With the tax regulator taking a more aggressive approach to tax debts and reviewing work from home deduction rules, tax issues could become a higher priority in 2022-23.

With the tax regulator taking a more aggressive approach to tax debts and reviewing work from home deduction rules, tax issues could become a higher priority in 2022-23.

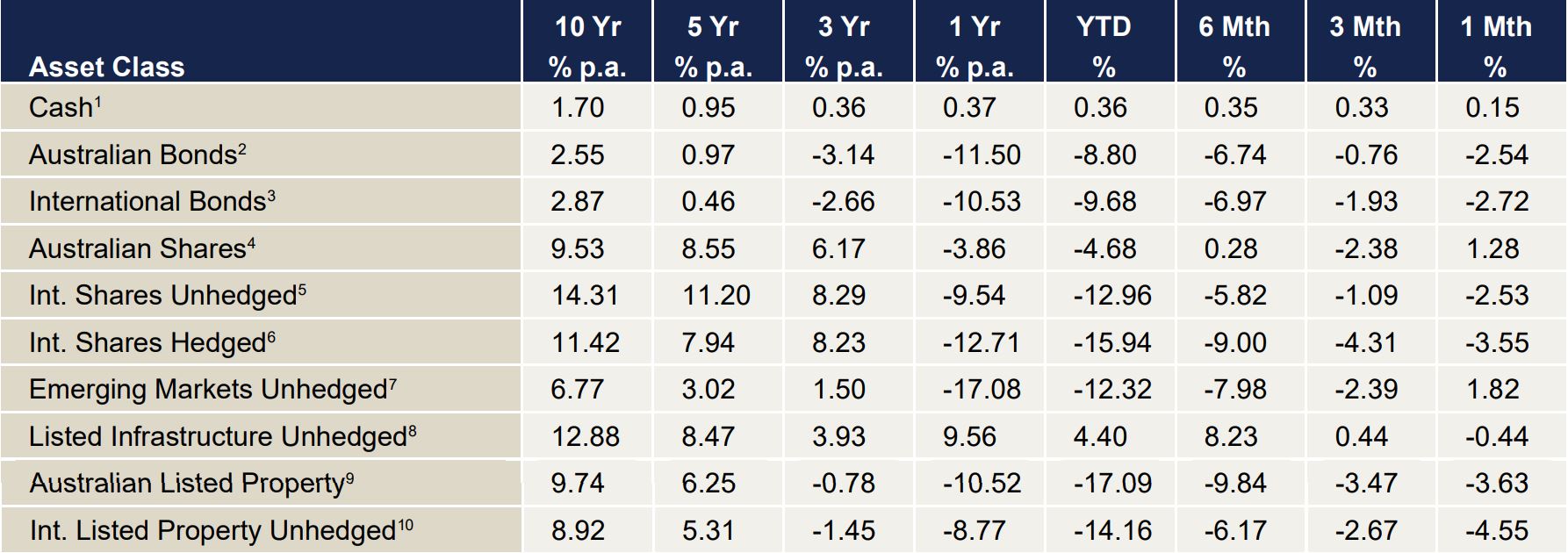

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direc

Global growth concerns rose during August with many forecasters revising their estimates for regional and global economic growth lower, this saw US, Europe and Japan all declining in local currency terms. Unhedged returned -2.72%, whilst hedged returned -3.55% across the month, which was in stark contrast from last month’s strong returns. The key drivers were the risks of rising interest rates, inflation surging in Europe, and lastly weaker consumer and business sentiment (as shown by the Markit PMI surveys).

Australian shares stood out in August posting a positive 1.28% gain for the month. Earnings season was broadly well received with most stocks reporting positive earnings and sales surprises versus consensus estimates. The local technology sector disappointed slightly with Computershare missing on its earnings estimates. While Australia isn’t immune to rising energy prices, broad inflation (including wage growth) has remained more contained than is the case in the US for example. The labour market continues to hold up well and despite weaker consumer confidence, retail spending has also held up with discretionary consumer businesses performing well in the August 2022 reporting season, particularly amongst “bricks and mortar” retailer businesses.

Negative returns within both Australian and International bonds occurred across the month (-2.54% and -2.72%, respectively). The bulk of the damage came following Federal Reserve Chairman Powell’s remarks on US monetary policy. His clear conviction was that the Fed’s task on inflation was still incomplete. This carried the implication of more rate rises being necessary. The pace of RBA hikes, however, is beginning to show meaningfully signs of weakening the economy. Credit growth is a leading indicator of house prices. The current trend suggests a meaningful correction is already underway and has more scope to continue. The negative impact on household wealth is likely to drag further on sentiment and ultimately spending.

