Introduction

VIEW PDFOn the evening of 9 May 2023, the Government delivered its second Budget in the current parliamentary term.

Inflationary pressures, interest rates and escalating costs of living have all had a significant impact on the lives of every-day Australians. The Budget needs to deliver the right balance of spending and savings.

This year’s Budget has a strong emphasis on providing cost of living relief, strengthening Medicare, and investing in a stronger and more secure economy. There were very few surprises and most of the significant announcements had been made prior to the Budget being released.

Importantly, it goes without saying the measures announced in the Budget are not a fait accompli. They will be subject to the successful passage of relevant legislation.

Highlights

2022-23

SURPLUS

$4.2bn

ENERGY BILL

RELIEF

$3bn

STRENGTHENING

MEDICARE

$5.7bn

FALLING

INFLATION

3¼% by 2023-24

The state of the economy

Perhaps the surprise in this year’s Budget was the announcement of a surplus for the 2022-23 financial year of $4.2 billion. This is the first surplus since 2007-08 and represents significant turnaround from the projected $36.9 billion deficit forecast in the October 2022 Budget.

Real GDP growth is expected to be 1½% for 2023-24 before rising to 2¼% in 2024-25.

The unemployment rate in recent years has placed Australia in an enviable position. The currently historically low unemployment rate is expected to increase marginally in 2023-24 and 2024-25.

Much of the focus of the past year or so has been the rapid rise in the inflation rate. The Government predicts the inflation rate has now peaked and is starting to moderate. The inflation rate for 2023-24 is forecast to be 3¼% and will return to the Reserve Bank’s target band of 2-3% by 2024-25.

The big-ticket items in this year’s Budget include:

- Cost-of-living relief,

- Increased Parenting Payment (Single), JobSeeker, and Youth Allowance,

- Further investment in renewable energy

Now for a more detailed look at some of the key announcements.

Superannuation

The Budget was decidedly quiet on the superannuation front this year. The only measures of any significance were:

Better targeted super concessions

This simply repeats the release made on 28 February 2023 when the Government announced plans to proportionately increase the tax on a person’s total superannuation balance that exceeds $3 million by an additional 15%. The Budget announcement does not depart from the initial proposal despite the measure having been open for public consultation between 31 March and 17 April 2023.

This measure will not apply until 1 July 2025 and is only expected to affect 80,000 individuals, at least in the early stages. Yet, this is expected to increase as the $3 million threshold is not indexed.

This measure will also extend to members of defined benefit superannuation schemes.

Securing Australians Superannuation Package.

Employers are currently required to pay superannuation guarantee contributions for their employees by the 28th day of the month following the end of each quarter. The Budget proposes that from 1 July 2026, employers will be required to pay their employees superannuation guarantee contributions on the same day they pay their employees. This initiative will help to counter the underpayment or non-payment of superannuation guarantee contributions, which remains a significant problem.

Self manged super funds – amendments to non-arm’s length (NALI) income provisions

The provisions announced by the previous Government covering the NALI provisions as they apply to expenditure incurred by superannuation funds will be amended to provide more certainty.

In particular, the income subject NALI provisions will be limited to twice the level of a general expense. In addition, fund income subject to NALI will exclude contributions.

Perhaps what was more notable from the Budget was what wasn’t mentioned.

Pension drawdowns

For the past couple of financial years, the minimum prescribed income to be drawn from a pension account has been discounted by 50%. Discounting was due to end on 30 June 2023.

The Budget did not include any reference to the current 50% discount being extended beyond 30 June 2023.

Legacy pension amnesty

In its 2021 Budget, the previous Government announced their intention to allow a two-year window (from 1 July 2022) to allow people with old-style defined benefit income stream products (e.g. lifetime, life expectancy, and market linked pensions) to exit those products without incurring tax or social security penalties. Unfortunately, legislation to implement this opportunity was not passed before the last Federal Election was called.

While it has been hinted the current government will revisit this proposal, the Budget was silent on this.

Transfer balance cap indexation

The general transfer balance cap is scheduled to increase to $1.9 million from 1 July 2023.

While the method of indexation is enshrined in current law, there had been some concern the Government might move to pause or limit indexation.

Again, the Budget was silent on any changes to the indexation of the general transfer balance cap, so we expect the cap to increase to $1.9 million from 1 July 2023.

Income Tax

Like superannuation, the Budget was very quiet on income tax, with a couple of minor exceptions.

Stage 3 rates and thresholds from 2024-25 onwards

The Budget did not announce any changes to the Stage 3 personal income tax cuts that are set to commence from 1 July 2024.

Under the Stage 3 tax changes from 1 July 2024, as previously legislated, the 32.5% marginal tax rate will be cut to 30% for one big tax bracket between $45,000 and $200,000. This will more closely align the middle tax bracket of the personal income tax system with corporate tax rates. The 37% tax bracket will be entirely abolished at this time.

