Recent studies show that more than two in five Australians lack confidence when it comes to financial decision making.

The Federal Government believes this is largely due to a lack of financial literacy within the community, which is why it has developed the National Financial Literacy strategy. This initiative aims to motivate Australians of all ages, genders and socioeconomic backgrounds to engage more with their finances. In turn, this will help people make informed financial decisions that will improve their economic wellbeing.

What does it mean for women?

As social norms and family structures have changed, financial decision-making is no longer the sole domain of the male breadwinner – these days it’s just as important for women to take charge. Yet women experience higher levels of stress when it comes to managing money, with more than a third saying they find it overwhelming.

That’s why it’s vital for women to build their financial literacy. Becoming more financially savvy can change a woman’s life, by empowering her to be self-sufficient and make confident decisions that will improve her financial situation. Currently, only 10% of Australian women retire with enough savings to fund a comfortable lifestyle – so by arming women with strategies to help close the ‘super gap’ at each life stage, they may become less reliant on social services in retirement.

How you can take control

The financial decisions women make throughout their lives can impact their financial position in later years. With this in mind, here are some things you can do to take control at each stage of your life journey.

Starting out

Generally speaking, the gender pay gap puts women on the back foot as soon as they enter the workforce. Although there may be greater equality between the sexes than ever before, women’s average salaries are still 17.3% lower than those of men doing the same job.

This highlights how important it is for women to be able to budget if they want to build their savings and get ahead.

Raising a family

Women are still more likely than men to take time out of the workforce to raise kids, which means they receive less in employer super contributions during their careers. This leads to a significant super gap – men have an average super balance of $292,500 when they retire compared to $138,150 for women.

That’s why you need to prepare carefully for your career breaks, and top up your super either before or after to make up any shortfalls. The Government’s Parental Leave Calculator and Career Break Super Calculator make it easier to plan your finances around having a family. Visit https://www.moneysmart.gov.au/tools-and-resources to access these calculators.

Paying off debts

If you’re like most women, the largest debt you’ll ever have to pay off is your home loan. Before taking the plunge into homeownership, a Mortgage Calculator can show you how much you can afford to borrow, so you can work out a repayment plan that fits your budget. And if you’re prone to splurging on your credit card, a Credit Card Calculator could help stop your debts from spiralling out of control. Visit https://www.moneysmart.gov.au/tools-and-resources to access these calculators.

Investing for the future

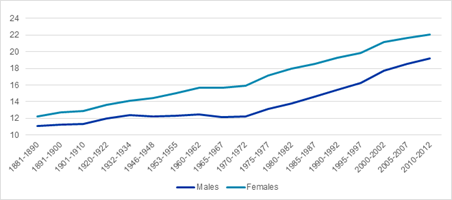

With lower confidence levels and a smaller appetite for risk in their investments, women are less likely than men to choose high-growth investments like shares. This also means they miss out on potentially higher returns. But as women generally retire earlier and live longer than men, they can expect to spend more time in retirement – which makes it even more important for them to have enough money to last the distance. As the first step, make sure your investment mix matches your life stage. That way your super and other investments will have the best chance of growing over time.

Your financial adviser can help

Because women face so many distinct challenges, they need customised solutions – which is where a licensed financial adviser comes in. If there’s ever an aspect of your finances that you’re unclear about, reach out to the Sherlock Wealth team to discuss your unique situation here. We can explain it in a way that makes sense to you, so you can make wiser financial decisions.

Source: AMP News & Insights.