The Australian Dollar (AUD) almost completed a round trip in August (AUD/USD). Starting the month of August at 0.7344 and ending August at 0.7316. Weakness in the Australian Dollar was caused by sharply falling commodity prices due to the slowdown of demand from China. The US dollar had a mixed run over the month of August. We saw a fall in the middle of the month due to stronger than expected payroll numbers and potential US interest rate cuts. This was then reversed following the speech at Jackson Hole by US Federal Reserve Chair Jerome Powell who reiterated that the Federal Reserve would continue to rase rates and fight inflation. This saw the US Dollar rise as it continues to be a haven asset for investors.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

(As at 31 July 2022)

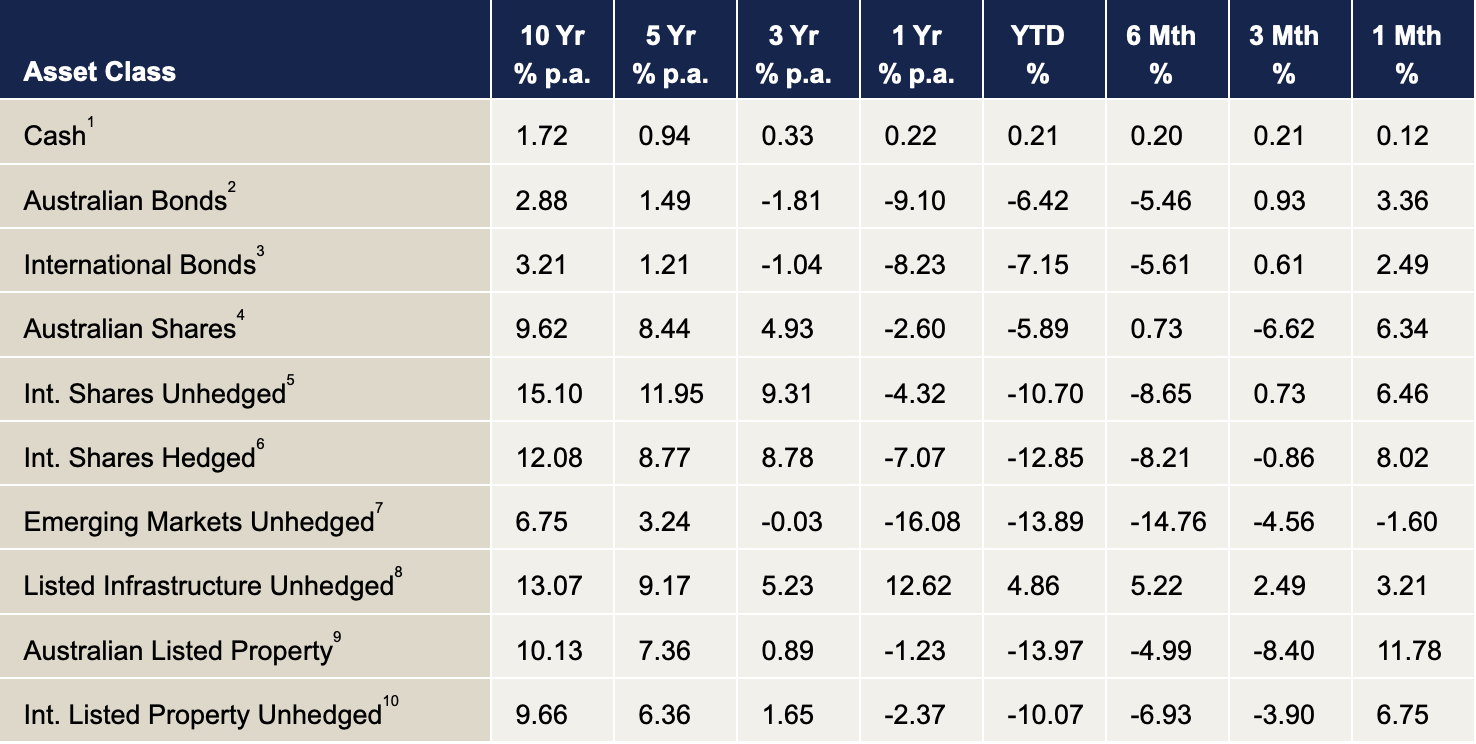

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

In stark contrast to the previous months, international equities posted strong returns during July 2022. Unhedged returned 6.46%, whilst hedged returned 8.02% across the month. Whilst central banks around the world are continuing to raise rates to combat inflation, markets are beginning to price in an easing of this policy as many economists are predicting a ‘peak in inflation’ towards the end of 2022. Time will tell as to whether this actually plays out. A reacceleration in inflation towards the later end of the year would be a shock to markets.

