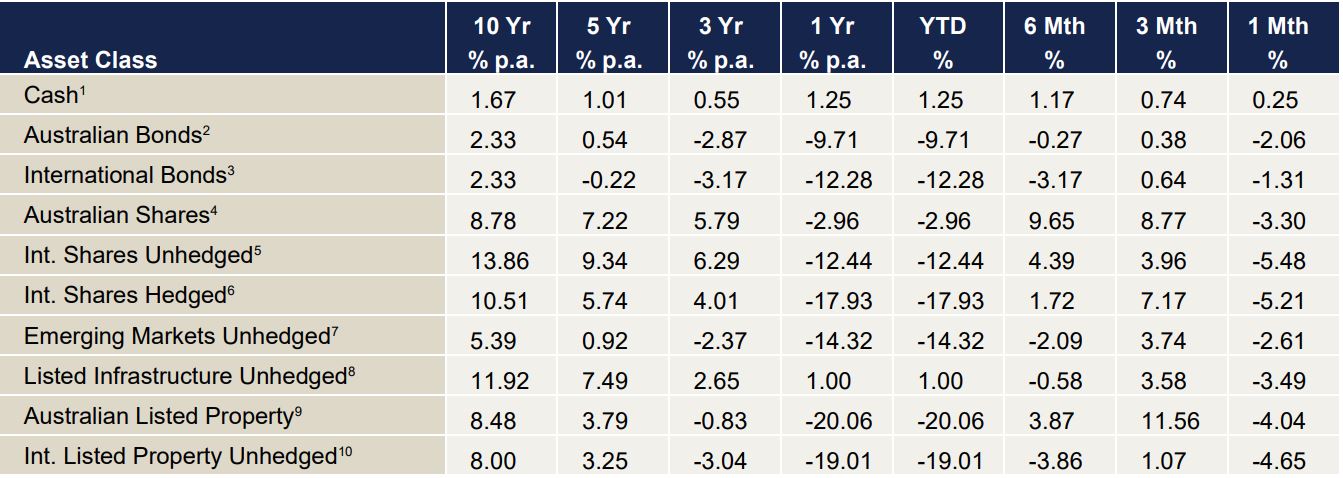

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

After a couple months of positive gains, international equity markets retraced by -5.48% and -5.21% in unhedged and hedged terms for the final month of the year. All three major US markets (Dow Jones, S&P 500 and NASDAQ) had their worst year since 2008. During December, markets started to price in a recessionary environment with elevated interest rates. This combination is rare as a recessionary period generally comes with a lowering of interest rates. Members of the United States Federal Reserve Bank have continued to keep expectations focused on higher interest rates throughout 2023. Indications of a slowing economy are forcing the markets to second-guess just how sustainable this is, however. Materials, information technology and consumer discretionary were the hardest hit sectors during the month and are indicative of recessionary (materials and consumer discretionary) and interest rate (technology) factors negatively impacting the market.

Australian shares were not sheltered from this general market sell-off. The Australian market was down 3.3% in December with Technology, Real Estate and Industrials leading the way. Whilst the Australian market was down overall, the materials sector was buoyed by the reopening of China from their Covid-Zero policy. Energy and utilities also outperformed the ASX 200. Australia ended the year as the best performing index compared to the US, Europe, and Emerging Markets.

International and domestic bonds had a negative month to end the year. International bonds fell 1.31% and domestic bonds fell 2.06%. The US raised rates another 50 bps in December and reaffirmed their commitment to stamping out inflation. This was perceived as negative for bonds as higher interest rates for longer amounts of time put downward pressure on bonds. A battle between bond traders and central banks is currently occurring. Bond markets are trying to suggest that interest rates should be lower by the end of 2023 due to a weakening global growth picture, however central banks thus far have remained adamant that interest rates will remain elevated. Throughout 2023, we will see who is correct.

