Monthly Market Review – September 2021

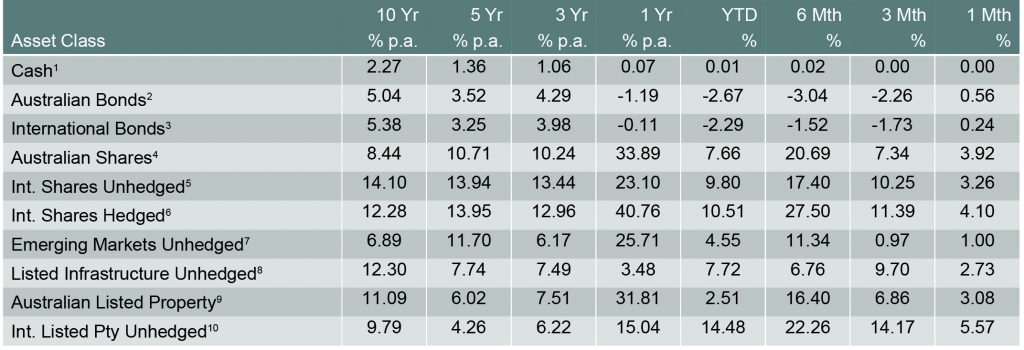

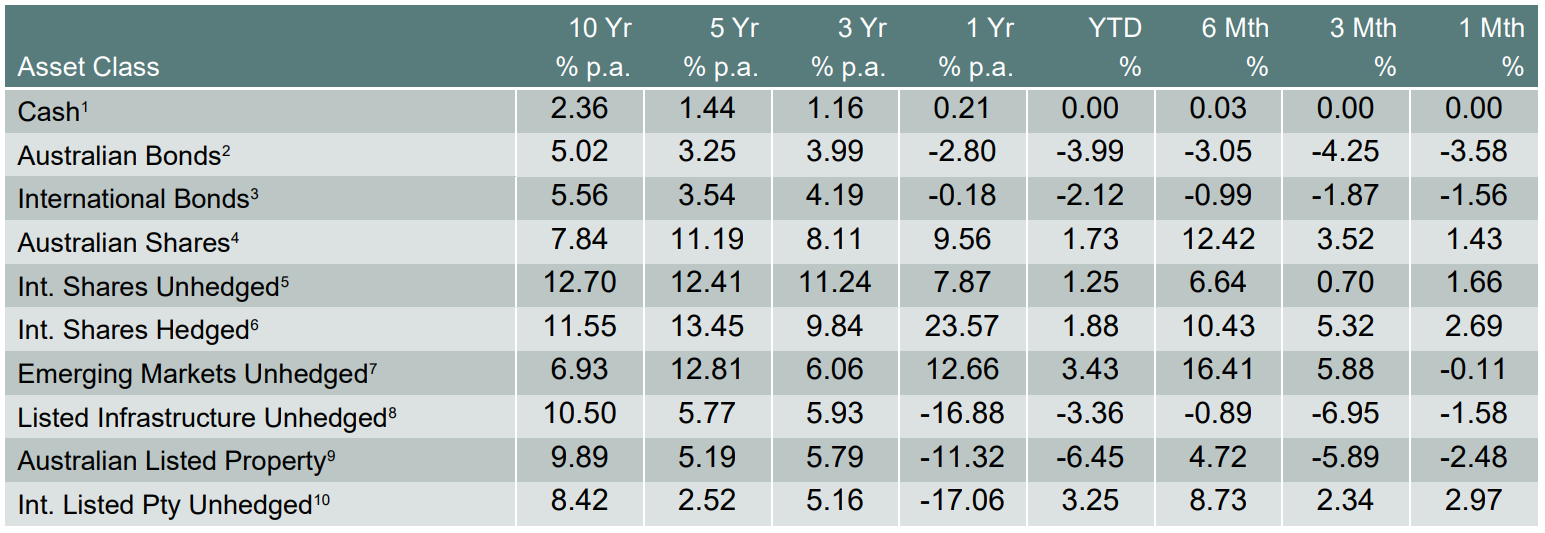

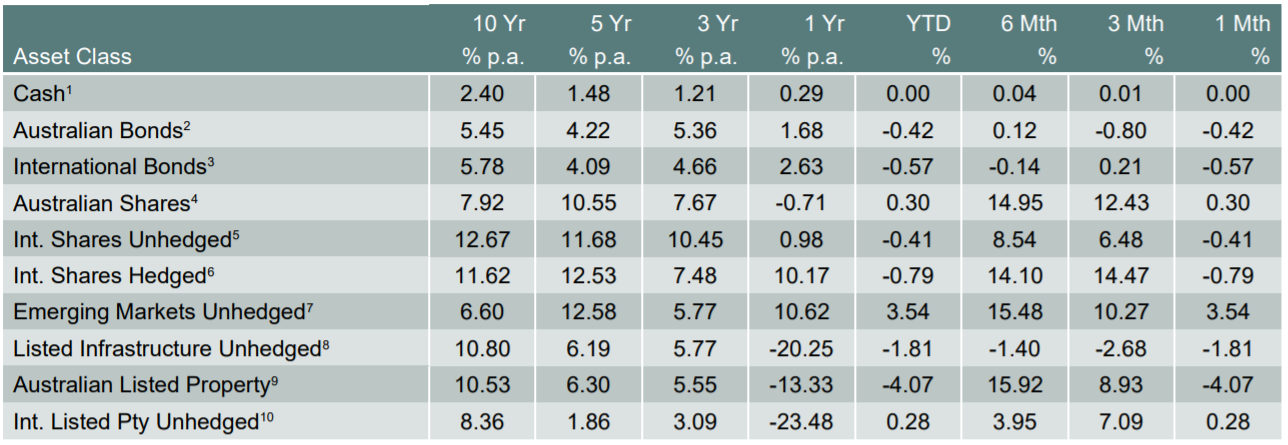

VIEW PDFHow the different asset classes have fared: (As at 30 September 2021)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

International Equities

International share markets (unhedged) fell by -3.04% in September. The performance of hedged and unhedged shares is now fairly similar over longer time periods. However, with a weaker A$, unhedged shares are now outperforming hedged over the past 6 and 12 months. Share markets fell because of concerns about higher inflation and interest rates. The sharp selloff in Chinese property developers weighed on emerging market shares.

The vaccine rollout continues to be a good news story and is progressing well in both the US and Europe, despite concerns about the spread of the “Delta” variant of Covid-19. Market valuation, particularly in the world’s largest share market, remain a key risk, with the US share market trading at valuation levels last seen just prior to the 2000 crash. In other countries valuations are at the upper end of the range, but are nowhere near as excessive as is the case in the US.

Australian Equities

The S&P/ASX All Ordinaries Index fell by -1.6% in September, largely following international markets. There are some risks that the prolonged lockdowns may impact the real economy and market sentiment negatively. However, the Australian vaccine rollout is finally starting to gain momentum, with credible forecasts of 90% vaccination rates likely to be achieved by late October in some states. A risk factor for Australian shares is the continued fall in iron ore prices. The falling value of the A$ will however partially offset these falls.

Domestic and International Fixed Income

Australian government bond yields rose in September, leading to capital losses in Australian and international fixed interest markets. The RBA has quite clearly indicated that Australian cash rates are likely to be held at current levels for at least the next few years. In the US the Federal Reserve is under greater pressure to raise rates.

Australian Dollar

The Australian dollar fell modestly against the US dollar in September. If commodity prices continue to fall as we expect then we would anticipate a lower A$ in the future.

Disclaimer

The information contained in this material is current as at date of publication unless otherwise specified and is provided by ClearView Financial Advice Pty Ltd ABN 89 133 593 012, AFS Licence No. 331367 (ClearView) and Matrix Planning Solutions Limited ABN 45 087 470 200, AFS Licence No. 238 256 (Matrix). Any advice contained in this material is general advice only and has been prepared without taking account of any person’s objectives, financial situation or needs. Before acting on any such information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. In preparing this material, ClearView and Matrix have relied on publicly available information and sources believed to be reliable. Except as otherwise stated, the information has not been independently verified by ClearView or Matrix. While due care and attention has been exercised in the preparation of the material, ClearView and Matrix give no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this document is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the material. Any opinions expressed in this material, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved. Past performance is not an indicator of future performance.