Australia joined in on the global equity rally and posted a 6.34% gain for the month. This was led by Technology, Real Estate and Healthcare, all sectors which are most sensitive to interest rates. As long-term interest rates fell over the month, a tailwind behind these sectors took place. As a gloomier economic environment evolved over the month, sectors such as industrials and materials were hurt as they rely on economic growth to perform well.

Positive returns within both Australian and International bonds occurred across the quarter with 3.36% and 2.49% gains, respectively. This is a significant change in trend to what has been occurring over the year. Significant drops in long term interest rates took place as a recessionary environment began to get priced into markets. These falls in interest rates are very positive for bonds overall and caused a significant rally globally.

The Australian Dollar (AUD) rallied 3.05% across the quarter as pullback occurred in the United States Dollar (USD). The US Dollar pullback occurred as the United States posted a 9.1% increase in inflation from this time in the previous year. The US has also entered a recession by posting two quarters of negative GDP growth. A gradual weakening in the USD has been the main cause of the AUD rise as opposed to Australian economic strength.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

Australia is on the brink of the nation’s biggest ever intergenerational wealth transfer. Yet estate or inheritance planning is rarely discussed by families. With baby boomers shifting into retirement, it’s important to start the conversation now about your legacy and the people it may impact.

We are seeing continued movement in interest rates after a lengthy period of historical lows, making this a good time to think about how your money is working for you.

New rules that came into force on July 1 will create opportunities for older Australians to boost their retirement savings and younger Australians to build a home deposit, all within the tax-efficient superannuation system.