The Australian Dollar (AUD) rallied 1.2% during December. This was aided by the US Dollar (USD) continuing its drop from the extremely elevated levels seen during its historic rise in 2022. This has allowed the Australian Dollar to continue to move higher from the lows of 0.63 AUD/USD in October this year. If economic growth expectations continue to deteriorate and inflation moderates in the United States, the Australian Dollar will benefit. If either of these trends reverse, the AUD could still move lower.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

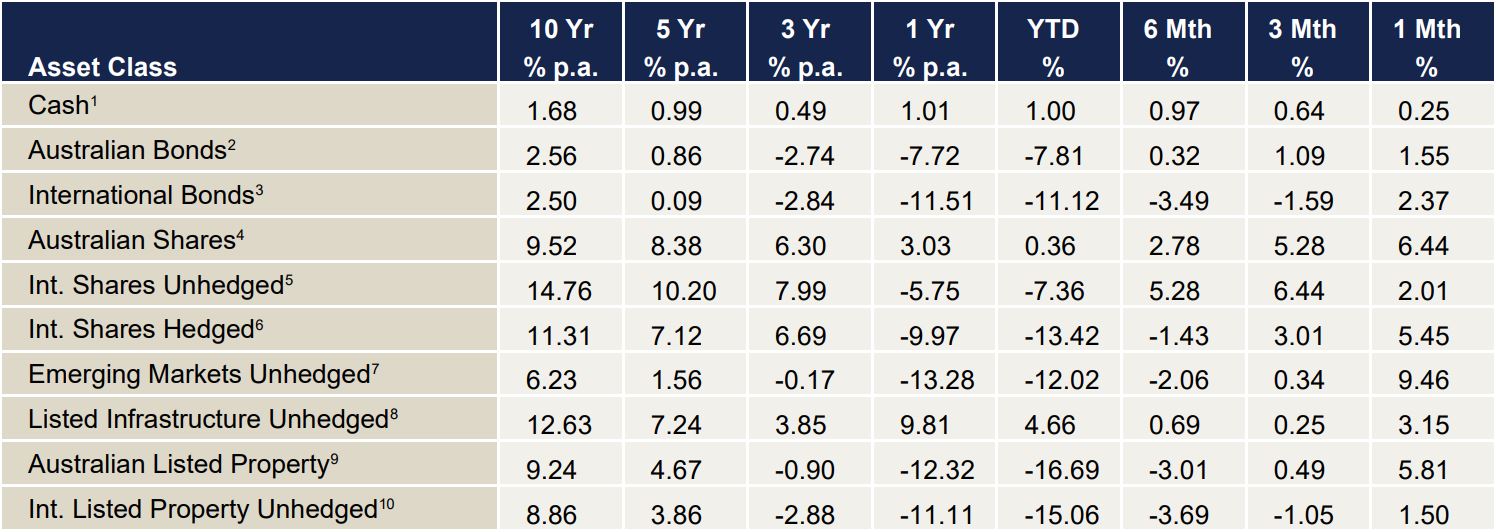

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International shares have now had back-to-back months of positive returns following the gain of 5.45% in hedged shares and 2.01% gain in unhedged shares. Markets rallied due to a mild moderation in inflation within the United States (US). Inflation was 8.2% in September and has now fallen to 7.7% in October. Whilst the number remains elevated, markets are taking note of the change in direction. US inflation peaked at 9.1% in June and has fallen slightly each month. This naturally starts to put less pressure the central bank to keep interest rates elevated to fight inflation. Interest rates have been the biggest cause of pain for the markets this year and the reprieve from this has been positive for markets.

Australian shares had a very strong month in November, inking a 6.44% gain. This was aided by hopes of a less aggressive US central bank but was also combined with rumours of a China reopening. China moving away from the Zero-Covid policy would be highly constructive for global economic activity and therefore stronger materials exports for Australia. It is still up for debate whether China will truly reopen in the near future, however, there appears to be a gradual trend towards this as government restrictions have greatly impacted the Chinese economy causing civil unrest in many regions.

Both international and domestic bonds had a positive month, returning 2.37% and 1.55% respectively. Once again this was driven primarily from the decrease in inflation within the US. Asset classes generally have been moving in quite a correlated nature based on inflation news. This means equities and bonds are having positive months at the same time. Historically, bonds and equities have been negatively correlated, meaning one will do well when the other does not. This is not the case when inflation is high. Once a moderation of inflation occurs, this relationship should return. The timing of this is difficult to know.

The Australian Dollar (AUD) rallied 4.8% during November. As mentioned in last month’s report, signs of inflation moderation would benefit the AUD. This is exactly what occurred over the month as the USD finally showed a reverse in trend with a near 5% drop in the US Dollar Index. The uncertainty within markets still remains high, so any apparent trend has the potential to change quickly. That being said, there is some reprieve in USD upwards pressure. A toning down in interest rate increase rhetoric by the US central bank would significantly move the USD lower over the coming months and send the AUD upwards. If China decides to entirely reopen much like the rest of the world, the AUD should significantly benefit from this too.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

Rising inflation brings about concern for many, but a long-term focus—can help any investor navigate choppy waters.

