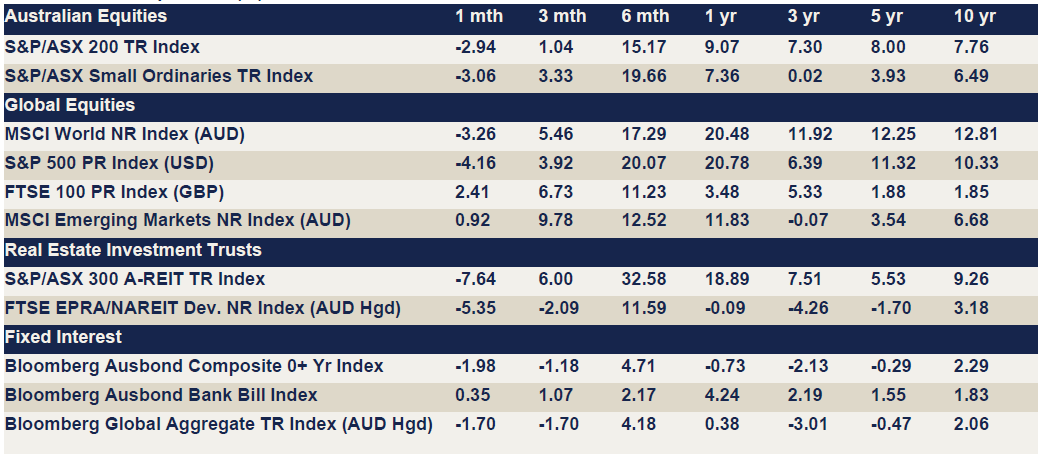

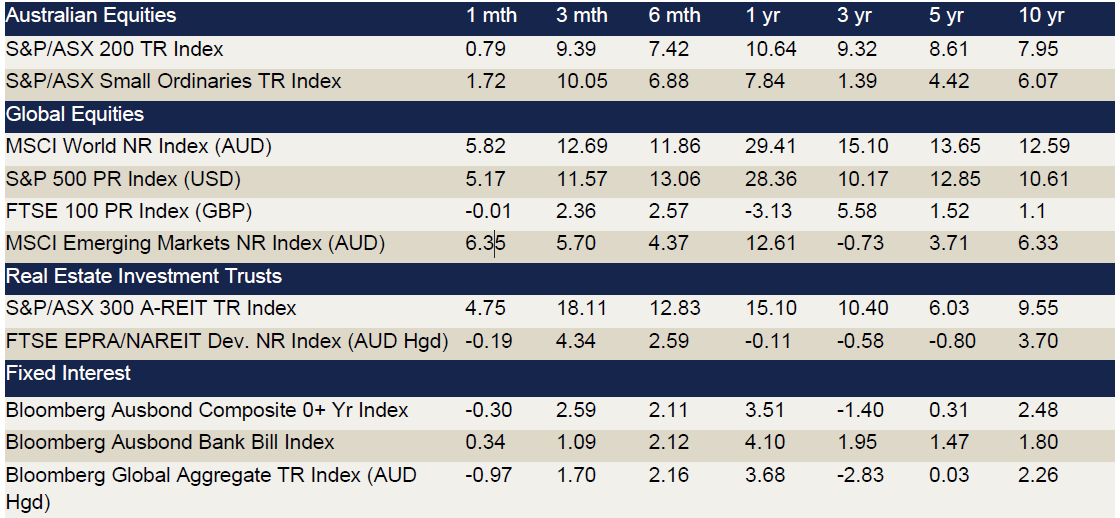

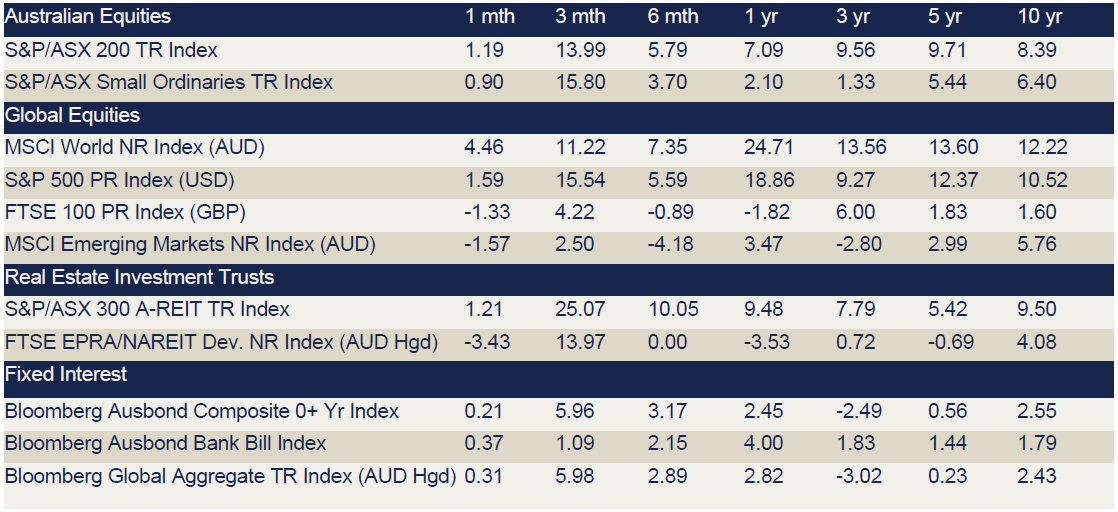

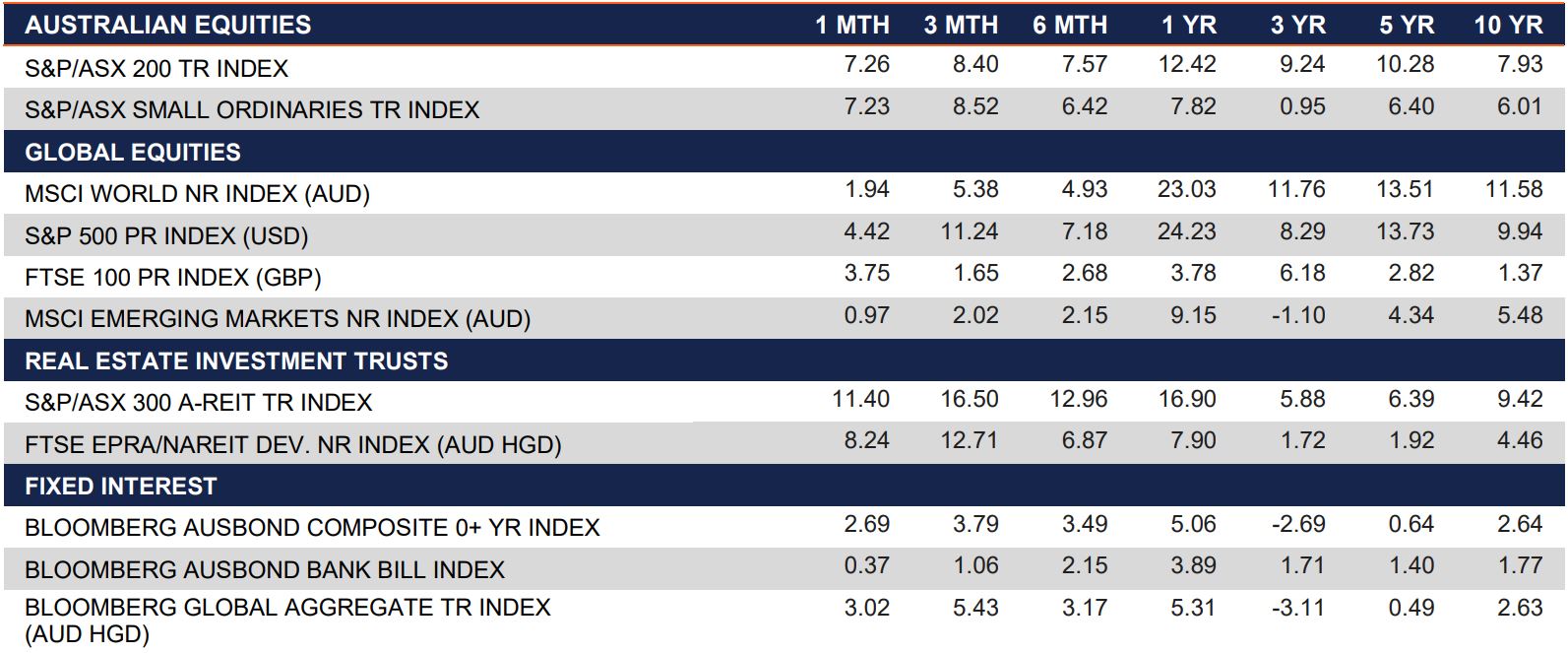

Month in Review as at June 2024

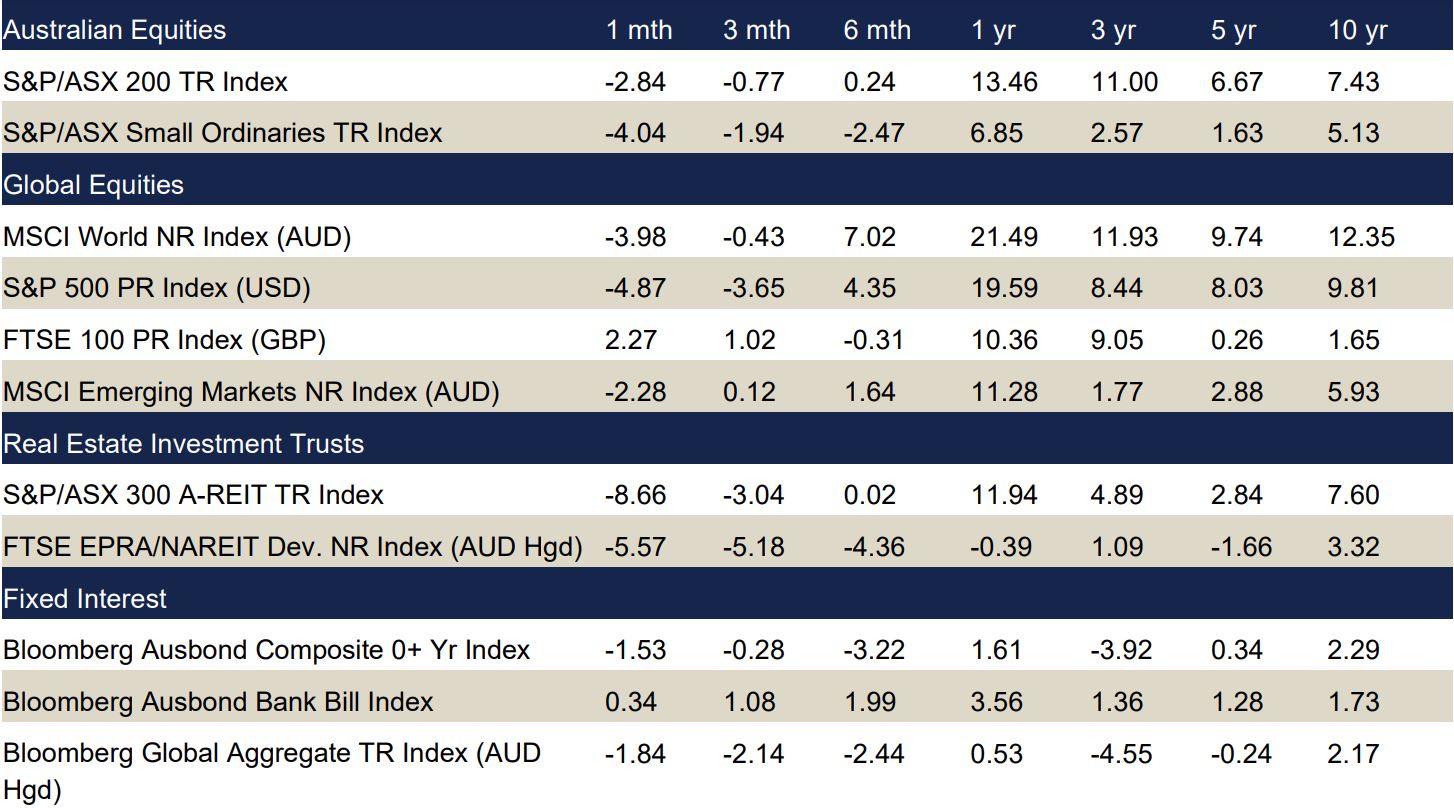

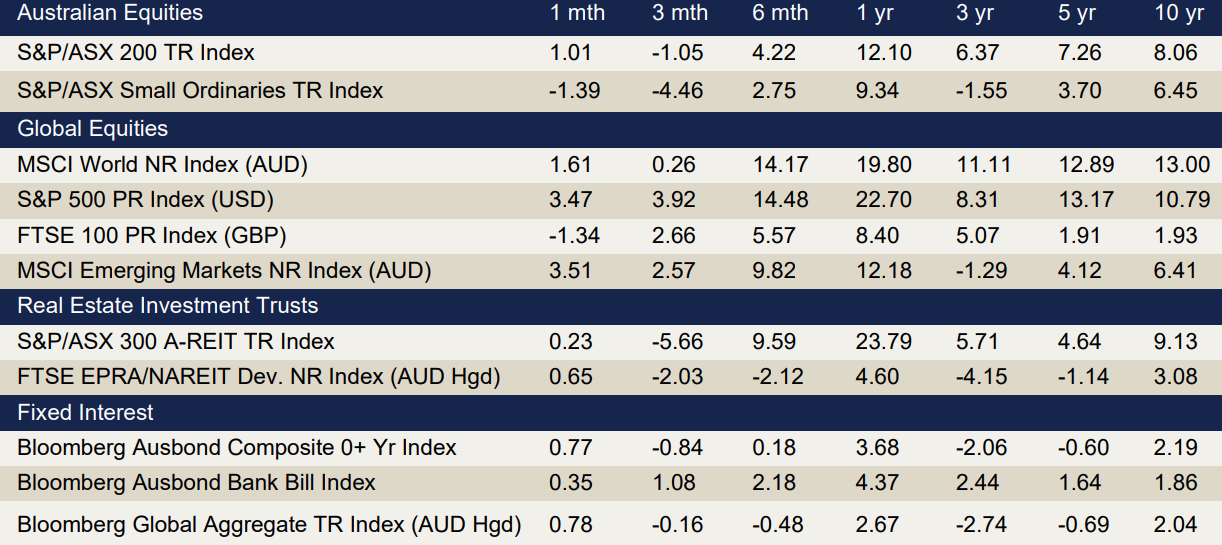

VIEW PDFIndex returns at June 2024 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Market Points

- The Australian market continued to make gains, rising 1.0% during June with mixed returns across underlying sectors.

- The US and Japanese markets were the strongest overseas markets, finishing the month up 3.1% and 2.0% respectively (S&P 500 Index (USD) and Nikkei 225 Index (JPY)).

Australian equities

June saw the ASX 200 Accumulation Index rise by 1.0%. Following May’s mixed results, June was another month of a wide range of returns at the sector level. Financials