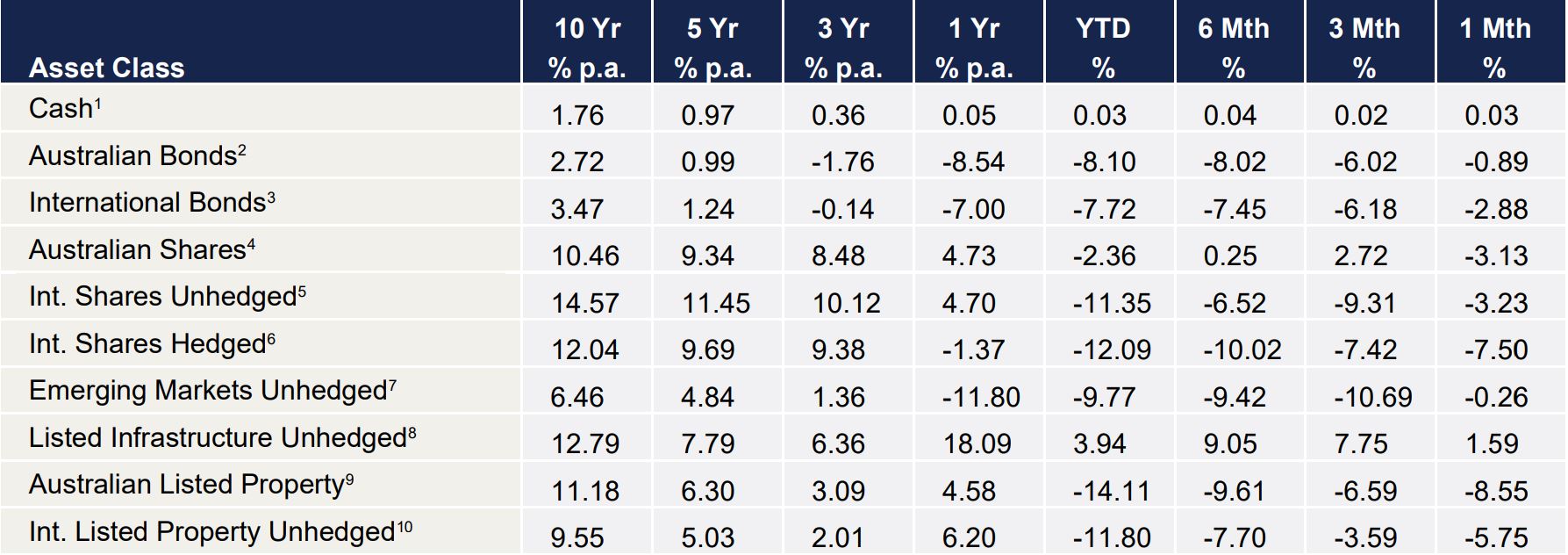

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

Throughout 2022 markets have continued to react negatively to both inflation and interest rates. This negative reaction occurred whilst economic growth was and still is moderately strong. However, interest rate increases are now seeping into economic fundamentals as fears of a recession begin to surface. Hedged international shares returned -8.15% and unhedged returned -4.67%. This was the first month of a changing market narrative towards lower economic growth going forward whilst rates are being raised at this pace to impede the rise in inflation.

Concerns on economic weakness resulted in Australian shares dropping 9.36% during the month, with ten out of eleven sectors finishing lower. The accelerating sell-off in the Materials sector was driven by market participants weighing up the potential for recessionary risks given the tightening interest rate cycle and continued inflationary pressures. Likewise, similar sentiment around potentially subdued economic growth drove a sell-off in the Financials sector. Overall, the downtrend in equities persisted as investors mulled various negative economic headwinds and continued hawkishness from central banks.

Australian Fixed Income markets have delivered another month of poor returns in June, as the Reserve Bank of Australia continues to tighten monetary policy, raising the cash rate by 50bps in both their June and July meetings to a total of 1.35% at present. Despite this, yields remained fairly stable at the short end of the curve with such increases having already been priced in.

Internationally the story remains similar, as central banks continue raising rates in an effort to contain inflation. This can be seen in the US Federal Reserve, which raised the federal funds rate by 75bps in its June meeting, the first hike of such a magnitude since 1994. However, fears of a recession have seen yields fall further out on the yield curve. Overall performance in global Fixed Income markets has been weak throughout June, as the rate increases at the short end of the curve have been more impactful. The Bloomberg Barclays Global Aggregate Index (AUD Hedged) Index returned -1.6% throughout the month.

The Australian Dollar fell a substantial 4.33% during the month of June. This points to a general slowdown in economic activity being priced into the currency. The Australian Dollar is viewed as a ‘risk-on’ currency, meaning it will usually perform well when global and domestic economic activity is strong. Strength in the United States Dollar as a safe haven from market volatility also put downward pressure on the Australian Dollar during the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

Heightened global market volatility – as we’re experiencing right now – can easily trigger kneejerk reactions by panicked investors.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

Whilst volatility moderated somewhat during the month of May, International Shares, both unhedged and hedged fell 3.23% and 7.5% on the month. Markets continue to price in the impacts of increasing interest rates and inflation. Inflationary pressures remain present globally as the German inflation rate came in above forecasts at 7.9% during the month. Energy remains the biggest outperformer within the international equities market across the month followed by utilities. Real estate, consumer discretionary and consumer staples were among the worst performers. Listed real estate has started to show weakness as rising rates put pressures on property. Markets are paying close attention to every word coming out of Central Banks as their guidance remains the single most impactful driver of markets. The Federal Reserve Bank followed through with their promise and rose the target policy rate by a significant 0.5% in May. They have outlined that two more increases of 0.5% are still to come in the subsequent months.

The domestic market also suffered a weak month (-3.13%) as technology and real estate dragged the index lower. Interest rates and inflation remain the key driver domestically just like in international shares. Weakness from China stemming from the lockdowns occurring across the region pulled down the price of iron ore, hurting the major materials miners within Australia. Australia remains one of the worlds best performing stock markets year-to-date (YTD) as resilience within financials, utilities and resources helped steady the market. An above forecast 0.8% growth in GDP for the first quarter of the year reassured Australians of economic weakness. This, however, is of course a backward-looking metric.

Australian bonds (-0.89%) were finally not the worst performer relative to international bonds (-2.88%) on the month. They are however, still down 8.1% compared to 7.72% for international bonds YTD. Hotter than expected inflation numbers in Europe significantly increased bond yields in the region, feeding into the international bond index. Australia’s bond yields rose moderately on the month but have stabilised somewhat with a lot of the increases in interest rates already priced into the market.

The Australian Dollar (AUD) rose 0.94% in May due to a general weakening in the United States Dollar (USD) that saw most currencies valued in USD rise on the month. The USD weakened on the back of falling yields spurred by perceived dovish central bank rhetoric coming out of the Federal Reserve. This talk has been wound back by Fed Chair Jerome Powell since then.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.