Therefore, from 1 July 2024, there will only be 3 personal income tax rates – 19%, 30% and 45%. From 1 July 2024, taxpayers earning between $45,000 and $200,000 will face a marginal tax rate of 30%.

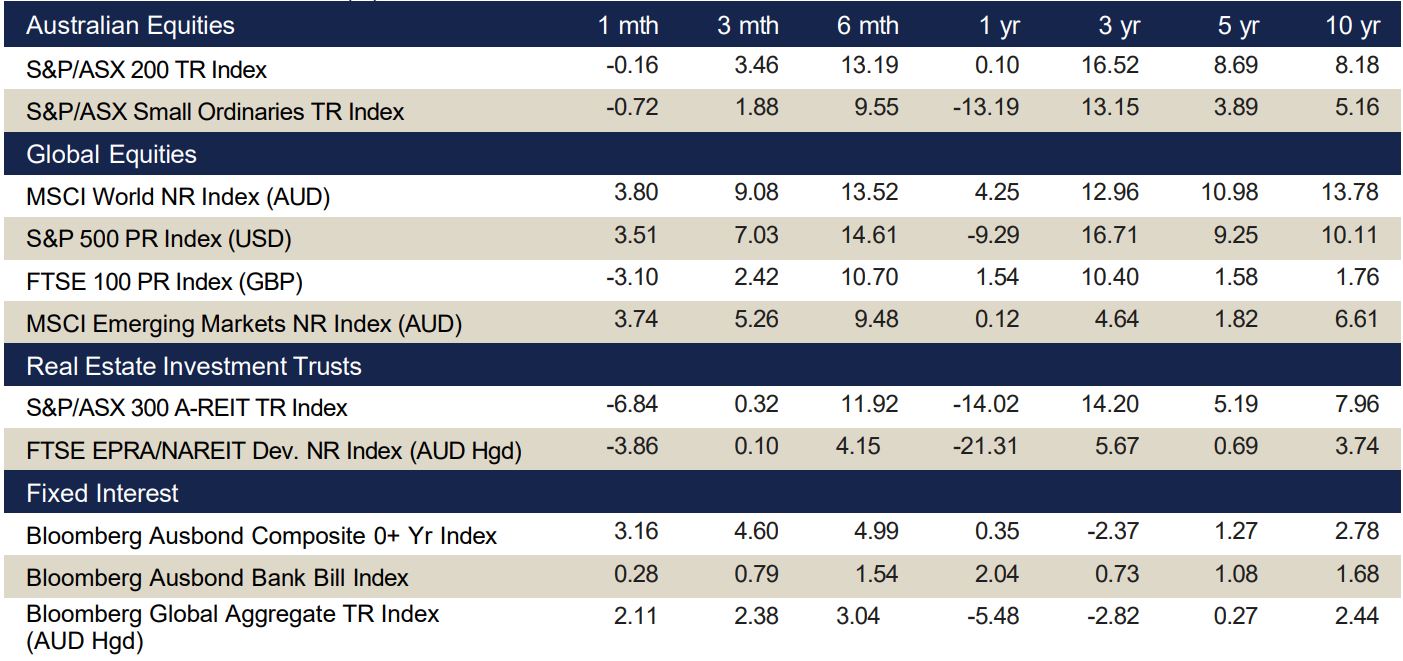

Tax rates and income thresholds – from 2024-25 onwards:

Exempting lump sums in arrears from the Medicare Levy

This initiative, due to apply from 1 July 2024, will ensure that low-income earners don’t pay a higher Medicare Levy because of receiving an eligible lump sum payment, such as compensation for underpaid wages.

While this is worthwhile for those affected, it is expected to have minimal impact as the cost to the Budget is only $2m over the next five years.

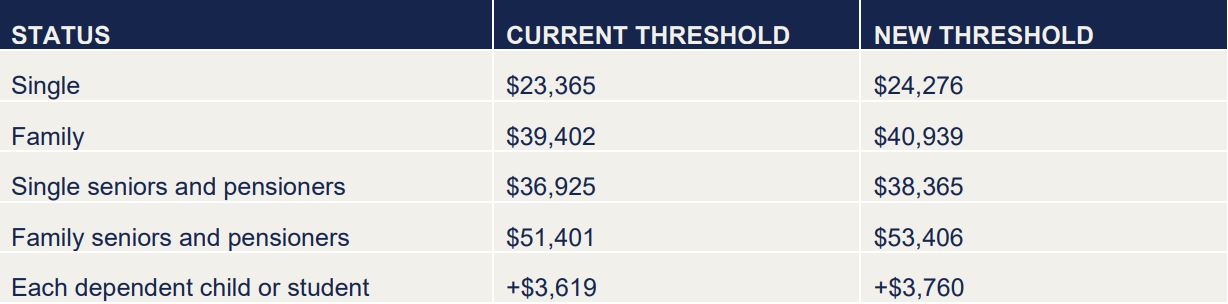

Medicare levy low-income threshold

As occurs most years, the income thresholds applying to the Medicare Levy are to increase from 1 July 2022.

The proposed thresholds are:

Small Business

Small Business

To provide continued support to small businesses (those with an aggregate turnover of less than $10 million) the Government has announced a temporary increase in the instant asset write-off threshold to $20,000. This will apply from 1 July 2023 and will continue until 30 June 2024.

Importantly, the instant asset write-off applies per asset so small business may be able to access this opportunity on multiple occasions.

Aged Care

The Government has committed to spending a total of $36 billion on the aged care sector in the 2023-24 year with a focus on increased wages for aged care workers, funding to help improve the quality of care for both home care recipients and those in residential care facilities and additional funding to implement recommendations identified in the Royal Commission into Aged Care.

Wages to increase by 15%

From 30 June 2023, it is proposed that a 15% increase to award wages will be available for many aged care workers including registered nurses, enrolled nurses, assistants in nursing, personal care workers, home care workers, recreational activity officers, and some head chefs and cooks.

Implementation of Royal Commission initiatives

Over the next 5 years, the Government will provide funding exceeding $300 million to implement recommendations from the Royal Commission into Aged Care Quality and Safety including:

- Enhancements to the Star Rating system to improve accountability and transparency of aged care providers,

- The development and implementation of a new, stronger Aged Care Regulatory Framework to support the new Age Care Act which is due to commence from 1 July 2024,

- Establishment of a national worker screening and registration scheme and the development, monitoring and enforcement of food and nutritional standards.

Improvements to care at home

Funding has been committed to improve in-home aged care by implementing a range of initiatives including the release of an additional 9,500 Home Care Packages and the design, build and implementation of the new Support at Home Program which is proposed to commence from 1 July 2025.

Welfare

Delivering cost-of-living relief was a key focus for the Government in this year’s budget including reduced energy bills, reduced health costs and increases to Rent Assistance for 1.1 million households.

Energy bill relief

Two initiatives have been announced to help reduce energy bills for eligible Australian households.

Firstly, the Commonwealth Government in conjunction with state and territory governments will provide targeted electricity bill relief of up to $500 for eligible households. The amount that will be available will depend on which state or territory you live in.

To be eligible for the bill relief, you will be the primary electricity account holder and you must also hold an eligible concession card or receive an eligible government payment in your specific state or territory.

The second initiative announced was the establishment of the Household Energy Upgrades Fund to support home upgrades that improve energy performance and save energy, therefore providing further reductions to energy bills.

Reducing out-of-pocket health costs

From 1 July 2023, a range of measures have been announced to help reduce out-of-pocket health costs including:

- Tripling incentives for doctors to provide bulk billing,

- Investing in more bulk billing Urgent Care Clinics,

- Improving access to medicines, vaccinations and related services delivered by pharmacies.

The Government also proposes to allow 2 months’ worth of certain PBS medicines to be dispensed by pharmacies from 1 September 2023.

Additional support to help combat rental affordability

With rental prices in most Australian locations increasing rapidly over the past decade, rental affordability for many, including those on Government income support and family benefits, is a major problem.

To assist, the maximum rates of the Commonwealth Rent Assistance will increase by 15%. It is projected that this will support over 1 million households including veterans, pensioners, job seekers, students and those receiving family tax benefits.

Social Security

Some positive news for those receiving working age payments from Centrelink with an increase to the base rate of payment confirmed. Single parents will also be supported when eligibility rules are expanded for Parenting Payment (Single).

Payments to increase by $40 per fortnight

The Government has announced that the base rate for a range of working age payments will increase by $40 per fortnight from 20 September 2023.

Payments that will benefit from the increase include:

- JobSeeker Payment

- Youth Allowance

- Parenting Payment (Partnered)

- Austudy

- ABSTUDY

- Disability Support Pension (Youth), and

- Special Benefit.

Older Job Seekers

To recognise the barriers that older job seekers often face when looking for work such as age discrimination, the Government is expanding eligibility for the existing higher rate of JobSeeker to recipients 55 and over who have received the payment for 9 or more continuous months. This higher rate (which is $92.10 per fortnight more than the standard JobSeeker rate) is currently available to those 60 and over.

It is estimated that this change in age will help around 52,000 eligible recipients.

Eligibility to Parenting Payment for single parents expanded

From September 2023, eligible single parents, 91% of whom are women, will receive Parenting Payment (Single) until their youngest child turns 14. Currently, these parents are required to move to JobSeeker when the youngest child turns 8.

The current base rate of Parenting Payment (Single) is $922.10 per fortnight, compared to the JobSeeker Payment base rate of $745.20 per fortnight. It is hoped that the improved support for single parents will provide wellbeing benefits particularly for single mothers, who are overwhelmingly the recipients of this payment, and their children.