Given the inherent volatility of security prices in capital markets, it is useful to remind ourselves of strategies that investors can utilise to meet their investment goals.

Frustrated with your current rate of progress? Here are seven types of busy that could hold you up, plus tips on overcoming them. Which one are you?

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD Source: Centrepoint Research Team, Morningstar Direct

Global equities saw respite in October as September’s developed market losses were mostly erased. A combination of resilient corporate earnings in the US, easing concerns of an energy crisis in Europe and a mutual hope that Central Banks could be nearing a monetary policy pivot sent markets higher. The same could not be said for China and Hong Kong however, with the Hang Seng finishing the month materially lower. Investors are concerned that Premier Xi Jinping’s historic third term will be dominated by a fight to secure China’s economic independence. News that China will not relax its strict zero-COVID policy also weighed on sentiment. Chinese and Hong Kong markets are down -40.2% and -27% for the year, respectively. Emerging Markets were therefore unable to participate in the same rally seen by developed market equities as China’s returns weighed heavily. Despite this, there were still several winners. Indonesia, Thailand, India, Malaysia and South Africa outperformed the index. OPEC+’s production cuts assisted oil exporting markets to advance. The MSCI Emerging Markets Index (hedged to AUD) closed October -2.6% lower.

The Australian market finished October with the S&P/ASX 200 Accumulation Index rising sharply by +6.0%, with nine out of the eleven sectors finishing positively. The top performers were the Financials (+12.2%), Property (+9.9%) and Energy (+9.5%) sectors as the broader market rebounded from substantial selling pressure in September.

The Financials sector was led by strong performance amongst the major Australian banks. The Property sector also rebounded from heavy year-to-date losses as investors continued to price in volatility around policy rate outlook. Likewise, Energy performed strongly as the tight supply conditions continued to place upward pressure on spot prices across various segments of the market.

Overall, geopolitical uncertainty abroad continued to persist, whilst major central banks indicated the prospect of further interest rate tightening to control persistently higher inflationary figures. In an Australian context, the CPI figures surprised to the upside with the Reserve Bank of Australia subsequently electing for an 0.25% increase in the cash rate.

October experienced a considerable turnaround in performance for both the local A-REIT market and the broader Global real estate equities market, with the S&P/ASX 200 A-REIT Index (AUD) and the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged) advancing 9.9% and 2.9% MoM, respectively. This was the second-best month for A-REIT returns since the December 2020 rally. Australian infrastructure performed well during October, with the S&P/ASX Infrastructure Index TR advancing 7.8% for the month, and 7.9% YTD.

The Australian residential property market experienced a –1.1% change month on month in October represented by Core Logic’s five capital city aggregate. Brisbane (- 1.9%), Sydney (-1.3%) and Melbourne (-0.9%) were the worst performers. Adelaide (-0.3%) and Perth (-0.2%) stayed relatively neutral.

Australian fixed income markets were met with a reprieve in October. While the RBA has continued to tighten, in their October meeting they increased the cash rate by a smaller than expected 25bps. Yields on 2 and 10-year Australian Government Bonds both fell by approximately 25bps over the course of the month, which was the primary driver in the Bloomberg AusBond Composite 0+ Yr Index returning 0.93% during the course of October.

Internationally, markets continued to sell off as a hawkish Federal Reserve has given no indication of an end to rate rises in the US. The Bloomberg Global Aggregate Index (AUD Hedged) returned -0.38% in October, while the unhedged variant returned -0.14% due to currency fluctuations

The Australian Dollar (AUD) fell 0.54% in the month of October. This was relatively mild compared to the prior months where the United States Dollar (USD) has been on a relentless upward trajectory. Intra-month the AUD fell 3% and then reversed course. Some weakness crept into the USD as markets hoped for signals of a tapering in interest rate increases. If inflation shows signs of moderating somewhat in the US, the AUD will have some potential to rally.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

Success is a concept that is different for every person. Whether it means living a long life, having a great career or a thriving business, achieving our own definition of success can provide a profound sense of accomplishment.