ex-Property recorded the strongest returns (+5.1%), followed by Consumer Staples (+4.6%), Utilities (+4.6%) and Health Care (+4.4%). Laggards for the month were Materials (-6.5%), Energy (-1.6%) and Industrials (- 0.2%).

Three of the ‘Big Four’ banks led the way for Financials, as NAB, CBA and Westpac all posting gains. Macquarie Group shares also drove positive returns for the sector.

The decline in Materials stocks could be attributed to several factors. The Chinese economy continues to show signs of uncertainty as a disinflationary spiral lingers. The softening of commodity prices, especially iron ore, also weighed into the sell-off. Shares in Mineral Resources (ASX: MIN), one of the largest iron ore miners in the Index, fell approximately 25% over the month after the announcement that it was closing its Yilgarn Hub operation.

As the 2023/24 Australian Financial Year wrapped up, the ASX 200 posted total returns of 12.1%. After a strong finish to the year, Financials ex-Property was the leading sector gaining 29.2%. Three other sectors posted returns greater than 20%: Information Technology (+28.4%), Property (+24.7%) and Consumer Discretionary (+22.7%).

Global Equities

Both Emerging and Developed markets rallied in June, to a positive finish for the first half of 2024. Emerging markets outperformed developed markets in June returning 3.51% (MSCI Emerging Markets Index (AUD)) versus a 2.34% return (MSCI World Ex-Australia Index (AUD)).

Large Cap stocks drove growth in June, with the Nasdaq Composite gaining 18.6% for 1H 2024 and 6% for June (in local currency terms). While the S&P500 rose 15.3% and 3.6% (in local currency terms) over the same periods. Softening economic data and the lowering of projected rate cuts by the Federal Reserve by year end a driving force behind the bullish movements. The US Tech sector continued to charge with a 9.3% increase in June (in local currency terms).

European Equity markets were mostly lower, with the DAX 30 Index (EUR) dropping 2.37% while the FTSE EuroTop 100 Index (EUR) lost 0.25% in June as Central Banks began cutting rates and the French Election created market uncertainty.

Taiwanese markets were the best performing in the Asia-Pacific region for the first half of 2024 with the Taiex gaining 28.45% (in local currency terms). Largely boosted by Taiwan Semiconductors (TPE:2330) which gained 63% over the same period, as excitement around AI continues to drive sentiment. Japan also continued to gain with the Nikkei 225 Index up 2.01% in June (in local currency terms) after hitting all-time highs earlier in the year.

