Monthly Market Review – October 2022

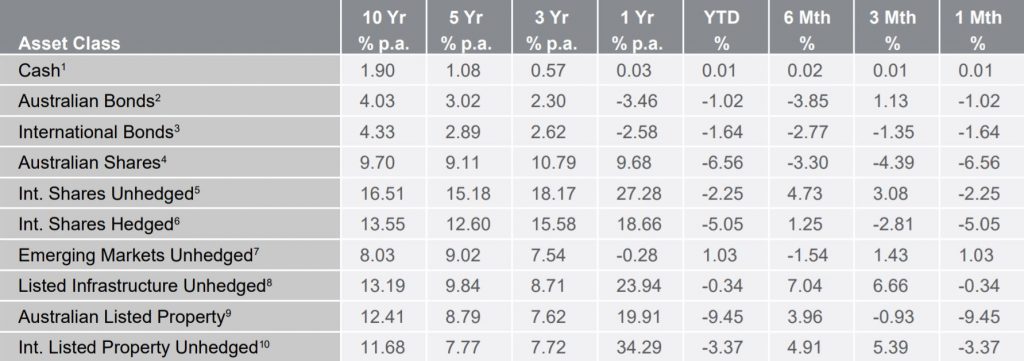

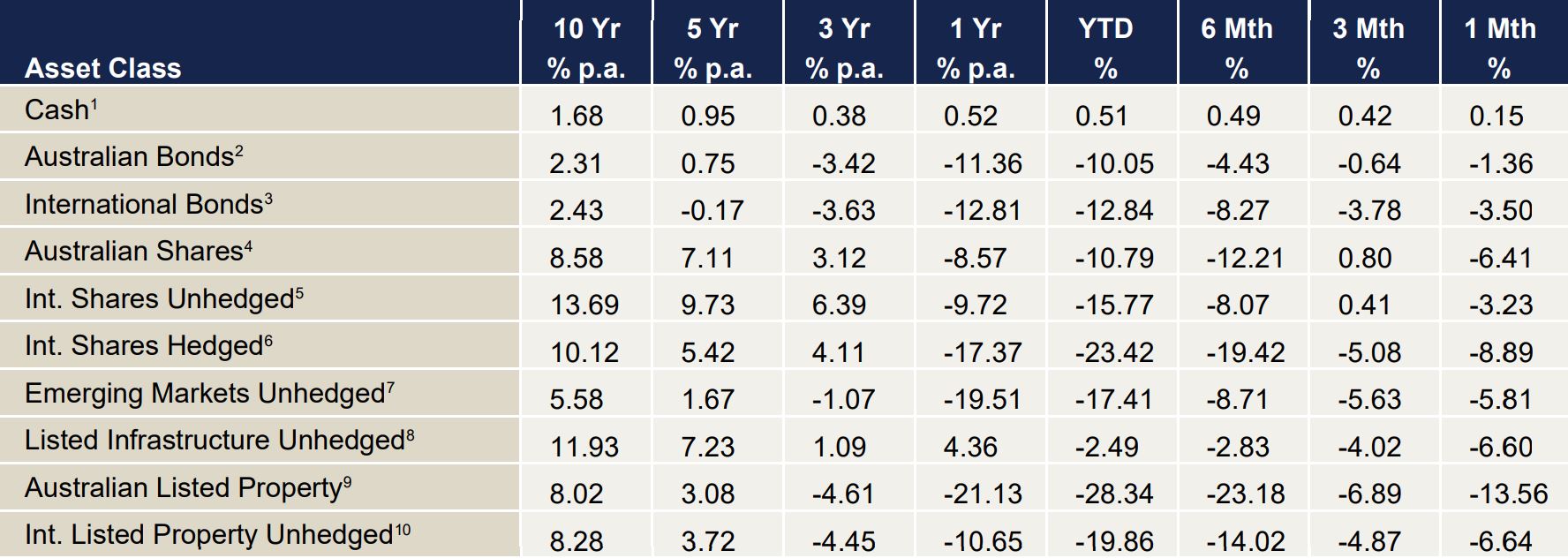

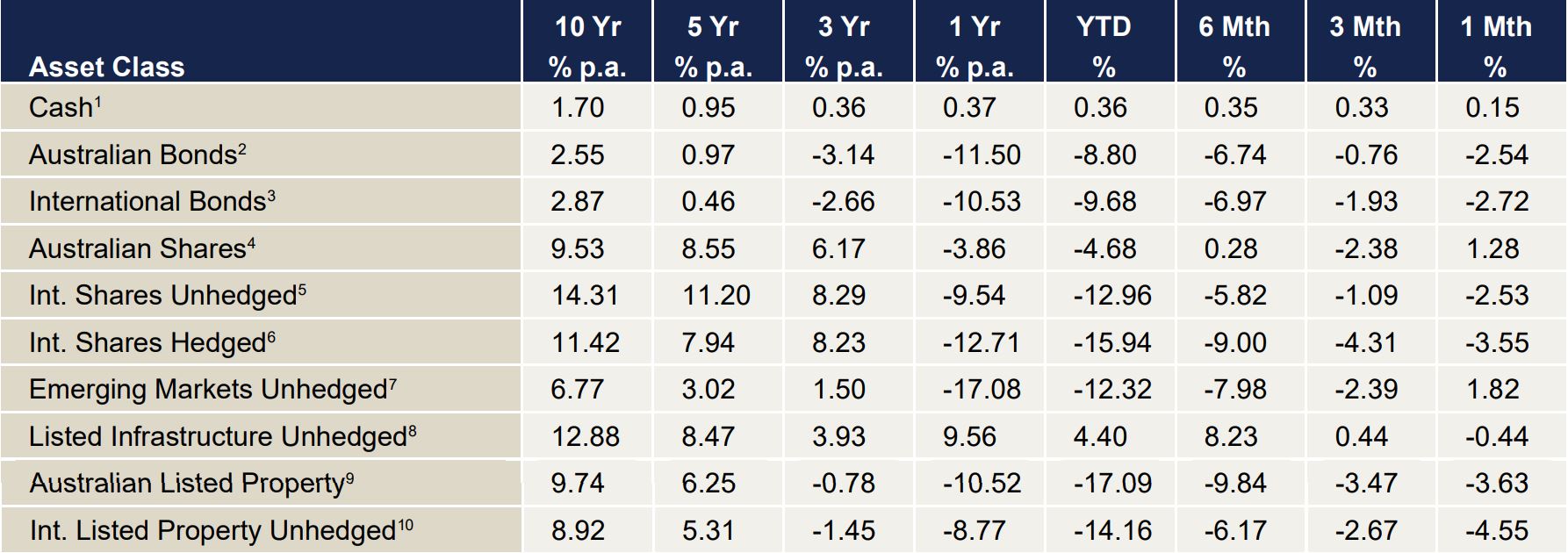

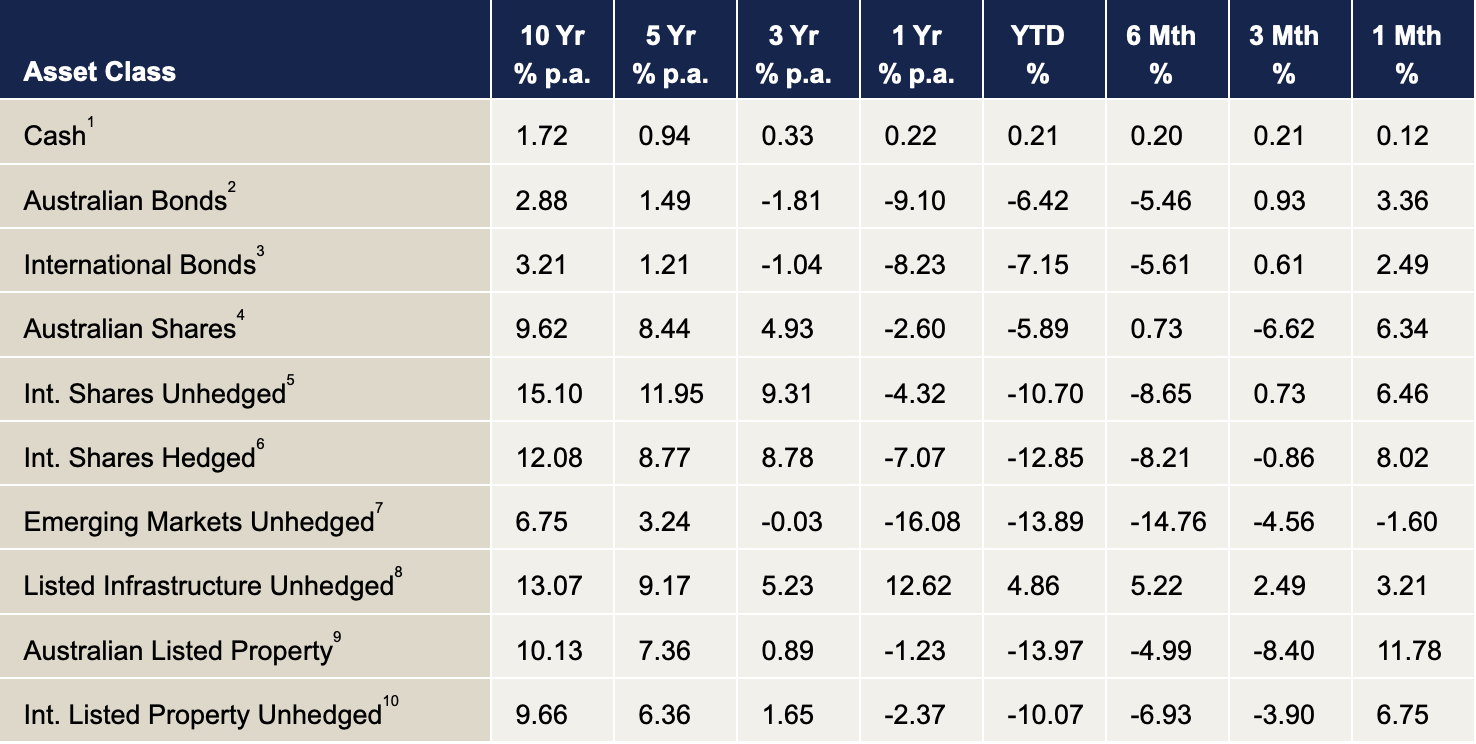

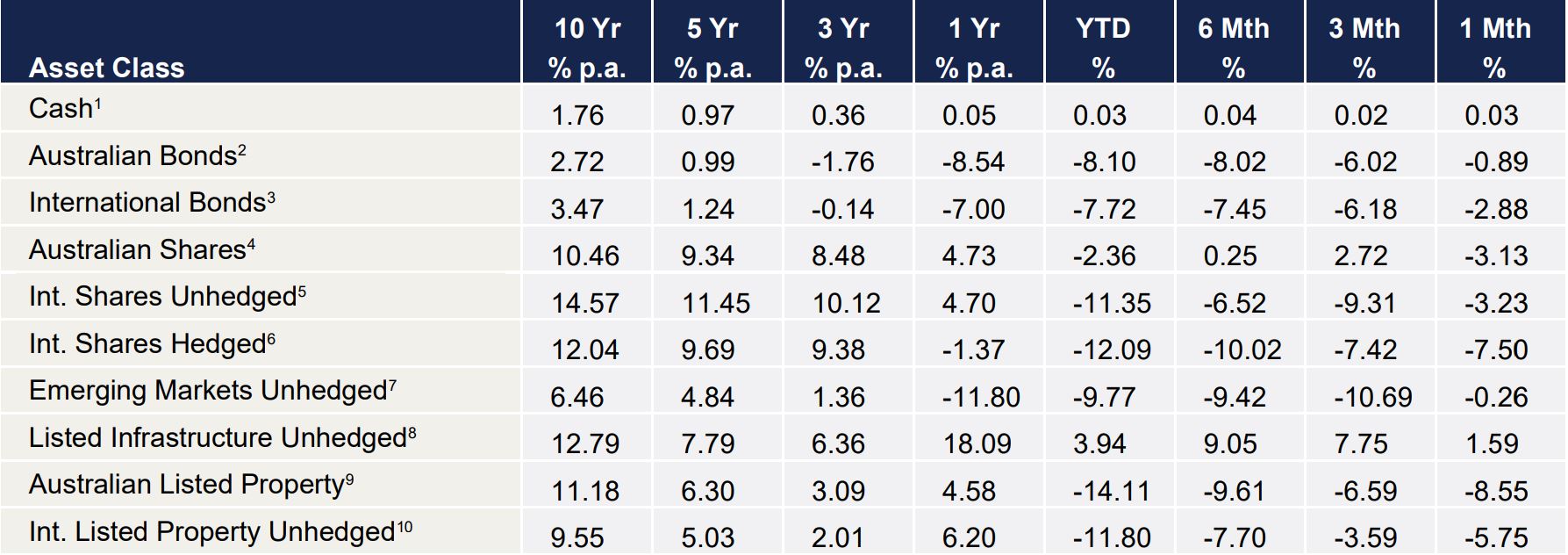