Property

The S&P/ASX 200 A-REIT Accumulation index progressed in June, finishing the month 0.39% higher. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also advanced, up 0.83% for the month.

Australian infrastructure continued to perform strongly during June, with the S&P/ASX Infrastructure Index TR returning 2.35% for the month and up 5.27% YTD.

Fixed Income

Following a surge in bond markets during the first half of June, a quick sell-off in the latter half of the month swiftly reversed any gains. Month-end to month-end, Australian 2-Year Bond yields rose 4 basis points whilst Australian 10-Year Bond yields fell 10 basis points. The Australian bond market, measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.77% over the course of June. At its June meeting, the RBA board voted to leave the cash rate target unchanged at 4.35%, with the market pricing in a low in the cash rate in 2026. Inflation remains sticky with the Australian Bureau of Statistics releasing higher than expected inflation figures – 4% for the year to May. Electricity and food prices were amongst the sectors with the highest price increases.

The global backdrop in June was a large driver of Australian bond market performances. The European Central Bank was one of the first to lower interest rates – lowering by 25 basis points, French elections were called, and U.S presidential campaigns were well underway, including the presidential campaign debate this month. Additionally, geopolitical uncertainties remain elevated – such as the heightened conflicts and tensions in the Middle East and Ukraine – and continue to have the potential to affect supply chains. Against this backdrop, U.S. 2-Year and 10-Year Treasury Note yields fell 11 and 10 basis points respectively.

Key Economic Points

- The RBA left the cash rate at 4.35% in its May meeting.

- Australian annual inflation came in above expectations at 4.0% in May.

- The ECB cut interest rates by 0.25 to 4.25%.

Australia

As expected, the RBA left the interest rate unchanged at 4.35% in its June meeting, but retained the option for further increases if inflation remains stubbornly above the 2-3% target rate.

The annual inflation rate rose to 4% in May, above the expected 3.8%, with the financial markets pricing in a 45% chance of rate hike by September this year, compared to 10% before the data release. Minutes from the RBA meeting earlier this month indicated increasing concerns that inflation may not be on track to return to the bank’s 2-3% target range by the end of 2025.

Retail sales rose 0.6%, exceeding the forecast of 0.2% as consumers took advantage of early end of financial year sales. Annual retail sales were up 1.7% in May compared to a year ago, a better-than-expected result, but still indicative of falling demand volume once price inflation is stripped out.

The unemployment rate dropped to 4.0%% in April, above the anticipated 3.9%. The Westpac-Melbourne Institute Consumer Sentiment Index rose marginally to 83.6 points for June, but remains far below the neutral level of 100, which was last seen in early 2022.

Composite PMI slowed to 50.6 in June, still in expansion territory but at the lower rate than previous months. The NAB business confidence index fell to -3 in May, suggesting that the subdued activity in Q1 has continued into Q2 as sentiment worsened in manufacturing, transport, and construction.

The trade surplus narrowed to $5.77 billion in May, well below the market forecast of $6.68 billion.

US

The Federal Reserve kept the target range for the federal funds rate unchanged at 5.25%-5.50% during its June meeting, with policymakers unlikely to reduce rates until there is greater confidence that inflation is moving sustainably towards 2%. Annual inflation unexpectedly eased to 3.3% in May, below the forecast 3.4% as inflation eased for food, shelter, and transportation.

June non-farm payrolls rose 206,000, ahead of the 190,000 market forecast. However, focus was on the overall 111,000 downward revisions to the previous two months’ figures. Unemployment rate rose to 4.1% from 4.0%, as expected amid a slight rise in the participation rate. New US jobless claims increased marginally to 238,000, while the continuing claims of those still unemployed hit a two and a half year high of 1.86 million people. These figures are considered to indicate a gradual cooling of the labour market, a positive sign which might support the Federal Reserve to proceed with interest rate cuts by year end.

Retail sales for the month of May rose 0.1%, below the expected increase of 0.3%, but ahead of the revised 0.2% decline for the prior month. Annual retail sales grew 2.3% for the year to May, above the market forecast of 2.1%, below the expected 2.1% increase. Consumer sentiment dropped to 68.2 in June, above the expected 65.8 as inflation expectations are moderating.

Composite PMI rose to 54.6 in June, with services showing significant improvement with a PMI of 55.1. Business confidence for the upcoming year, particularly in services, and increasing demand leading to higher operating capacity prompted companies to expand their workforce for the first time in three months.

The trade deficit widened to US$75.1 billion in May, below forecasts of a US$76.2 billion gap.

Euro area

The European Central Bank cut interest rates by 0.25% to 4.25% in its June meeting, in response to inflation declining by more than 2.5 percentage points since September 2023. The inflation rate in the Euro area eased to 2.5% in June, matching market expectations. The unemployment rate was flat at 6.4% in May, matching market forecasts.

Retail sales increased 0.1% in May, below the anticipated 0.2%, while annual sales rose 0.3%, better than the expected 0.1%. Consumer confidence rose to 14.0 in June, largely driven by slowing inflation.

The Composite PMI fell to 50.8 in June, significantly below expectations, with services growth offset by a deep contraction in manufacturing output.

UK

The Bank of England left interest rates unchanged at 5.25%, in line with market expectations. Two out of the nine policy makers voted in favour to a cut to 5.0%, with a decision to cut more ‘finely balanced’. Inflation rate for May year-on-year came in line with market expectations at 2.0%, better than the 2.3% reading reported in the prior month and hitting the Bank of England target rate.

Consumer confidence rose to -1 in June, improving for the third month in a row, but the headline score remains negative high borrowing and living costs batter household budgets. Retail sales for the month of May rose to 2.9%, ahead of the 1.5% expected and rebounding from the 1.8% contraction in the prior month. while annual sales rose 1.3%, above the anticipated 0.9% increase.

Composite PMI fell to 52.3 in June, as activity in both services and manufacturing slowed for the second month in a row.

China

Inflation in China dropped 0.1% in May, with the annual rate coming in at 0.3%, slightly below market expectations of 0.4%. China’s unemployment rate was flat at 5.0% in May, matching forecasts. Composite PMI came in at 52.8 in June with output growth accelerating in the manufacturing sector but easing for services.

Annual retail sales improved 3.7% in May, ahead of the expected reading of 3.0% and prior month rise of 2.3%.

Japan

The inflation rate rose to 2.8% in May, overshooting market forecast of 2.5%, whilst the core inflation rate also rose to 2.5%, below the 2.6% expected. Retail sales increased 1.7% in May, well above the forecast of -0.5%, with annual sales growing 3.0%, also well above the 2.0% forecast.

Consumer confidence increased marginally to 36.4 in June, just below market expectations of 36.5.

Composite PMI dropped to 49.7 in June as the rise in manufacturing output was outweighed by a fall in services activity.

Currencies

The Australian dollar (AUD) appreciated over the month of June, closing 0.3% higher in trade weighted terms to 63.3, appreciating against all four referenced currencies in this update.

The AUD/USD exchange rate experienced its least volatile month since December 2002. This marks its third monthly increase in the past four months and its highest monthly close since December of the previous year. The strength of the US Dollar (USD) offset the impact of a hawkish RBA statement and higher-than- expected Australian inflation on the AUD/USD. The Japanese Yen (JPY) was the most notable mover, dropping to its lowest level against the Aussie dollar since 2007 and its lowest level against the USD since the mid-1980s.

Relative to the AUD, the USD depreciated the least during the month, closing 0.2% lower. The laggard of the month was the JPY, depreciating in relative terms against the AUD by 2.7%. Year-on-year, the AUD is ahead of the USD, Pound Sterling (GBP), Euro (EUR) and JPY by 0.8%, 0.8%, 2.7% and 12.5%, respectively.

Important notice

This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No.421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure at the date of publication: Lonsec receives a fee from the fund manager or product issuer(s) for researching the financial product(s) set out in this document, using comprehensive and objective criteria. Lonsec may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec services. Lonsec’s fee is not linked to the rating(s) outcome.

Lonsec does not hold the product(s) referred to in this document. Lonsec’s representatives and/or their associates may hold the product(s) referred to in this document, but details of these holdings are not known to the Analyst(s).

Disclosure of Investment Consulting services: Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other financial advice and may receive fees from this fund manager or product issuer for providing investment consulting services. The investment consulting services are carried out under separate arrangements and processes to the research process adopted for the review of this financial product.

For an explanation of the process by which Lonsec manages conflicts of interest please refer to the Conflicts of Interest Policy which is found at: http://www.lonsec.com.au/aspx/IndexedDocs/general/LonsecR esearchConflictsofInterestPolicy.pdf

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Lonsec’s research process relies upon the participation of the fund manager or product issuer(s). Should the fund manager or product issuer(s) no longer be an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).