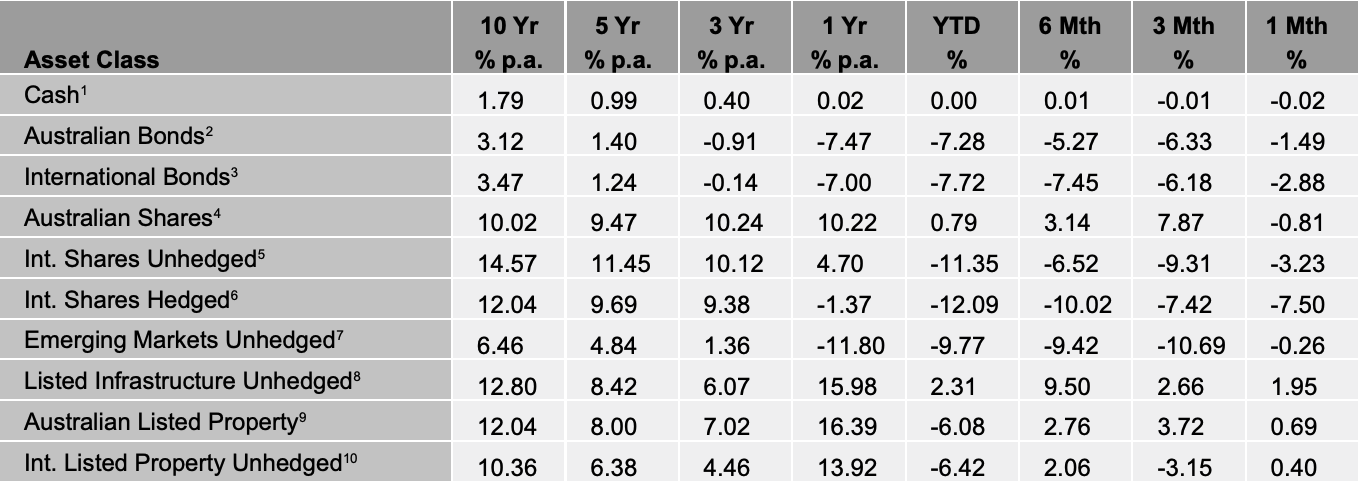

VIEW PDFHow the different asset classes have fared: (As at 31 October 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD Source: Centrepoint Research Team, Morningstar Direct

International Equities

Global equities saw respite in October as September’s developed market losses were mostly erased. A combination of resilient corporate earnings in the US, easing concerns of an energy crisis in Europe and a mutual hope that Central Banks could be nearing a monetary policy pivot sent markets higher. The same could not be said for China and Hong Kong however, with the Hang Seng finishing the month materially lower. Investors are concerned that Premier Xi Jinping’s historic third term will be dominated by a fight to secure China’s economic independence. News that China will not relax its strict zero-COVID policy also weighed on sentiment. Chinese and Hong Kong markets are down -40.2% and -27% for the year, respectively. Emerging Markets were therefore unable to participate in the same rally seen by developed market equities as China’s returns weighed heavily. Despite this, there were still several winners. Indonesia, Thailand, India, Malaysia and South Africa outperformed the index. OPEC+’s production cuts assisted oil exporting markets to advance. The MSCI Emerging Markets Index (hedged to AUD) closed October -2.6% lower.

Australian Equities

The Australian market finished October with the S&P/ASX 200 Accumulation Index rising sharply by +6.0%, with nine out of the eleven sectors finishing positively. The top performers were the Financials (+12.2%), Property (+9.9%) and Energy (+9.5%) sectors as the broader market rebounded from substantial selling pressure in September.

The Financials sector was led by strong performance amongst the major Australian banks. The Property sector also rebounded from heavy year-to-date losses as investors continued to price in volatility around policy rate outlook. Likewise, Energy performed strongly as the tight supply conditions continued to place upward pressure on spot prices across various segments of the market.

Overall, geopolitical uncertainty abroad continued to persist, whilst major central banks indicated the prospect of further interest rate tightening to control persistently higher inflationary figures. In an Australian context, the CPI figures surprised to the upside with the Reserve Bank of Australia subsequently electing for an 0.25% increase in the cash rate.

Property

October experienced a considerable turnaround in performance for both the local A-REIT market and the broader Global real estate equities market, with the S&P/ASX 200 A-REIT Index (AUD) and the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged) advancing 9.9% and 2.9% MoM, respectively. This was the second-best month for A-REIT returns since the December 2020 rally. Australian infrastructure performed well during October, with the S&P/ASX Infrastructure Index TR advancing 7.8% for the month, and 7.9% YTD.

The Australian residential property market experienced a –1.1% change month on month in October represented by Core Logic’s five capital city aggregate. Brisbane (- 1.9%), Sydney (-1.3%) and Melbourne (-0.9%) were the worst performers. Adelaide (-0.3%) and Perth (-0.2%) stayed relatively neutral.

Domestic and International Fixed Income

Australian fixed income markets were met with a reprieve in October. While the RBA has continued to tighten, in their October meeting they increased the cash rate by a smaller than expected 25bps. Yields on 2 and 10-year Australian Government Bonds both fell by approximately 25bps over the course of the month, which was the primary driver in the Bloomberg AusBond Composite 0+ Yr Index returning 0.93% during the course of October.

Internationally, markets continued to sell off as a hawkish Federal Reserve has given no indication of an end to rate rises in the US. The Bloomberg Global Aggregate Index (AUD Hedged) returned -0.38% in October, while the unhedged variant returned -0.14% due to currency fluctuations

Australian Dollar

The Australian Dollar (AUD) fell 0.54% in the month of October. This was relatively mild compared to the prior months where the United States Dollar (USD) has been on a relentless upward trajectory. Intra-month the AUD fell 3% and then reversed course. Some weakness crept into the USD as markets hoped for signals of a tapering in interest rate increases. If inflation shows signs of moderating somewhat in the US, the AUD will have some potential to rally.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD